- United States

- /

- Semiconductors

- /

- NasdaqGS:AMAT

New ASU Materials-to-Fab Center Opening Might Change the Case for Investing in Applied Materials (AMAT)

Reviewed by Sasha Jovanovic

- In the past week, Applied Materials and Arizona State University celebrated the official opening of the $270 million Materials-to-Fab Center at ASU's Research Park in Tempe, designed to speed innovation by connecting academic, industry, and government partners with advanced semiconductor manufacturing tools.

- The facility's launch highlights how regional partnerships and infrastructure investments are supporting U.S. semiconductor leadership against a backdrop of tightening export restrictions and heightened geopolitical scrutiny.

- We'll examine how escalating US-China trade tensions and stricter export controls may reshape Applied Materials' future growth outlook and risk profile.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Applied Materials Investment Narrative Recap

Owning Applied Materials stock means believing in the continued structural growth of semiconductor demand, especially in AI and advanced chip architectures, while accepting the risks of geopolitical headwinds and export controls that can directly affect short-term revenue. The launch of the Materials-to-Fab Center in Arizona highlights Applied’s focus on regional manufacturing and collaborative innovation, but does not materially change the fact that escalating US-China trade restrictions remain the most important short-term risk, and could challenge near-term earnings visibility for the company.

Among recent announcements, Applied’s introduction of new systems for advanced chip packaging, including the Kinex bonding system, directly supports a key growth catalyst: capturing more revenue as device inflections and AI demand accelerate. This is especially relevant as advanced packaging is set to contribute a greater share of profits, with recurring revenues and expanded market potential acting as key buffers as the industry wrestles with export-related uncertainties.

Yet, despite robust US investments, the tightening scope of export rules means investors should be aware of...

Read the full narrative on Applied Materials (it's free!)

Applied Materials' outlook forecasts $32.5 billion in revenue and $9.2 billion in earnings by 2028. Achieving this would require annual revenue growth of 4.3% and an increase in earnings of $2.4 billion from the current $6.8 billion.

Uncover how Applied Materials' forecasts yield a $198.97 fair value, a 5% downside to its current price.

Exploring Other Perspectives

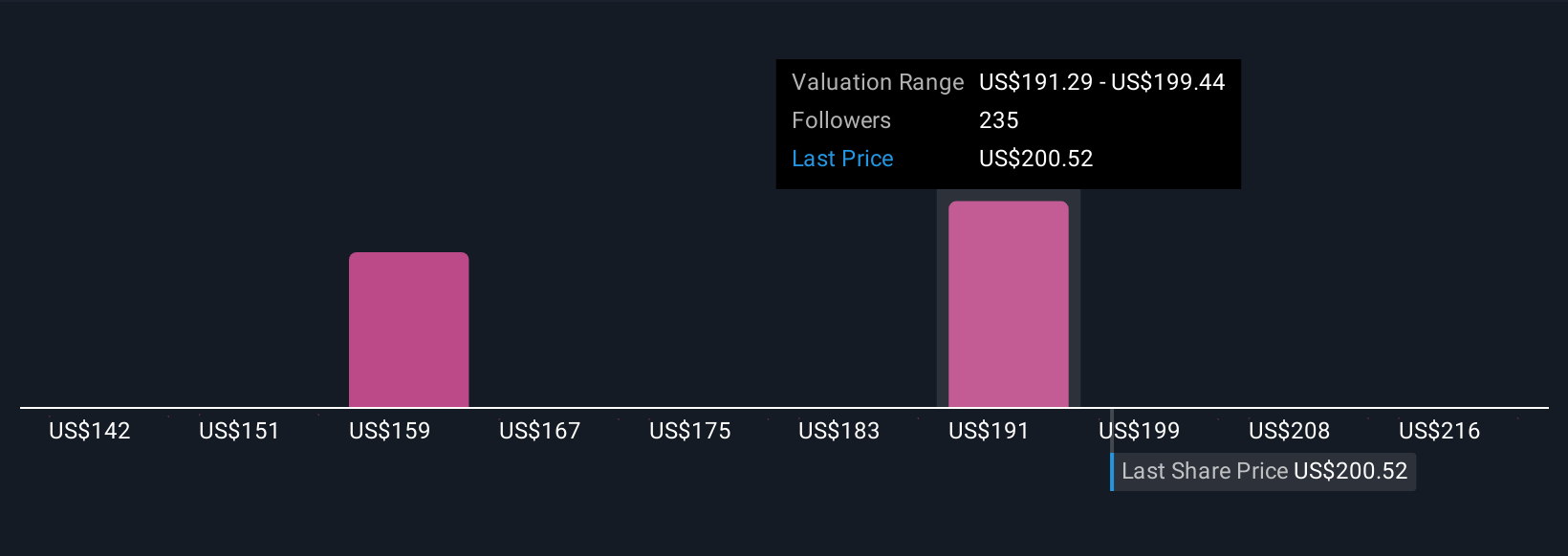

Twenty individual fair value estimates from the Simply Wall St Community span from US$142.35 to US$230.54 per share, showing a broad range of views on Applied Materials’ potential. Persistent export license uncertainties are top of mind, as these could have wide implications for capital flows and long-term market share, consider how your outlook aligns with the varied opinions of other investors.

Explore 20 other fair value estimates on Applied Materials - why the stock might be worth as much as 10% more than the current price!

Build Your Own Applied Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Materials research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Applied Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Materials' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMAT

Applied Materials

Engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.