- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

Astera Labs (ALAB) Reports Strong Q2 2025 Earnings

Reviewed by Simply Wall St

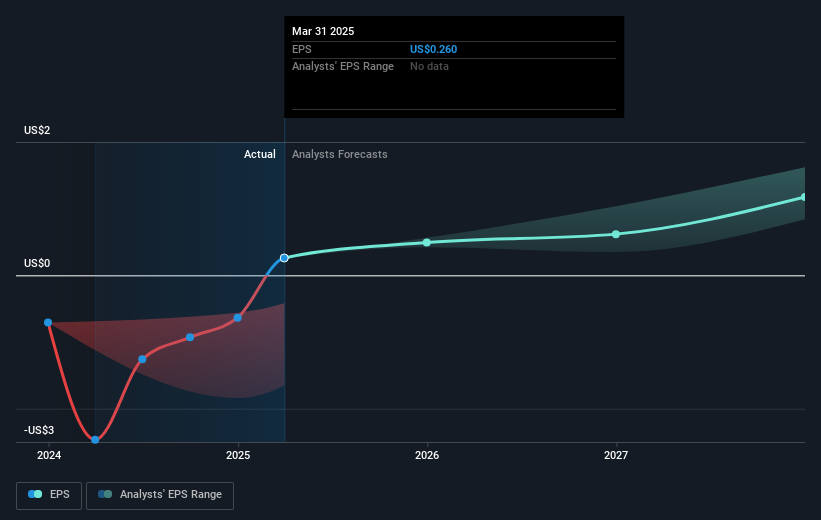

Astera Labs (ALAB) recently reported strong Q2 2025 financial results, demonstrating a robust year-over-year growth in sales and net income, potentially influencing its impressive 143% stock price rise over the last quarter. This financial recovery aligns with the favorable market trend, particularly with technology stocks witnessing solid gains as investors focused on earnings. However, the company's removal from several Russell benchmarks during the same period could have slightly countered these gains. Additionally, strategic partnerships with industry leaders such as Alchip Technologies and NVIDIA bolster its position in the AI infrastructure space, complementing overall market optimism.

Astera Labs has 2 risks we think you should know about.

Astera Labs' strong Q2 2025 results and strategic collaborations with Alchip Technologies and NVIDIA emphasize its commitment to the AI infrastructure sector. This focus aligns with the expansion into CXL technology, crucial for future revenue growth. The company's 143% stock price increase over the last quarter marks a remarkable recovery, further backed by the long-term total return of 379.49% over the past year. While the company's shares surpassed the broader US Market, which returned 22.4% in the last year, there remains a 10% discount when comparing its current share price of $174.39 against the analyst price target of $156.44.

Revenue and earnings forecasts suggest a robust growth trajectory, supported by the anticipated ramp-up of innovative product lines like Leo and Scorpio. These developments could significantly boost the company's market share and profitability, addressing the connectivity demands within the AI cluster domain. However, the removal from Russell benchmarks presents a risk, potentially affecting investor perception despite current positive financial performance. As investors evaluate the company's future prospects, the alignment of revenue and earnings growth with forecast assumptions remains critical for sustaining confidence and justifying valuations.

Understand Astera Labs' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives