- United States

- /

- Semiconductors

- /

- NasdaqGS:ALGM

What Allegro MicroSystems (ALGM)'s Operational Challenges Amid Sector Sell-Off Mean For Shareholders

- Earlier this week, a broad sell-off affected semiconductor stocks after equipment maker ASML issued a cautious industry outlook citing macroeconomic and geopolitical uncertainties, including possible new U.S. tariffs.

- This negative sector sentiment coincided with ongoing operational concerns at Allegro MicroSystems, where shrinking sales, earnings, and cash flow margins have raised questions about its long-term outlook.

- We'll examine how these heightened concerns over Allegro's operational performance may now alter the company's previously optimistic investment narrative.

Allegro MicroSystems Investment Narrative Recap

To be a shareholder in Allegro MicroSystems, you need to believe in the long-term demand for its sensor and power ICs, especially as automotive and industrial electrification trends evolve. The recent sector-wide sell-off triggered by ASML's caution on macroeconomic headwinds may weigh on sentiment, but the most important near-term catalyst, Allegro’s anticipated sales recovery in upcoming quarters, remains unchanged. However, the biggest risk continues to stem from Allegro’s shrinking cash flow and persistent margin pressure.

Among recent announcements, management’s upbeat Q1 sales guidance, expecting up to US$202 million, an 18% year-over-year increase, directly addresses concerns about demand recovery. This target will be watched closely, especially as profitability and margin improvements are still in question given the ongoing operational headwinds identified in recent earnings.

By contrast, what remains underappreciated is how Allegro’s heavy reliance on the automotive sector leaves investors exposed to ongoing inventory and pricing pressures that...

Read the full narrative on Allegro MicroSystems (it's free!)

Allegro MicroSystems' narrative projects $1.1 billion in revenue and $121.9 million in earnings by 2028. This requires 11.4% yearly revenue growth and an increase of $187.2 million in earnings from the current earnings of $-65.3 million.

Exploring Other Perspectives

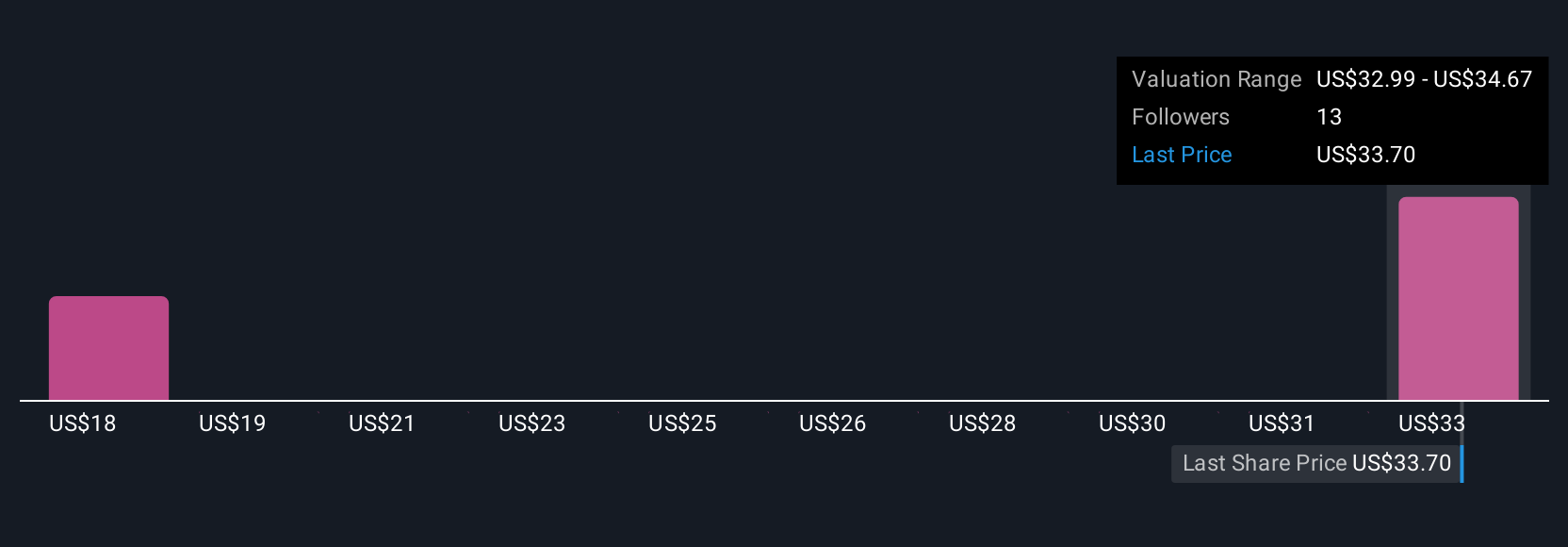

Simply Wall St Community members provided two fair value estimates for Allegro MicroSystems, ranging from US$17.85 to US$25.71 per share. While some expect further margin pressure, others see room for growth, highlighting different ways market participants evaluate operational risks and future performance.

Build Your Own Allegro MicroSystems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allegro MicroSystems research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Allegro MicroSystems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allegro MicroSystems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGM

Allegro MicroSystems

Designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific power ICs for motion control and energy-efficient systems.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion