- United States

- /

- Semiconductors

- /

- NasdaqGS:AMAT

Will Applied Materials (AMAT) and ASU’s New Arizona Lab Deepen Its Semiconductor Edge?

Reviewed by Sasha Jovanovic

- Earlier this month, Applied Materials and Arizona State University officially opened the US$270 million Materials-to-Fab Center in Tempe, creating a collaborative facility focused on accelerating semiconductor innovations and prototyping.

- This major expansion highlights Arizona’s growing status as a semiconductor hub, strengthening ties between industry, academia, and government in developing advanced chipmaking technologies.

- We'll explore how the new Materials-to-Fab Center collaboration enhances Applied Materials’ ability to support next-generation chip development and industry partnerships.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Applied Materials Investment Narrative Recap

To be a shareholder in Applied Materials, you need to trust in the continued expansion of advanced chipmaking, fueled by AI and digital transformation, where the company’s leadership in semiconductor technology and strong customer partnerships position it for long-term growth. The recently opened Materials-to-Fab Center with Arizona State University bolsters Applied’s R&D capacity and industry partnerships, but does not materially change the near-term catalyst: accelerating demand for AI and memory chips. The biggest risk remains ongoing export restrictions and geopolitical tensions affecting China, which could pressure revenue visibility but is not directly impacted by this partnership.

Applied Materials' launch of new semiconductor manufacturing systems, such as the Kinex Bonding system for next-generation AI chips, is particularly relevant as it directly supports the shift to advanced packaging and hybrid bonding technologies, key drivers expected to lift demand as chip architectures grow more complex and the AI wave builds.

However, investors should be aware that while domestic investments are ramping up, persistent regulatory uncertainty around China export licenses continues to...

Read the full narrative on Applied Materials (it's free!)

Applied Materials' narrative projects $32.5 billion revenue and $9.2 billion earnings by 2028. This requires 4.3% yearly revenue growth and a $2.4 billion earnings increase from $6.8 billion today.

Uncover how Applied Materials' forecasts yield a $215.06 fair value, a 4% downside to its current price.

Exploring Other Perspectives

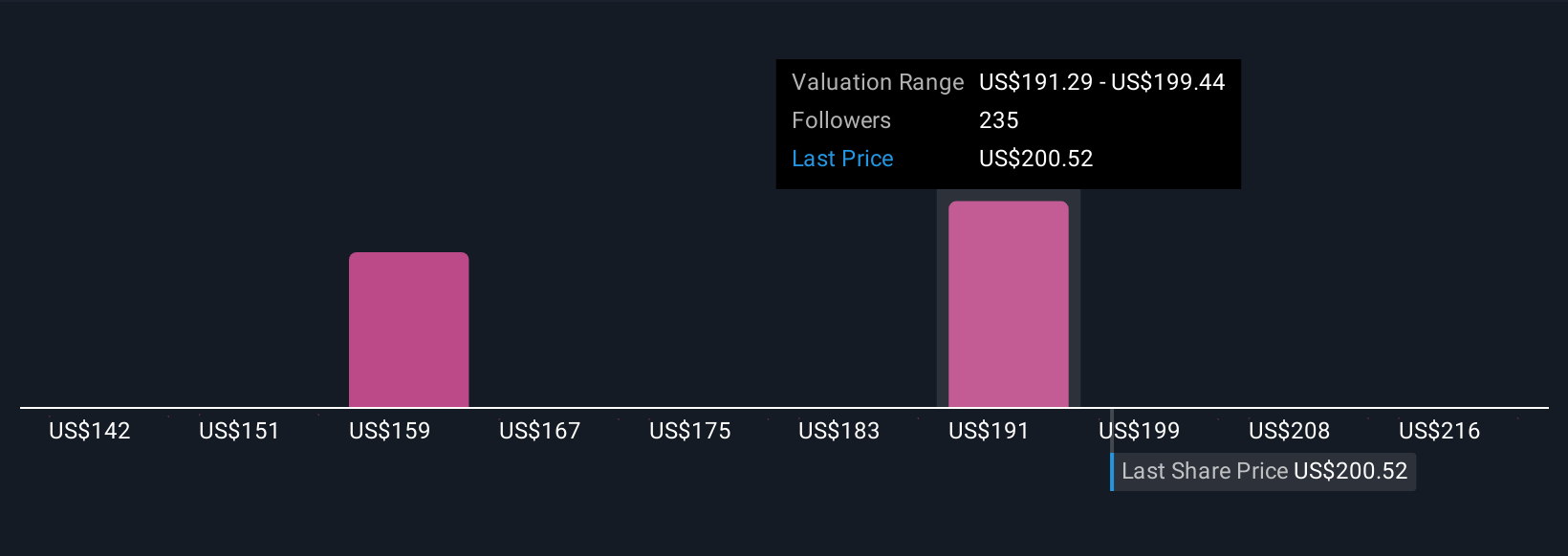

Community fair value estimates from 21 Simply Wall St members range from US$142 to US$234 per share, reflecting a broad spread of views. In light of heightened risk from export license restrictions, you might explore how different investors weigh these challenges against growth prospects for Applied’s core markets.

Explore 21 other fair value estimates on Applied Materials - why the stock might be worth as much as $234.00!

Build Your Own Applied Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Materials research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Applied Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Materials' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMAT

Applied Materials

Engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives