- United States

- /

- Semiconductors

- /

- NasdaqGS:AMAT

How Investors May Respond To Applied Materials (AMAT) Soft Guidance After Strong Quarter and China Challenges

Reviewed by Simply Wall St

- Earlier this month, Applied Materials reported third quarter sales of US$7.30 billion and net income of US$1.78 billion, both up from the same period last year, but issued guidance for the next quarter below analyst expectations due to challenges in China and uneven demand in certain chip segments.

- This mixed outlook highlights how ongoing export license uncertainties, regional demand variations, and investment cycles are materially shaping the company's short-term momentum and global revenue mix.

- We'll explore how the cautious forward guidance amid strong quarterly results impacts the long-term investment narrative for Applied Materials.

AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Applied Materials Investment Narrative Recap

To believe in Applied Materials as a shareholder, you must view the company as a key beneficiary of the evolving semiconductor cycle, particularly in advanced packaging and AI-driven process technologies, despite recurring geopolitical risks and cyclical demand shifts. The latest quarterly results confirmed healthy demand and solid financial execution, but management’s cautious guidance signals that a slower near-term recovery in China and timing of leading-edge chip investments remain the most important catalysts and also the biggest risks. This muted near-term outlook, while not fundamentally altering the longer-term investment case, is material for investors focused on immediate revenue momentum.

The corporate guidance issued alongside the third-quarter report, with expected revenue for the next quarter projected at US$6,700 million plus or minus US$500 million, stands out as the most relevant recent announcement. This guidance, which fell below analyst forecasts, reinforces the message that uncertainty in China and uneven customer order timing on key technologies are actively shaping near-term expectations. For those watching Applied’s momentum, this corporate outlook directly influences current perceptions of risk and opportunity, especially around the timing of recovery in export-sensitive regions.

By contrast, investors should be aware that an extended slowdown in China and further export license uncertainties could...

Read the full narrative on Applied Materials (it's free!)

Applied Materials is expected to reach $32.5 billion in revenue and $9.2 billion in earnings by 2028. This projection assumes annual revenue growth of 4.3% and an increase in earnings of $2.4 billion from the current $6.8 billion.

Uncover how Applied Materials' forecasts yield a $195.55 fair value, a 20% upside to its current price.

Exploring Other Perspectives

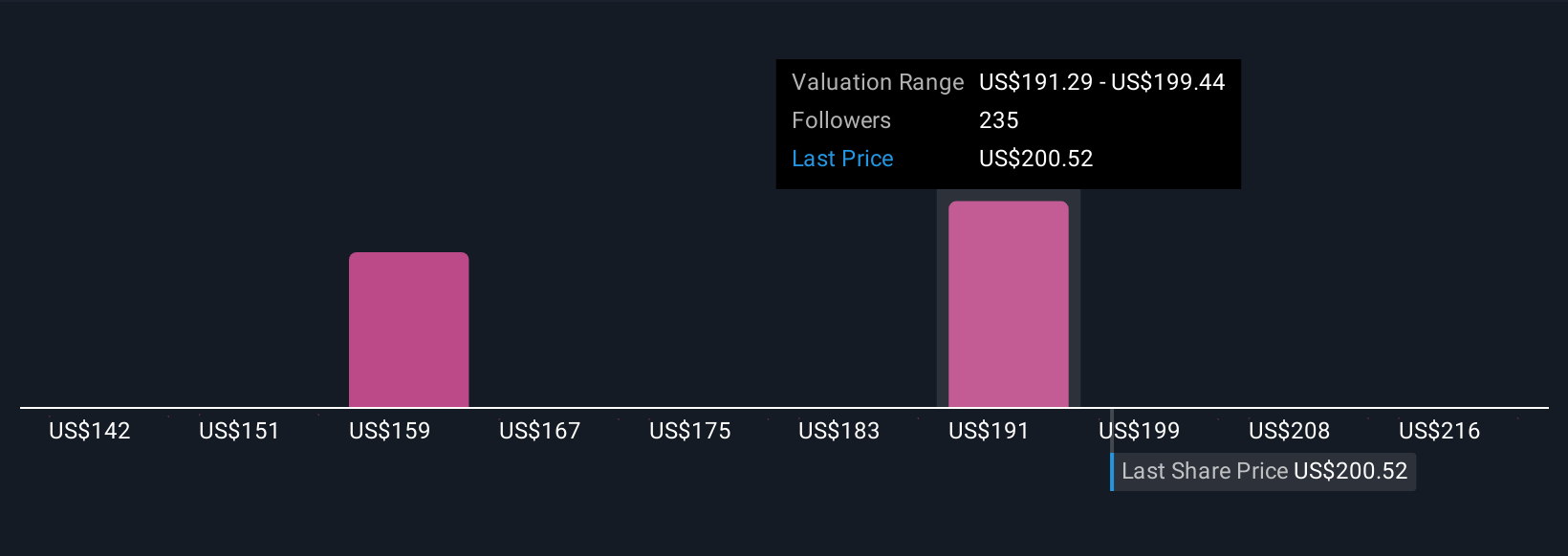

Seventeen members of the Simply Wall St Community assigned fair values for Applied Materials ranging from US$142.35 to US$211 per share, highlighting wide diversity in expectations. With current earnings forecasts facing headwinds from China and uneven chip demand, you should explore these alternative outlooks for deeper context.

Explore 17 other fair value estimates on Applied Materials - why the stock might be worth 12% less than the current price!

Build Your Own Applied Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Materials research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Applied Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Materials' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMAT

Applied Materials

Engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives