- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

Astera Labs (ALAB): Evaluating Valuation as AMD and Oracle Partnership Reshapes Market Dynamics

Reviewed by Kshitija Bhandaru

Astera Labs (ALAB) shares dropped sharply this week after AMD and Oracle unveiled a major GPU partnership. This development has fueled investor worries that closer collaboration between chipmakers and cloud players might weaken demand for Astera's connectivity hardware.

See our latest analysis for Astera Labs.

This week's sell-off comes after a period of head-turning gains for Astera Labs, with the stock still up an impressive 137.87% on a total return basis over the past year. While near-term share price momentum has faded, with the stock down almost 35% in the last month after peaking on major partnership announcements earlier this quarter, recent deals with Arm and high-profile events at OCP Global Summit have kept the long-term growth story intact, even if short-term sentiment has clearly taken a hit.

If you’re watching how AI and semiconductor partnerships are reshaping the market, it’s a perfect moment to explore the leading edge of innovation through our See the full list for free.

With shares now trading well below recent highs and long-term growth drivers still in play, the big question is whether Astera Labs is finally offering a genuine bargain or if the market is already factoring in all of its future gains.

Most Popular Narrative: 14.2% Undervalued

According to the most widely-followed narrative, Astera Labs’ fair value sits notably above its last closing price of $159.80. This indicates a meaningful valuation gap and sets the stage for a deeper look at the logic driving bullish expectations from market observers.

Rapid ramp-up and continued customer diversification of the Scorpio P-Series and soon-to-launch Scorpio X-Series switches are driving increased dollar content per AI accelerator. This is establishing a higher baseline for revenues as Astera Labs moves from early product adoption to large-scale rack-level AI infrastructure deployments, which will materially impact top-line growth and revenue stability.

What lies behind this pricing power and elevated fair value? The key factors are a set of aggressive growth forecasts and premium profit margin assumptions powering the narrative. Find out exactly which financial bets underpin the story. Unlock the numbers shaping the expected upside.

Result: Fair Value of $186.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. A slowdown in AI infrastructure investment, or a growing threat from larger chipmakers, could quickly challenge this bullish outlook.

Find out about the key risks to this Astera Labs narrative.

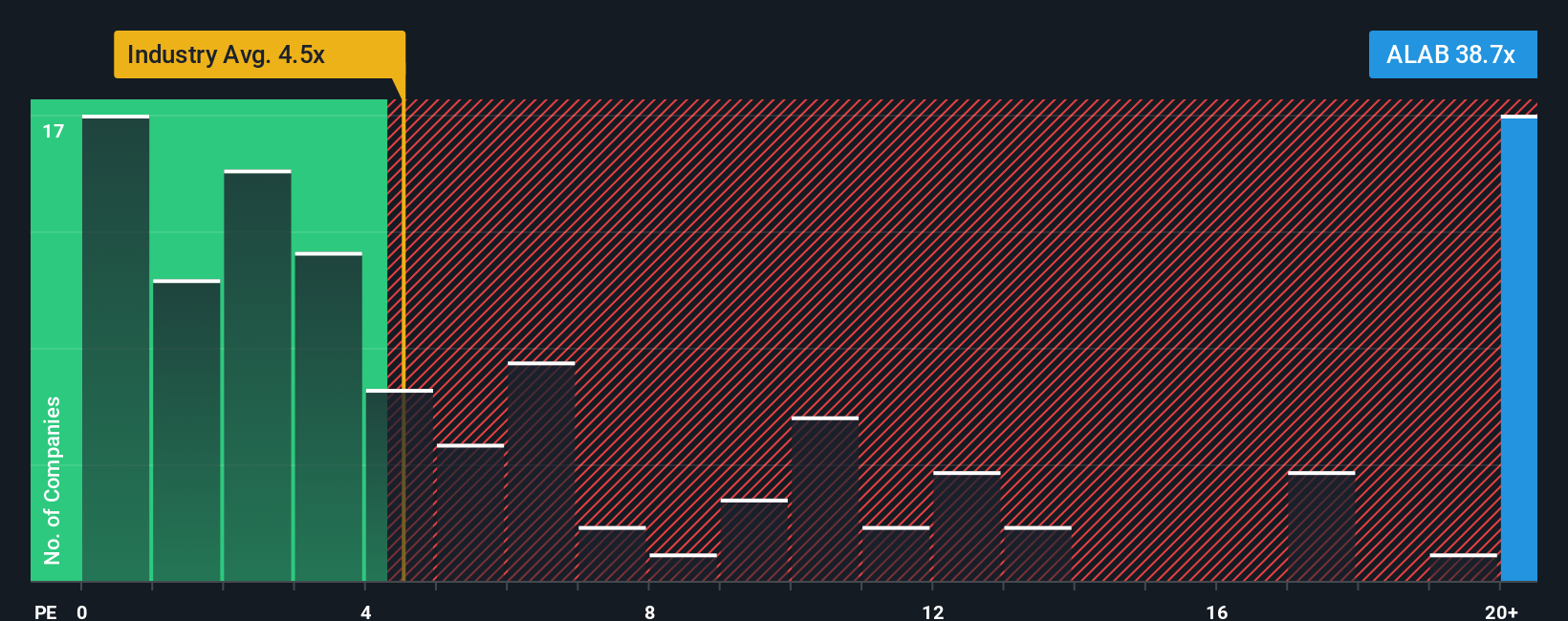

Another View: Look Beyond Analyst Targets

While analysts see upside, it’s important to weigh how the market is currently valuing Astera Labs. Shares are trading at a price-to-sales ratio of 43.9x, which is much higher than the industry average of 5.2x, its peers at 14.7x, and even above the fair ratio of 29.5x. This wide gap suggests investors are paying a substantial premium for future growth, which could amplify risks if expectations shift.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Astera Labs Narrative

Feel free to dig into the data firsthand and craft your own view. Building a personalized narrative for Astera Labs is quick and easy, taking under three minutes. Do it your way

A great starting point for your Astera Labs research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the crowd by investigating other promising themes right now. Unique stock opportunities are just a click away with the Simply Wall Street Screener.

- Unlock high yield potential and start earning from your portfolio by checking out these 18 dividend stocks with yields > 3% with yields above 3%.

- Spot game-changing innovations shaping the healthcare space. See today's most compelling opportunities with these 33 healthcare AI stocks.

- Broaden your search for hidden value and take control with these 876 undervalued stocks based on cash flows that stand out based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives