- United States

- /

- Semiconductors

- /

- NasdaqGS:AMAT

Is It Too Late to Consider Applied Materials After a 40% Rally in 2025?

Reviewed by Bailey Pemberton

Thinking about making a move on Applied Materials stock? You are not alone. With the price up over 12% in the past month and a staggering 39.6% gain year-to-date, investors are buzzing about what comes next. If you have been watching from the sidelines, that chart might look both exciting and intimidating. On the other hand, those who have held their shares since before 2021 are sitting on an eye-popping 162% three-year gain and an impressive 303.7% over five years.

So what is fueling all the enthusiasm? Much of the story centers on recent developments in the semiconductor industry. This year, Applied Materials has been at the center of several technology rollouts and government-backed investments aimed at securing supply chains and boosting domestic chip manufacturing. These moves have not only reassured investors about long-term growth but also helped shift the market’s perception of risk, nudging the stock to new highs.

Of course, the price tag matters. As the stock climbs, investors want to know if Applied Materials is still a good value. According to our latest assessment, the company scores a 3 out of 6 on our value checklist. This indicates it is undervalued by several (but not all) of the key metrics we track. In the next section, we will break down how different valuation methods stack up for the company and why some investors look for an edge by considering more than just the traditional numbers.

Why Applied Materials is lagging behind its peers

Approach 1: Applied Materials Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's value. This approach tries to capture the present worth of all the business's expected future profits, placing a greater weight on near-term cash flows and less on those further in the future.

For Applied Materials, the current Free Cash Flow stands at approximately $6.3 billion. Analysts have provided forecasts for the next several years, projecting these cash flows to rise steadily. By 2029, free cash flow is estimated to reach about $9.5 billion, with further growth anticipated through extrapolations up to ten years out. These future cash flows are all calculated in US dollars and are discounted back to reflect their value in today's terms.

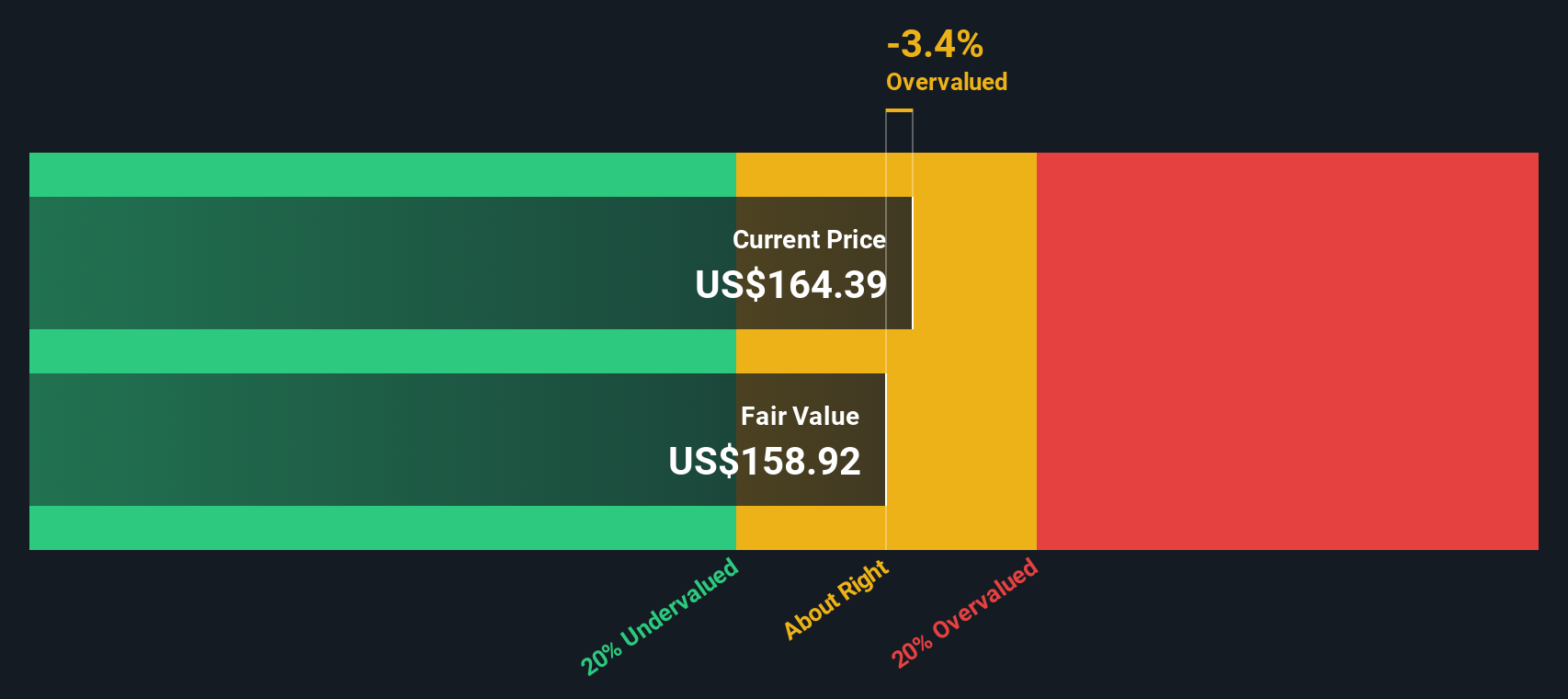

After running these projections through the DCF model, the estimated intrinsic fair value of Applied Materials' stock comes out to $161.57 per share. Compared to the current share price, this valuation suggests the stock is 41.6% overvalued based on underlying cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Applied Materials may be overvalued by 41.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Applied Materials Price vs Earnings

The Price-to-Earnings (PE) ratio is a tried-and-true valuation method for profitable companies like Applied Materials. Because it links a company’s share price with its actual earnings, the PE ratio helps investors understand how much they are paying for every dollar earned. In general, higher growth and lower risk can justify a higher PE multiple, while slower growth or greater uncertainty tend to pull that number down. What counts as a “normal” PE ratio often depends on how the business measures up against its sector, its peers, and the market’s expectations for future earnings growth.

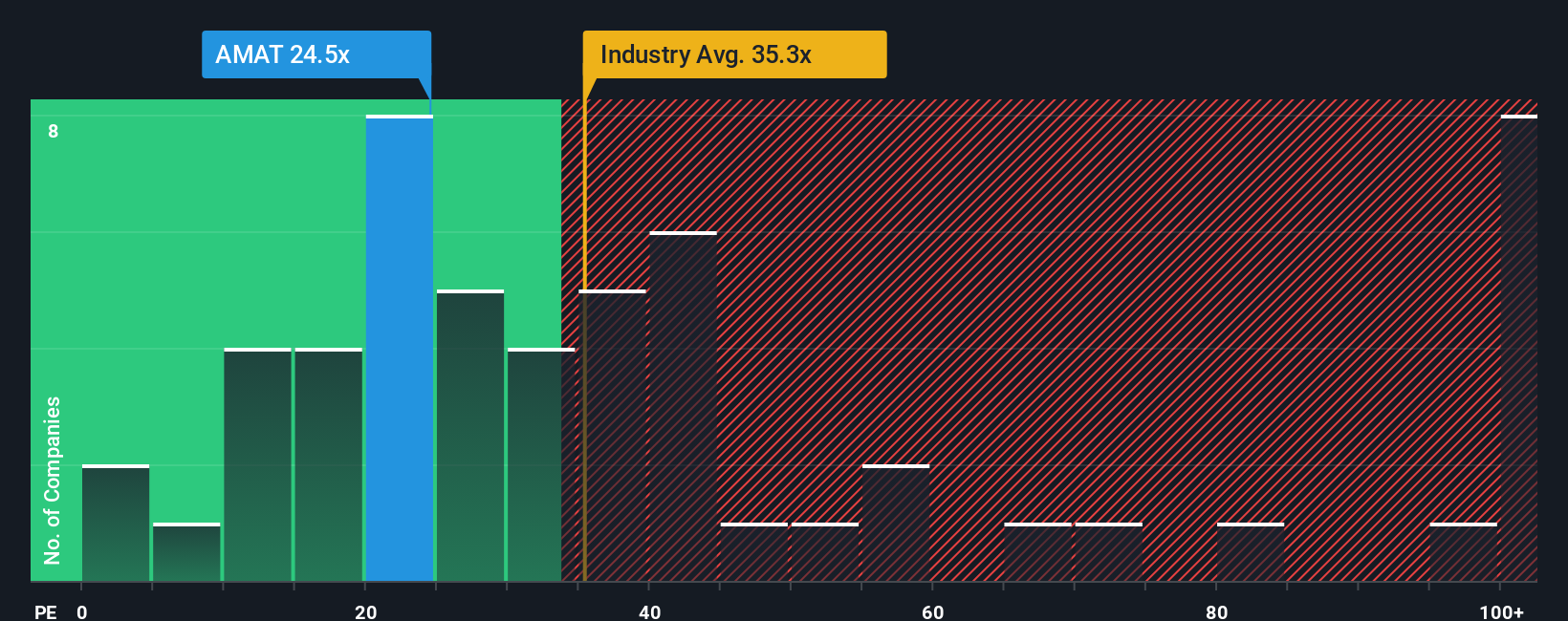

Currently, Applied Materials trades at a PE ratio of 26.7x. That is notably below the semiconductor industry average of 39.5x and beneath the average for peer companies at 36.4x. While those baseline comparisons provide some context, they do not account for everything that makes Applied Materials unique, such as its earnings growth rate, profit margins, size, or the risks the company faces.

This is where the Simply Wall St “Fair Ratio” comes in. Unlike traditional benchmarks, the Fair Ratio incorporates company-specific factors including growth prospects, profitability, the market environment, and risk profile. For Applied Materials, the calculated Fair Ratio is 32.4x. That is reasonably close to its current PE of 26.7x and suggests the market price is not far off from what we would expect if all those nuanced factors are considered together.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose Your Applied Materials Narrative

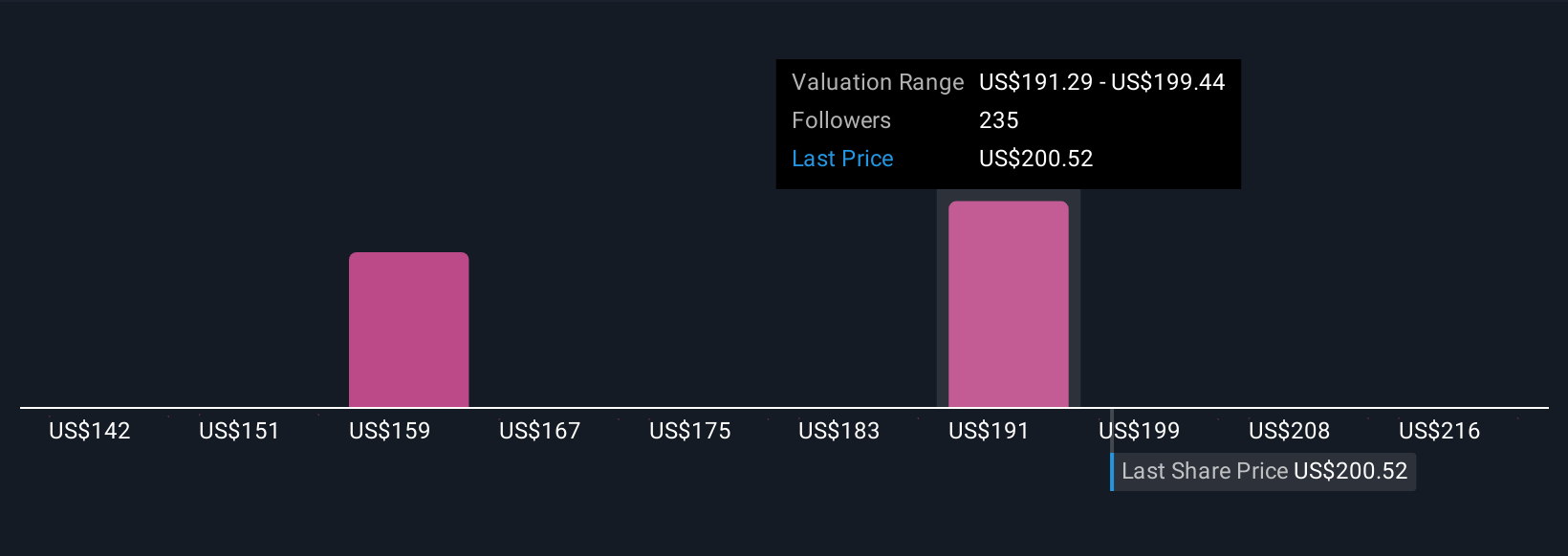

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a dynamic, story-driven approach that puts your perspective at the center of investment analysis. Rather than just relying on traditional financial ratios, a Narrative lets you lay out your own reasons and expectations for the company's future, connecting your view of Applied Materials’ business prospects, growth drivers, and risks directly to a financial forecast and a personal estimate of fair value.

Narratives are easy to use and accessible on Simply Wall St’s Community page, where millions of investors share their outlooks. They help you decide when to buy or sell by comparing the Fair Value you calculate against the current market price, making your decision process more transparent and tailored to your convictions.

What makes Narratives truly powerful is that they automatically update as new information, such as breaking news or earnings, becomes available. This ensures your analysis keeps pace with the real world. For example, one investor might build a bullish Narrative projecting a $240 fair value for Applied Materials, reflecting optimism about AI-driven semiconductor demand and margin expansion, while another might see the stock as worth just $160, focusing on industry cyclicality and geopolitical risks. Using Narratives, you can test your own assumptions against others, make more informed moves, and invest with confidence.

Do you think there's more to the story for Applied Materials? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMAT

Applied Materials

Provides materials engineering solutions, equipment, services, and software to the semiconductor and related industries in the United States, China, Korea, Taiwan, Japan, Southeast Asia, Europe, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion