- United States

- /

- Semiconductors

- /

- NasdaqGS:AMAT

Applied Materials (AMAT): Evaluating Valuation After Daiwa Downgrade and Mixed Post-Earnings Outlook

Reviewed by Simply Wall St

Applied Materials (AMAT) just wrapped up its latest earnings report, and the aftermath has sparked debate among investors weighing their next move. On one hand, revenue cleared expectations and new display technology is gaining traction with consumer device makers. On the other hand, a downgrade from Daiwa Securities quickly followed as the market digested lower earnings, cautious guidance for the next quarter, and the ongoing drag from weaker semiconductor equipment demand at major companies such as Intel and Samsung. The tension between innovation and uncertainty remains prominent, especially with China’s slowdown casting a longer shadow than many had hoped.

If you zoom out, Applied Materials has not seen significant gains recently. While long-term shareholders are still ahead, the stock has slipped about 16% over the past year, and short-term returns are flat to negative. Despite headlines about OLED momentum and the company’s late-stage investments aimed at capitalizing on AI-related growth, recent months show fading momentum as investors try to interpret mixed signals from both the industry and key end markets. The cautious outlook, along with last quarter’s earnings miss, is giving some observers pause.

After a year like this, the question remains: is Applied Materials trading at an attractive discount, or has the market already anticipated the upcoming challenges and the potential for future growth?

Most Popular Narrative: 16.3% Undervalued

According to the narrative by Unike, Applied Materials is currently considered significantly undervalued compared to its projected fair value. This perspective hinges on the company’s anticipated role in powering future semiconductor manufacturing and AI-driven chip demand.

"Catalysts

Most Immediate Catalysts (1-2 Years):

• Semiconductor Equipment Demand: As AI, cloud computing, and automotive chips grow, chipmakers (TSMC, Intel, Samsung) are increasing fab capacity, boosting demand for AMAT’s semiconductor equipment.

• AI Boom & High-Performance Computing: AI chips (from Nvidia, AMD, and Intel) require advanced manufacturing tools, where AMAT is a key supplier."

How strong are the numbers behind this bullish case? The narrative hints at remarkable revenue growth, expanding margins, and a future valuation multiple that could surprise even seasoned investors. Want to uncover the full financial roadmap and see the bold forecasts driving this undervalued call? There is more beneath the surface. Discover what powers this optimism.

Result: Fair Value of $194.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, export restrictions to China and the cyclical nature of semiconductor demand could still present challenges for Applied Materials’ future growth story.

Find out about the key risks to this Applied Materials narrative.Another View: Discounted Cash Flow

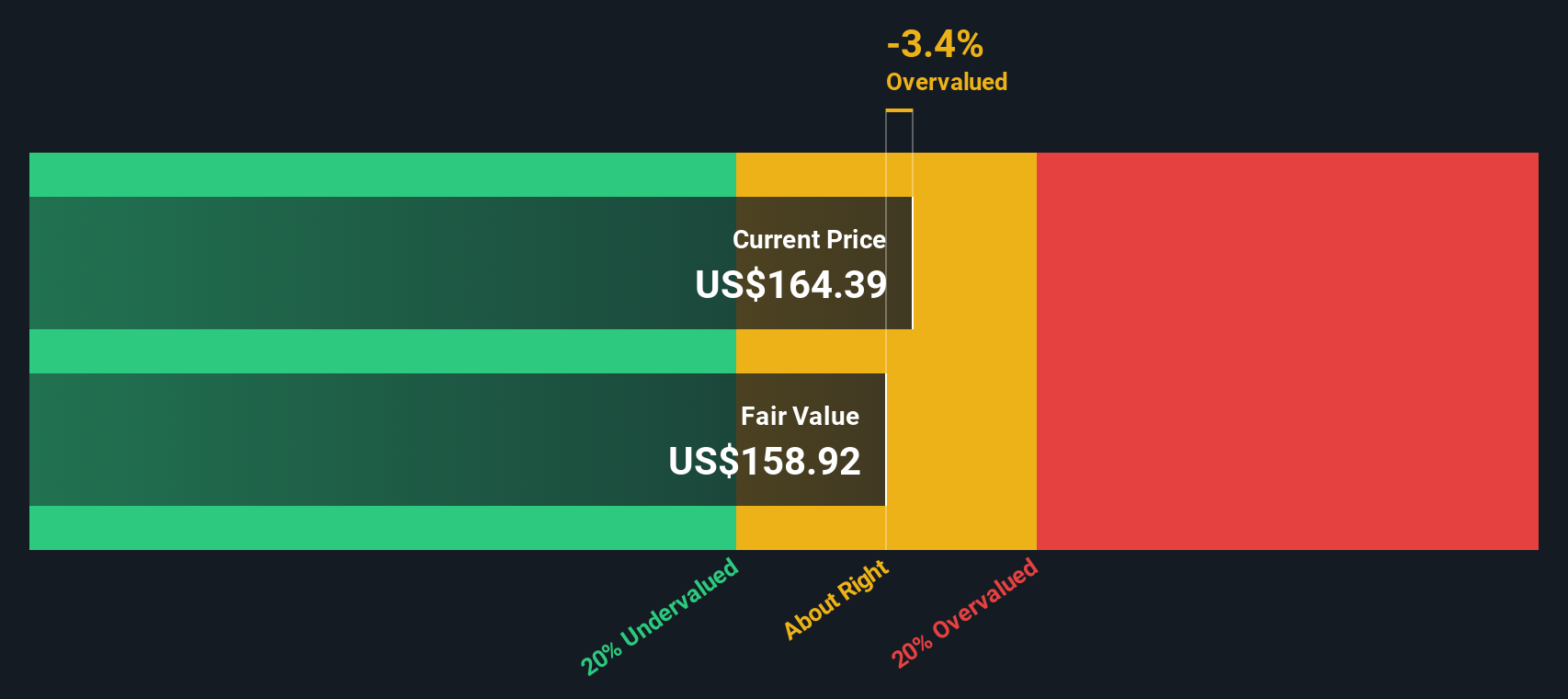

Looking at Applied Materials through the lens of our DCF model offers a measured perspective. Unlike the earlier approach, the DCF analysis suggests the stock is trading slightly above its calculated fair value. Could the market be more cautious than the headlines suggest?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Applied Materials Narrative

If these takes don’t quite align with your perspective or you’re keen to investigate your own insights, you can build a custom data-driven story in just a few minutes. do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Applied Materials.

Looking for more investment ideas?

Sticking to just one stock means missing out on other standout opportunities. Give your portfolio an edge by checking out unique themes and powerful trends shaping the market right now. Here are some top spots to find your next winner:

- Unlock steady income streams by finding top picks among dividend stocks with yields > 3%. These can help fortify your returns when the market gets shaky.

- Ride the AI revolution by targeting breakthrough companies making waves in the future of healthcare with healthcare AI stocks.

- Spot stocks harnessing digital innovation in the fast-moving world of cryptocurrency and blockchain stocks before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMAT

Applied Materials

Engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives