- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

Astera Labs (NasdaqGS:ALAB) Q1 Sales More Than Double Year-Over-Year

Reviewed by Simply Wall St

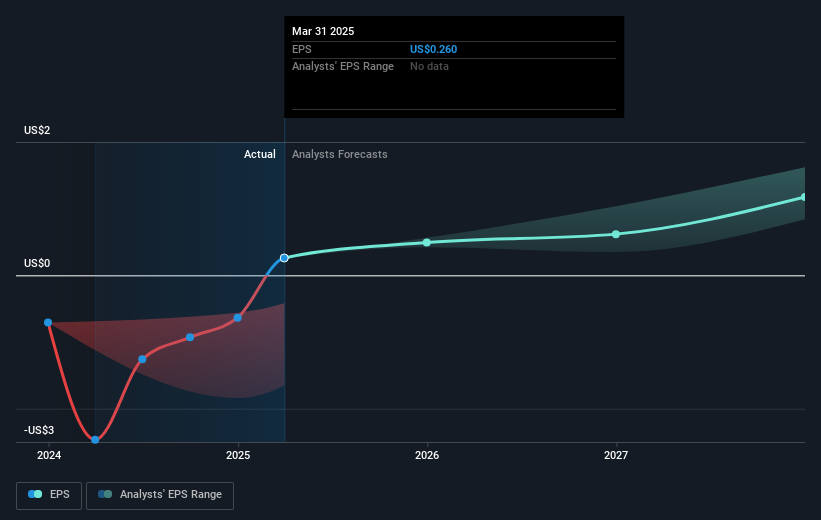

Astera Labs (NasdaqGS:ALAB) recently witnessed a 40% rise in its share price, potentially influenced by its strategic partnership with Alchip Technologies announced in June. This collaboration aims to enhance AI infrastructure, a timely move given the escalating demand for AI-driven solutions. Additionally, the company's impressive first-quarter earnings, with sales more than doubling year-over-year, further support this upward momentum. While U.S. markets faced mixed trends amidst geopolitical tensions and oil price fluctuations, Astera Labs' focused growth strategies and robust financial performance appear to have buoyed its market position during this period.

We've discovered 1 weakness for Astera Labs that you should be aware of before investing here.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent announcement of Astera Labs' partnership with Alchip Technologies is expected to significantly influence its growth narrative. This strategic move, aligned with the rise in AI infrastructure demand, enhances the company's position in the market, potentially boosting both revenue and earnings forecasts. By tapping into the expanding AI solutions sector and focusing on innovative product lines, Astera Labs is positioned for substantial revenue growth. The integration of complementary technologies, like CXL, could also improve future earnings visibility by diversifying its product offerings and capturing more of the AI infrastructure market.

Over the past year, Astera Labs' total shareholder return was a remarkable 68.67%. This performance is particularly significant when considering that the company's share price also exceeded the broader semiconductor industry, which returned 8.2% during the same period. With its current share price at approximately US$65.65, this presents a 40.9% discount to the analysts' consensus price target of US$111.16, suggesting there is room for potential upside, assuming future earnings projections and market conditions align favorably.

The valuation report we've compiled suggests that Astera Labs' current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion