- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

3 Growth Companies With High Insider Ownership Growing Revenues At 24%

Reviewed by Simply Wall St

The United States market has shown positive momentum, with a 3.4% increase over the past week and a notable 14% rise in the last year, while earnings are projected to grow by 15% annually. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business and have potential for substantial revenue expansion.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Zapp Electric Vehicles Group (ZAPP.F) | 16.1% | 170.8% |

| Super Micro Computer (SMCI) | 13.9% | 39.1% |

| Similarweb (SMWB) | 14.9% | 69.7% |

| Ryan Specialty Holdings (RYAN) | 15.5% | 91% |

| Prairie Operating (PROP) | 34.6% | 75.7% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Credo Technology Group Holding (CRDO) | 12% | 45% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 24% |

| Astera Labs (ALAB) | 13.1% | 44.4% |

Underneath we present a selection of stocks filtered out by our screen.

Celsius Holdings (CELH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Celsius Holdings, Inc. is a company that focuses on the development, production, marketing, and distribution of functional energy drinks worldwide with a market cap of $11.84 billion.

Operations: Celsius Holdings generates its revenue primarily from the non-alcoholic beverages segment, amounting to $1.33 billion.

Insider Ownership: 13.1%

Revenue Growth Forecast: 19.1% p.a.

Celsius Holdings exhibits characteristics of a growth company with high insider ownership, supported by significant expected earnings growth of 32% annually, surpassing the US market average. Despite a recent decrease in profit margins from 15.2% to 5.8%, the company's revenue is projected to grow at 19.1% per year. Recent corporate actions include an increase in authorized common stock and shelf registrations totaling approximately US$239 million, indicating strategic financial maneuvers for potential expansion or acquisitions.

- Click here to discover the nuances of Celsius Holdings with our detailed analytical future growth report.

- Our valuation report unveils the possibility Celsius Holdings' shares may be trading at a premium.

Astera Labs (ALAB)

Simply Wall St Growth Rating: ★★★★★★

Overview: Astera Labs, Inc. designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure with a market cap of $15.01 billion.

Operations: The company's revenue is primarily generated from its semiconductor segment, totaling $490.47 million.

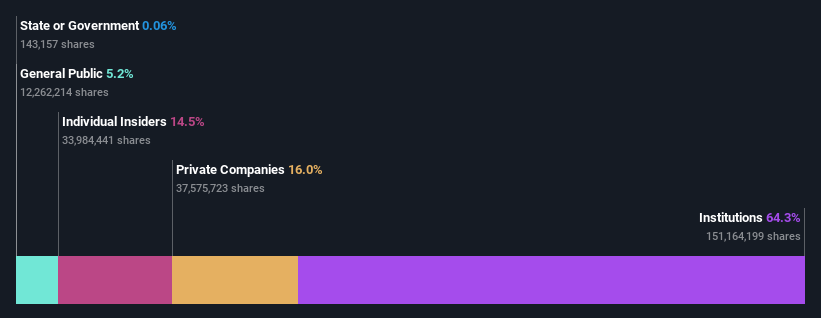

Insider Ownership: 13.1%

Revenue Growth Forecast: 24% p.a.

Astera Labs demonstrates growth potential with forecasted revenue and earnings growth rates of 24% and 44.4% annually, respectively, exceeding US market averages. Despite recent volatility and index removals, the company has become profitable this year. Insider activity shows substantial selling over the past three months. Recent strategic partnerships with Alchip Technologies and NVIDIA enhance its AI infrastructure capabilities, while a shelf registration of US$903 million suggests preparation for future financial strategies or expansions.

- Unlock comprehensive insights into our analysis of Astera Labs stock in this growth report.

- Upon reviewing our latest valuation report, Astera Labs' share price might be too optimistic.

AvePoint (AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AvePoint, Inc. offers a cloud-native data management software platform across various regions including North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of approximately $3.91 billion.

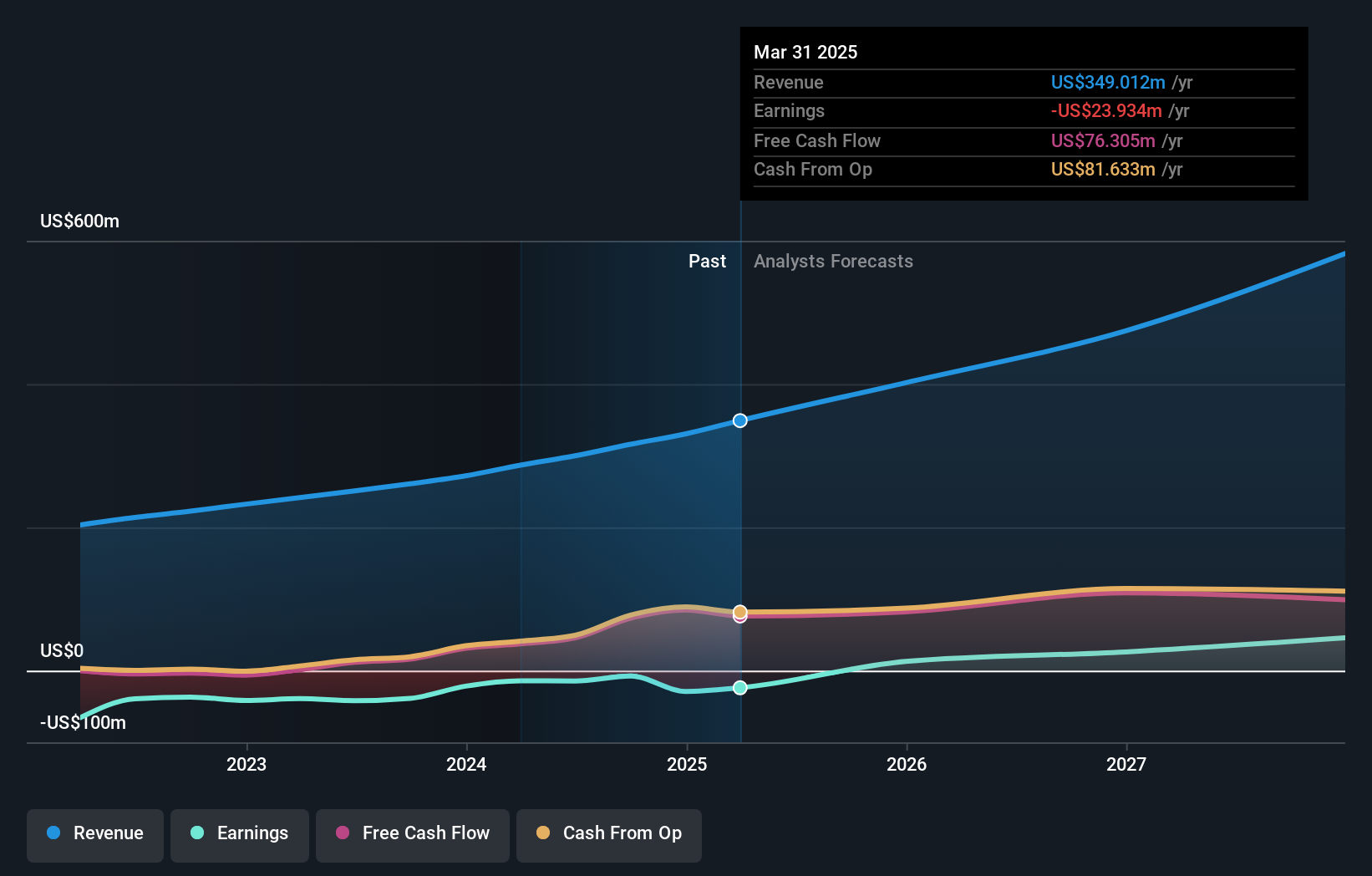

Operations: The company's revenue is primarily derived from its Software & Programming segment, amounting to $349.01 million.

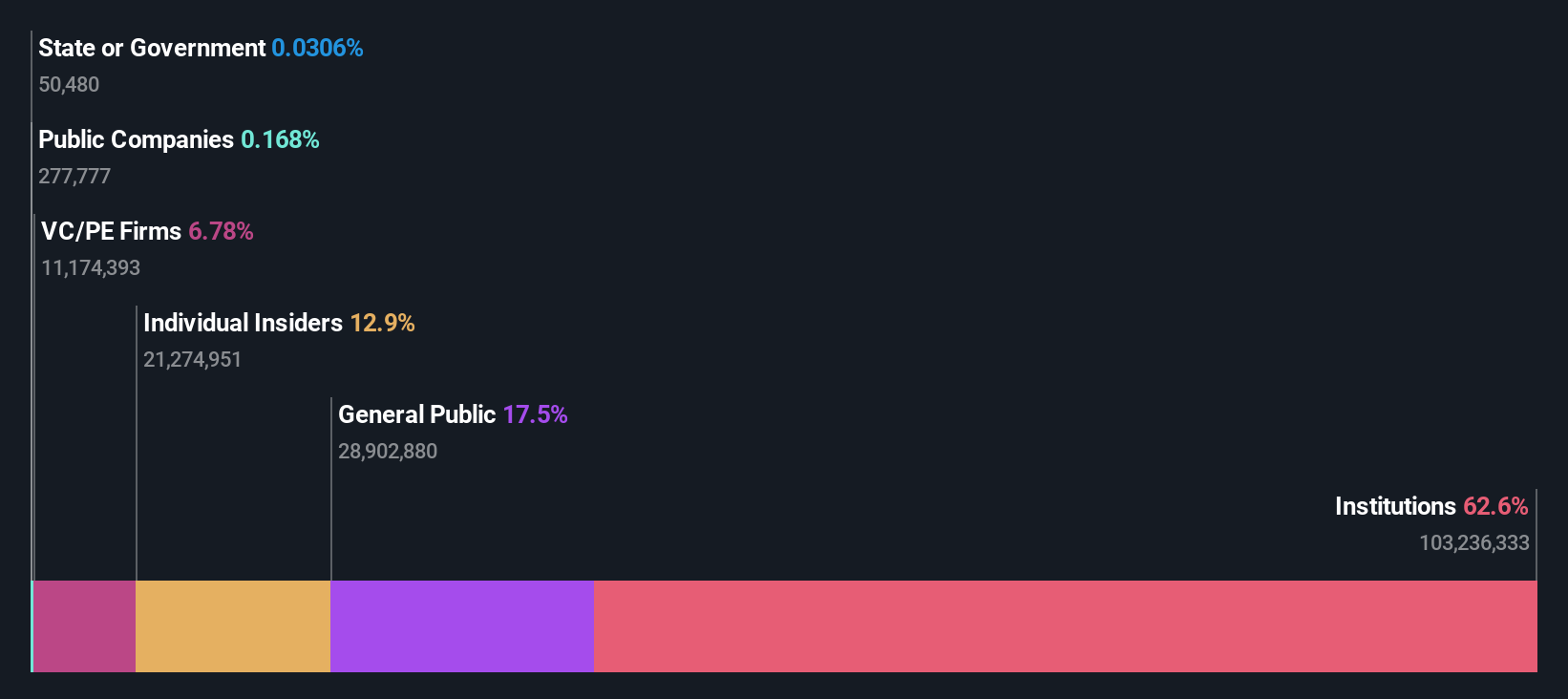

Insider Ownership: 34.5%

Revenue Growth Forecast: 18.3% p.a.

AvePoint's forecasted earnings growth of 93.73% annually, coupled with expected profitability within three years, indicates strong growth potential. Despite recent index removals and significant insider selling, AvePoint's strategic product updates enhance its data governance and cost optimization capabilities. The company's Q1 revenue increased to US$93.06 million from US$74.53 million a year ago, reflecting robust financial performance. Recent buybacks totaling US$11.91 million highlight confidence in its long-term strategy amidst evolving market dynamics.

- Get an in-depth perspective on AvePoint's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that AvePoint is priced higher than what may be justified by its financials.

Next Steps

- Dive into all 194 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Ready For A Different Approach? These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives