- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Advanced Micro Devices (NasdaqGS:AMD) Powers Oracle Cloud Despite 10% Price Dip

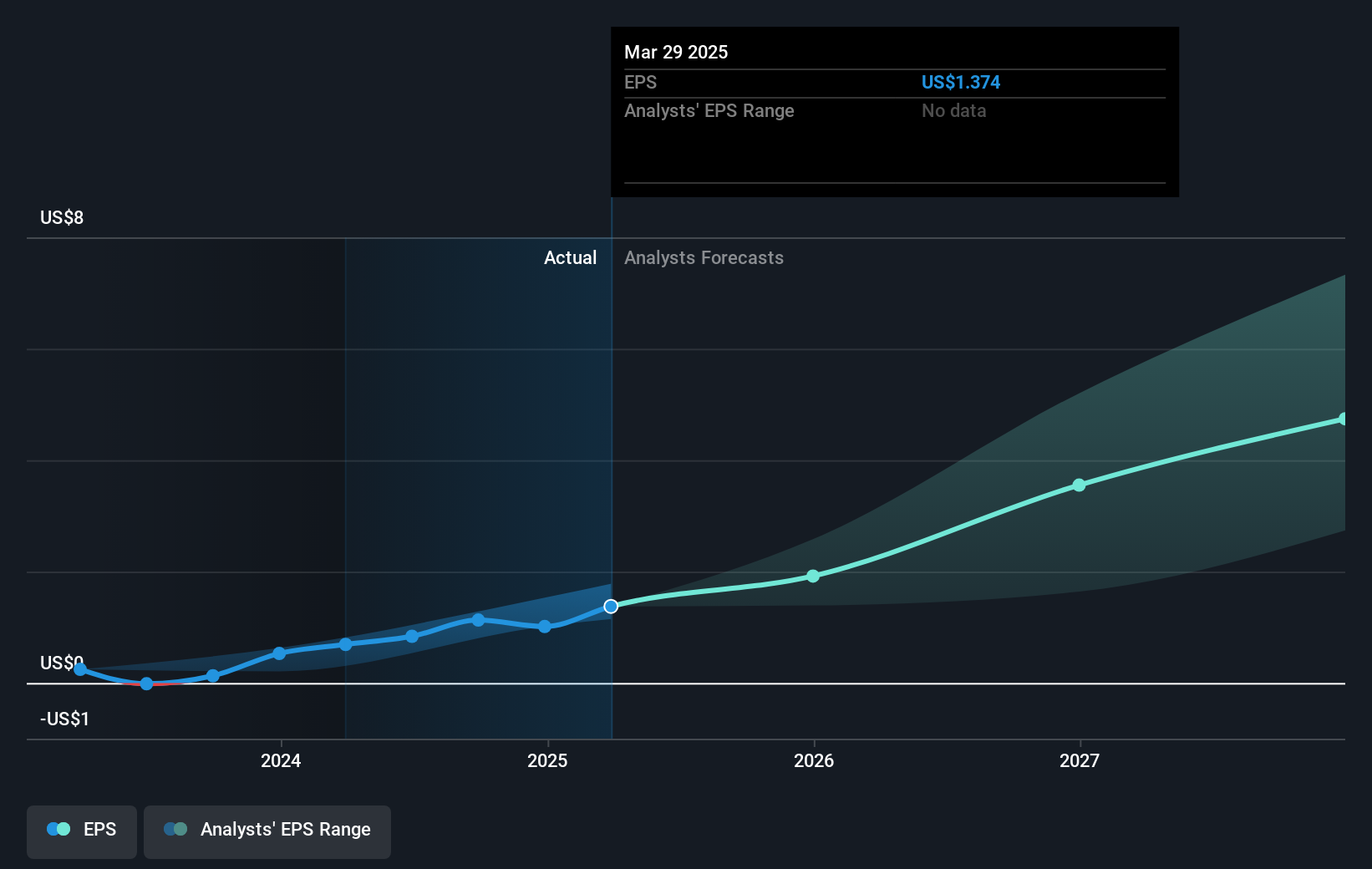

Advanced Micro Devices (NasdaqGS:AMD) recently unveiled its 5th Gen AMD EPYC processors, significantly enhancing the cost-performance ratio for Oracle Cloud Infrastructure, a notable development in the tech space. Over the past month, AMD's stock price increased by approximately 3%, reflecting a positive response to these innovations despite a broader market decline of 3%. The company's continued expansion in both embedded and server processor markets has drawn attention, despite prevailing economic uncertainty associated with tariffs. Within a volatile tech sector, AMD's performance underscores its ongoing relevance and adaptability in the face of fluctuating investor sentiment.

Over the past five years, Advanced Micro Devices (AMD) has delivered a total shareholder return of 116.20%, a robust performance reflecting its strategic advancements and market positioning. Key developments during this period include the expansion in Data Center AI with products like Instinct accelerators and ROCm, which have been pivotal in enhancing revenue potential. Significant product launches, such as the advanced EPYC processors, have strengthened AMD's footing in the AI and server markets. A partnership with Dell further extended its market reach in commercial PCs, potentially outpacing industry growth in client revenue.

Additionally, AMD's stock buyback program, completing 32.56 million share repurchases by February 2022, showcases a commitment to returning value to shareholders. Despite competitive pressures in the server CPU market, these strategic maneuvers have sustained AMD's growth trajectory in a challenging tech sector landscape. While AMD's five-year performance outpaced short-term benchmarks, it underperformed the US Semiconductor industry over the past year, returning 1.2% while the broader market saw a 6.1% gain.

Learn about Advanced Micro Devices' historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Advanced Micro Devices

Operates as a semiconductor company worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

The Green Consolidator

EDP as a safe capital allocation with a potential upside of 28% with steady dividends

#1 Silver Play with Positive Cashflow Gold Miner (Top Notch Team)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion