- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

AMD (AMD) Surges 14.7% After Launching AI Chip Collaboration and Raising MI350 Accelerator Prices

Reviewed by Simply Wall St

- In recent days, AMD announced a strategic collaboration with Aligned and USC's Information Sciences Institute to train MEGALODON, a new large language model, on the latest AMD Instinct MI300 GPUs, while also pursuing plans to raise the price of its Instinct MI350 AI accelerators from US$15,000 to US$25,000 in response to AI chip demand.

- This marks a rare large-scale LLM initiative to harness AMD hardware as an alternative to Nvidia, positioning AMD's GPUs as a credible option for cutting-edge AI workloads.

- We'll explore how AMD's move to boost MI350 accelerator pricing, amid new industry collaborations, influences its long-term growth and earnings outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Advanced Micro Devices Investment Narrative Recap

To invest in AMD today, you need to believe that its data center growth, driven by AI accelerators like the MI350 and MI400 series, will meaningfully boost both revenue and profits even as AMD contends with fierce competition and regulatory uncertainty. The recent MI350 price increase highlights the company’s effort to capitalize on robust AI demand, an important catalyst for the stock, but does not materially reduce exposure to the key short-term risk: export controls and regulatory issues affecting international sales.

Among AMD’s recent announcements, the partnership with Aligned and USC’s Information Sciences Institute stands out. This effort uses AMD Instinct MI300 GPUs for advanced AI research, signaling increased industry adoption of AMD hardware for large-scale language models. This type of collaboration complements AMD's goal of growing its data center and AI presence, directly tying in with the primary catalyst of expanding into new AI markets.

On the other hand, investors should be aware that tightening export controls and global regulatory changes could rapidly threaten AMD’s access to crucial markets and...

Read the full narrative on Advanced Micro Devices (it's free!)

Advanced Micro Devices' narrative projects $45.9 billion revenue and $8.9 billion earnings by 2028. This requires 18.3% yearly revenue growth and a $6.7 billion increase in earnings from $2.2 billion today.

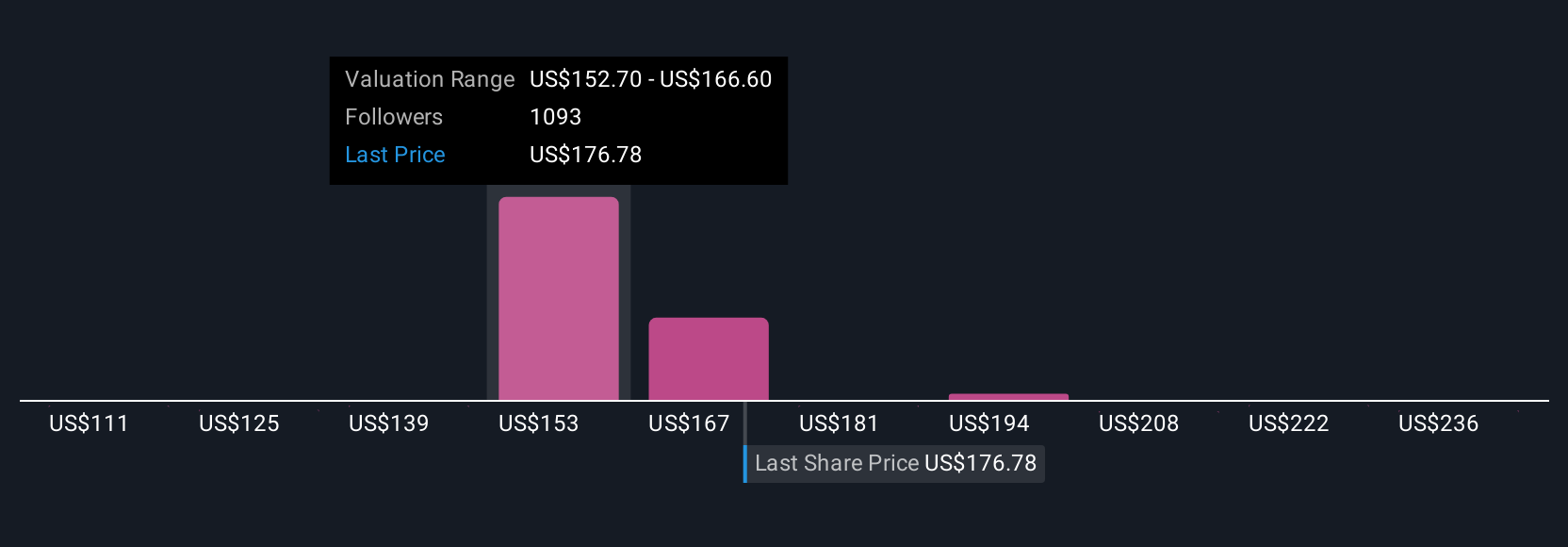

Uncover how Advanced Micro Devices' forecasts yield a $145.97 fair value, a 18% downside to its current price.

Exploring Other Perspectives

Contrast that baseline with the most pessimistic analysts, who recently expected AMD’s annual revenue to only reach about US$43.5 billion by 2028 and projected considerably lower earnings growth. These alternative views take regulatory tightening and restricted market access much more seriously as risks. It’s clear opinions on AMD’s future can differ widely, and recent headlines may soon prompt shifts in these forecasts.

Explore 104 other fair value estimates on Advanced Micro Devices - why the stock might be worth as much as 37% more than the current price!

Build Your Own Advanced Micro Devices Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Advanced Micro Devices research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Advanced Micro Devices research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Advanced Micro Devices' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives