- United States

- /

- Semiconductors

- /

- NasdaqGS:AMAT

Applied Materials (AMAT): Valuation in Focus Following Analyst Upgrades and New AI Chip Manufacturing Launch

Reviewed by Simply Wall St

Applied Materials (AMAT) stock grabbed attention this week as the company unveiled new semiconductor manufacturing technologies designed to power future AI chips. This announcement comes at a time when industry analysts are highlighting rising demand for advanced memory and logic solutions.

See our latest analysis for Applied Materials.

Momentum has been building for Applied Materials, with the share price notching a 20% gain over the past month and a robust 39% year-to-date price return. Positive news, such as analyst upgrades and major tech unveilings, has fueled broader investor optimism. A hefty 3-year total shareholder return of nearly 168% highlights the company’s longer-term outperformance despite periodic sector volatility.

If recent breakthroughs in semiconductor tech have you watching the sector, you might want to check out the full list of cutting-edge companies in our tech and AI stocks screener. See the full list for free.

But with shares near all-time highs and future growth headlines grabbing attention, the key question is whether Applied Materials is undervalued today or if the recent rally means investors have already priced in much of what comes next.

Most Popular Narrative: 6.1% Overvalued

With a fair value calculation at $215 and shares last closing at $228.13, the most widely followed narrative suggests the market price stands above where fundamental projections would set it. This has sharpened the debate over what is truly priced in for Applied Materials as it navigates a fast-moving AI and chip landscape.

Structural growth in AI and high-performance computing is reshaping semiconductor demand, driving heavy investments in advanced chip architectures such as gate-all-around (GAA) transistors, high-bandwidth memory (HBM), and advanced packaging. Applied is set to benefit from these device inflections due to its leadership in materials engineering and strong customer adoption of new process technologies. These are expected to deliver outsized revenue and market share gains as these nodes ramp from 2026 onward.

Curious what is fueling this premium price? The narrative hinges on a dramatic acceleration in next-generation chip demand and a profound shift in earnings potential. Discover the bold analytical leap that sets this valuation apart from the pack and glimpse the critical inflection points driving Wall Street’s model. Ready to follow the numbers to their surprising conclusion?

Result: Fair Value of $215 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainty and reliance on key customers in volatile markets could disrupt Applied Materials' expected trajectory and quickly shift the valuation outlook.

Find out about the key risks to this Applied Materials narrative.

Another View: What About the Market’s Go-To Ratio?

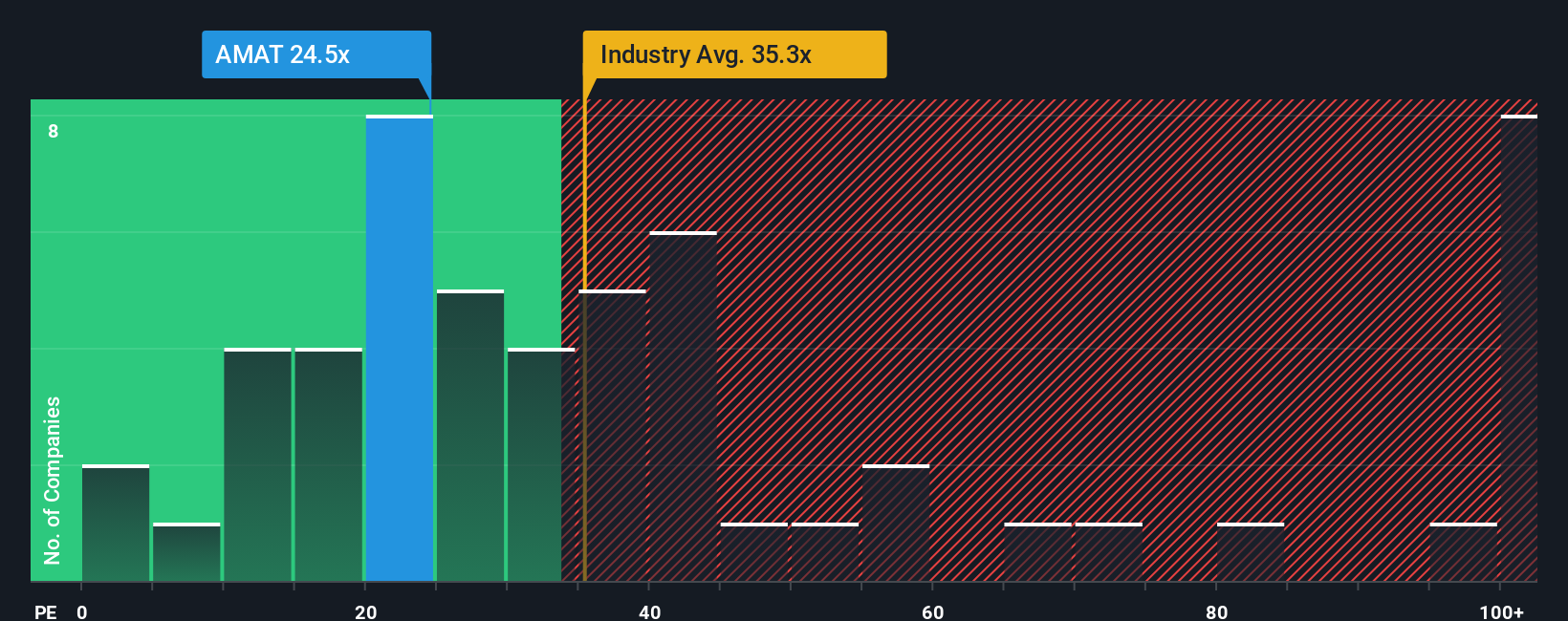

When measuring Applied Materials against its industry using the commonly watched price-to-earnings ratio, the stock trades at 26.6x, which is meaningfully below both its peer average of 36.1x and the broader US semiconductor industry’s 37.4x. Compared to a fair ratio of 32.4x, this presents a case for potential upside if market sentiment catches up. Could this gap signal a real value opportunity, or does it mask deeper risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Materials Narrative

If you think the current story misses something, or you want to analyze the numbers firsthand, you can build your own perspective in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Applied Materials.

Looking for More Investment Ideas?

Smart investors don't stop at one opportunity. Get ahead of the next market move by checking out handpicked stocks that fit powerful trends and unique criteria. Waiting means risking missed chances, so take action now and shape your portfolio’s future.

- Tap into rapid digital innovation and spot tomorrow’s disruptors by reviewing these 24 AI penny stocks that are reshaping the future with AI breakthroughs and robust business models.

- Boost your portfolio’s passive income by targeting these 17 dividend stocks with yields > 3% with sustainable yields and a history of shareholder rewards.

- Seize high-upside opportunities before they hit the mainstream when you evaluate these 3596 penny stocks with strong financials with strong financial foundations and significant growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMAT

Applied Materials

Engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives