- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

AMD (AMD): Examining Valuation After Recent Share Price Gains in the Semiconductor Sector

Reviewed by Simply Wall St

See our latest analysis for Advanced Micro Devices.

Advanced Micro Devices’ 1-day share price return of 7.6% underscores how quickly investor sentiment can shift, especially in fast-moving industries like semiconductors. This surge builds on a year-to-date share price return of over 100%, signaling strong momentum. The 1-year total shareholder return of 61.9% and even steeper multi-year gains show AMD’s longer-term performance story remains robust as the company navigates ongoing industry shifts and changing growth expectations.

If AMD’s rally has you watching the sector more closely, now’s a great chance to discover See the full list for free.

With such impressive gains on the books, the big question for investors now is whether AMD’s stock is undervalued compared to its future prospects, or if the market has already priced in all that expected growth.

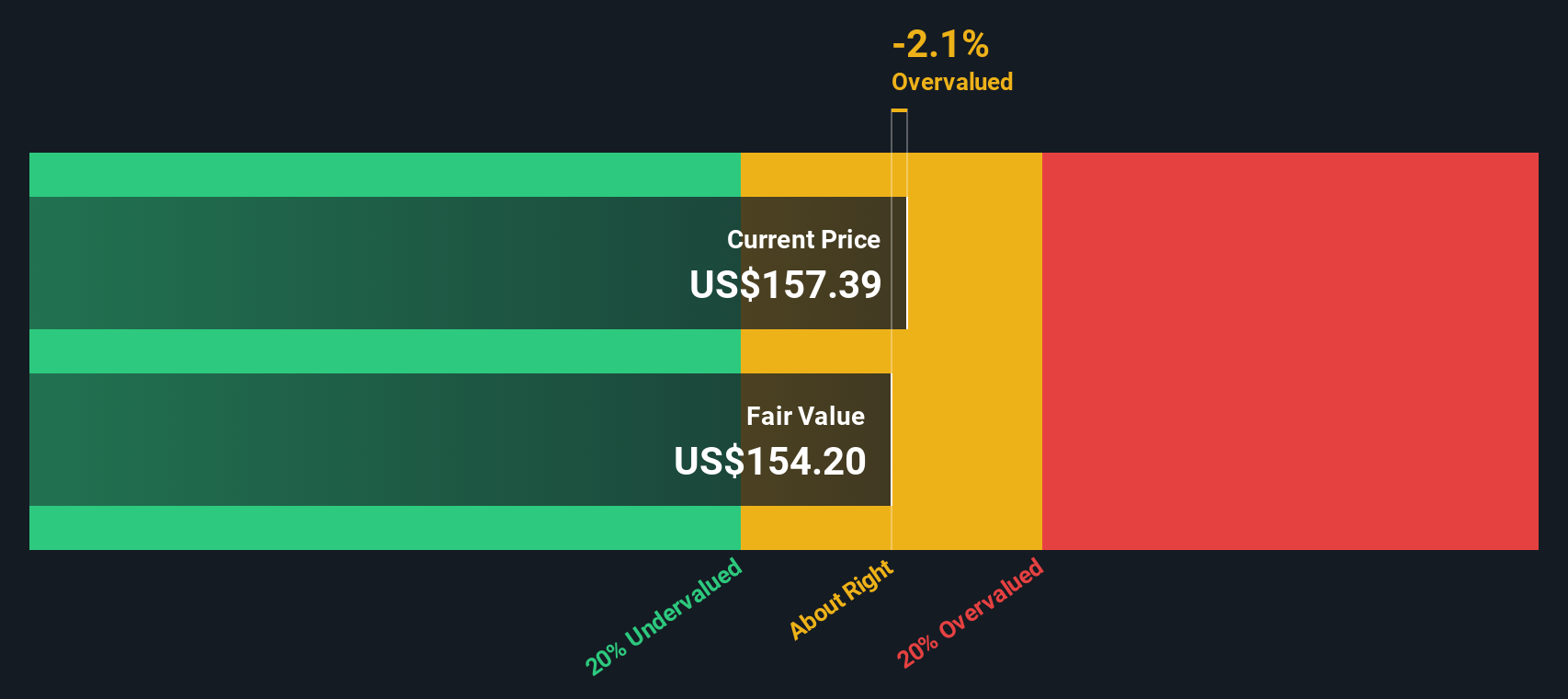

Most Popular Narrative: 20.4% Overvalued

According to oscargarcia’s widely discussed narrative, the implied fair value is well below AMD’s closing price. This highlights some big expectations already factored in and sets a high bar for growth. Investors are keenly focused on whether AMD’s projected pipeline can redefine what the company is worth over the next few years.

“A successful, high-scale AI business (especially tied to a marquee client like OpenAI) could shift investor perception of AMD from ‘chip / commodity competitor’ to a leading AI infrastructure play. That might justify a higher P/E or EV/EBITDA multiple than what it trades at today.”

Wondering what’s driving that premium price target? The story centers on transformative partnerships and electrifying revenue projections, all underpinned by ambitious growth and margin assumptions. If you want to see which numbers push the narrative’s valuation far above the market, you should see the full breakdown.

Result: Fair Value of $210.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory headwinds or a resurgence from competitors like Nvidia could quickly alter AMD’s growth story and shift sentiment for investors who are watching closely.

Find out about the key risks to this Advanced Micro Devices narrative.

Another View: SWS DCF Model Puts Value Lower

While the narrative points to AMD being overvalued based on its price-to-sales ratio, our SWS DCF model also suggests the stock is trading above its fair value. The DCF points to a fair value of $165.73 compared to the current market price, offering another cautionary perspective for investors. Will the future growth live up to these high expectations, or is the stock running ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Advanced Micro Devices Narrative

If you see the numbers differently or want to dig into the details yourself, you can craft your own narrative and analysis in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Advanced Micro Devices.

Looking for More Ways to Invest Smart?

Seize this moment to supercharge your portfolio. These opportunities are catching major attention right now, and you don’t want to get left behind.

- Unlock potential from rapid global disruption by targeting these 27 AI penny stocks, making headlines with breakthrough artificial intelligence and automation.

- Tap into consistent income with these 17 dividend stocks with yields > 3%, featuring companies offering impressive yields above 3% and strong financial track records.

- Stay ahead of market turns by tracking these 876 undervalued stocks based on cash flows, poised for gains based on real cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives