- United States

- /

- Semiconductors

- /

- NasdaqGS:AMBA

Why Ambarella (AMBA) Is Up 9.5% After Raising 2026 Growth Guidance and Posting Record Edge AI Sales

Reviewed by Sasha Jovanovic

- Ambarella recently reported third-quarter results, posting US$108.45 million in sales and reducing its net loss to US$15.11 million, while also raising its fiscal 2026 revenue growth guidance to a record range of 36% to 38%.

- A unique highlight is that Edge AI revenue accounted for around 80% of total revenue, underscoring Ambarella’s progress in expanding its AI-driven applications across sectors like enterprise security, portable video, and robotics.

- We’ll now explore how Ambarella’s raised guidance and record Edge AI sales may influence its investment outlook and industry position.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Ambarella Investment Narrative Recap

To be comfortable holding Ambarella, investors need to believe in the long-term growth of Edge AI and the company’s ability to scale its technology leadership beyond current end-markets. While the recently raised revenue guidance strengthens optimism for Edge AI and AI-powered video devices, it does not materially ease Ambarella’s reliance on the IoT segment, the biggest short-term catalyst, and the risk of revenue instability tied to customer concentration and cyclicality.

Among the recent announcements, the updated fiscal 2026 revenue growth guidance of 36% to 38% stands out. This highlighted the rapid expansion of Edge AI revenues and product wins, reinforcing the role of new applications as the core driver, even as margin pressures and concentrated customer risks remain key considerations for near-term prospects.

Conversely, investors should be aware that Ambarella still faces sizable risks from its dependence on large customers and the IoT market segment...

Read the full narrative on Ambarella (it's free!)

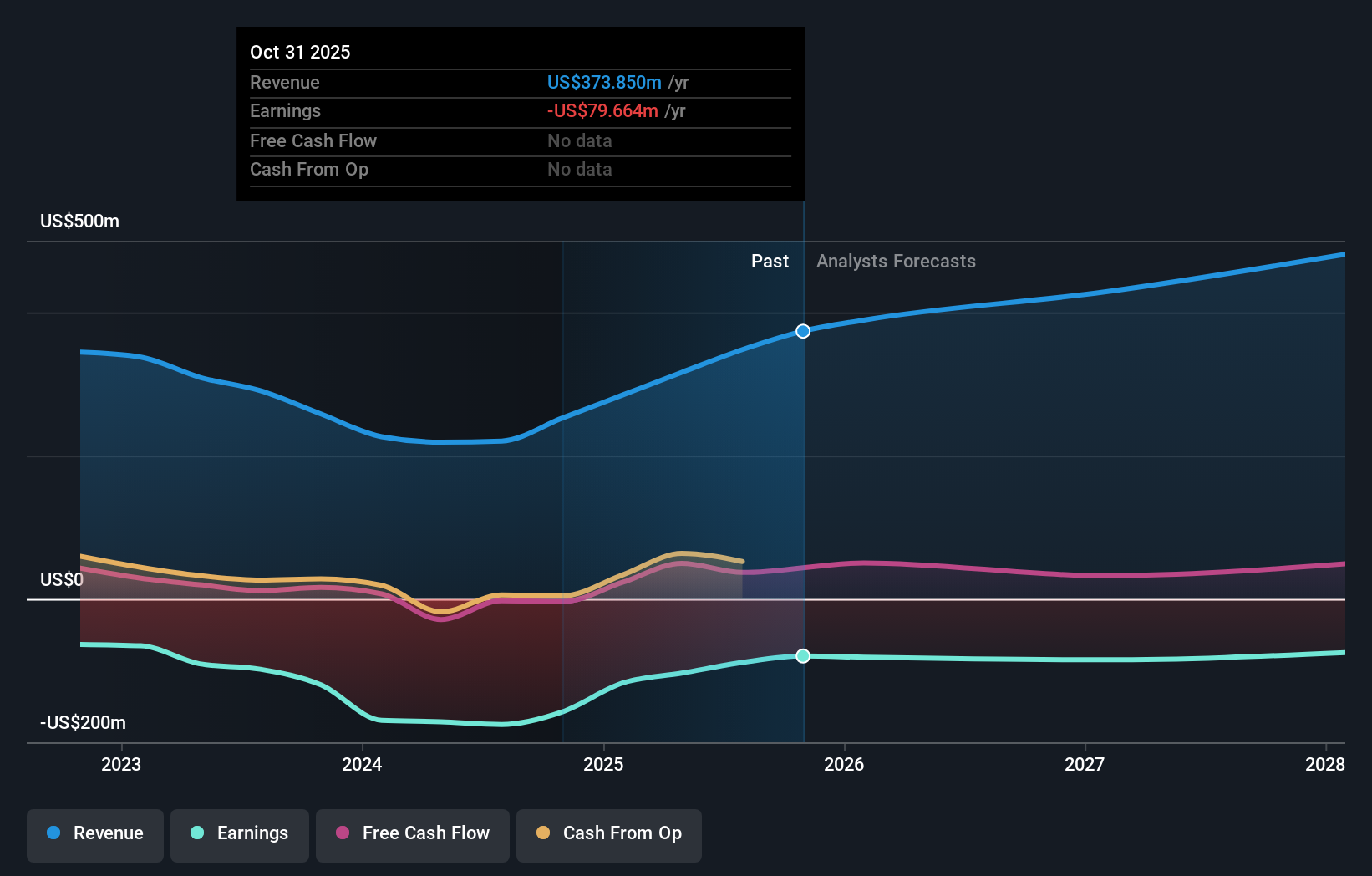

Ambarella's narrative projects $526.3 million revenue and $74.3 million earnings by 2028. This requires 14.8% yearly revenue growth and a $162.9 million increase in earnings from -$88.6 million.

Uncover how Ambarella's forecasts yield a $93.73 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community span US$31.03 to US$105 per share, reflecting broad divergence among individual investors. Many are weighing upbeat revenue gains against revenue concentration risks that could impact Ambarella’s performance, take a closer look at the range of views.

Explore 7 other fair value estimates on Ambarella - why the stock might be worth less than half the current price!

Build Your Own Ambarella Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ambarella research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Ambarella research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ambarella's overall financial health at a glance.

No Opportunity In Ambarella?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMBA

Ambarella

Develops semiconductor solutions that enable artificial intelligence (AI) processing, advanced image signal processing, and high-definition (HD) and ultra-HD compression.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success