- United States

- /

- Water Utilities

- /

- NasdaqGS:ARTN.A

Uncovering Aehr Test Systems And 2 Other Undiscovered Gems In The US Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it boasts a remarkable 22% increase over the past year with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying stocks like Aehr Test Systems that have potential for growth can be crucial for investors seeking opportunities beyond well-known names.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Aehr Test Systems (NasdaqCM:AEHR)

Simply Wall St Value Rating: ★★★★★★

Overview: Aehr Test Systems, Inc. offers comprehensive test solutions for semiconductor devices across various stages and formats globally, with a market capitalization of $318.51 million.

Operations: Aehr Test Systems generates revenue primarily from designing, manufacturing, and marketing advanced test and burn-in products, totaling $50.74 million.

Aehr Test Systems, a nimble player in the semiconductor testing space, has seen its earnings grow by 5% over the past year, outpacing the industry's -1.6%. Despite a volatile share price recently, Aehr remains debt-free and boasts a favorable price-to-earnings ratio of 14.5x compared to the US market's 18.5x. However, recent financials revealed a net loss of US$1.03 million for Q2 against last year's net income of US$6.09 million, with revenue dropping to US$13.45 million from US$21.43 million year-on-year due to order delays impacting growth prospects amidst ongoing legal challenges.

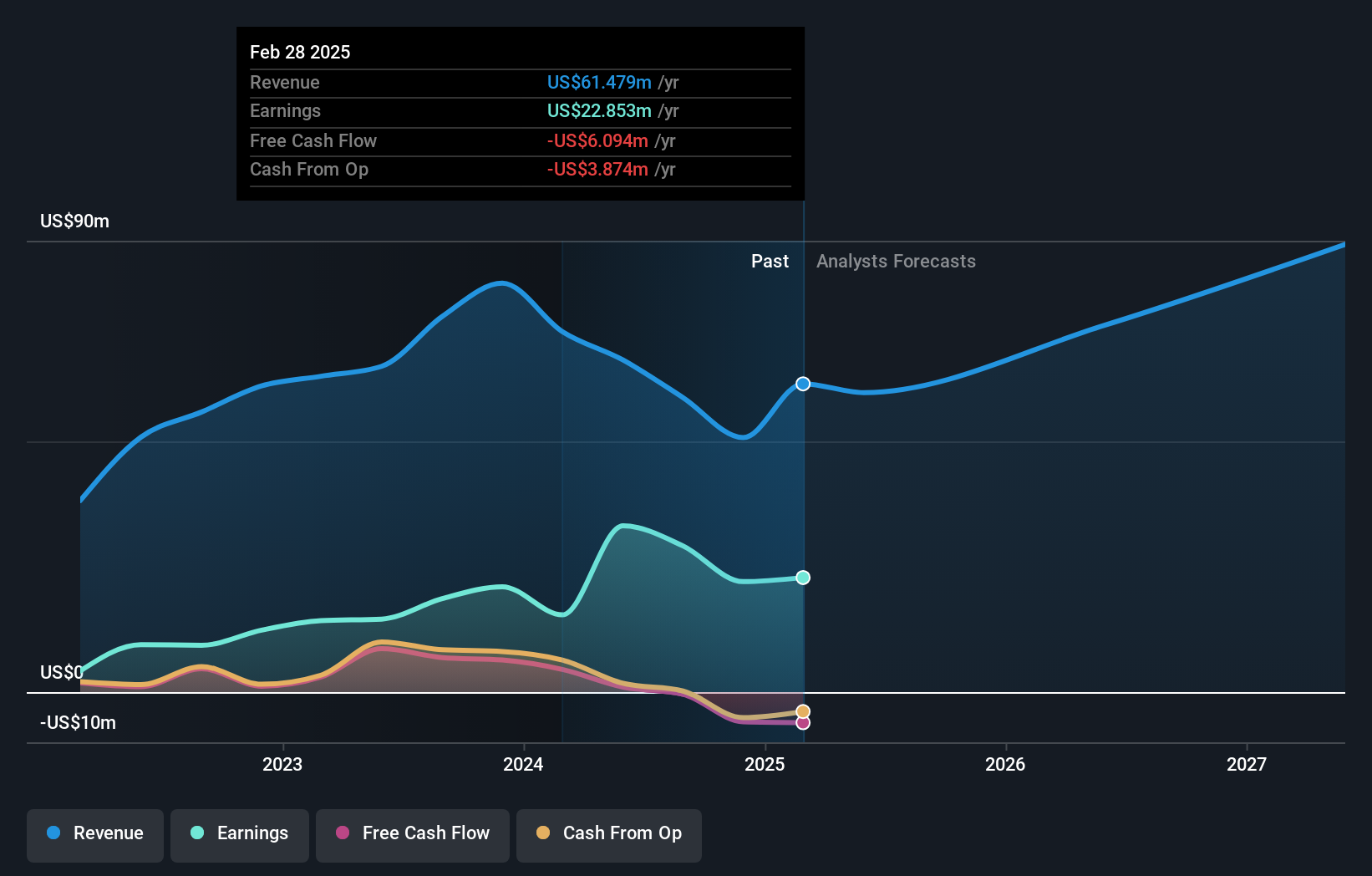

Artesian Resources (NasdaqGS:ARTN.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Artesian Resources Corporation operates through its subsidiaries to provide water, wastewater, and related services in Delaware, Maryland, and Pennsylvania, with a market capitalization of approximately $320.19 million.

Operations: Artesian Resources generates revenue primarily from its regulated utility services, amounting to $98.93 million, while non-utility services contribute $6.97 million.

Artesian Resources, a water utility player, stands out with its robust earnings growth of 28.9% over the past year, surpassing the industry average of 14.3%. Despite a high net debt to equity ratio at 72.4%, its interest payments are well covered by EBIT at 3.8x coverage, indicating strong financial management. Recent leadership changes see Nicholle R. Taylor stepping in as interim CEO while maintaining her role as Senior Vice President, ensuring continuity in operations during Dian C. Taylor's leave. The company declared a quarterly dividend of US$0.3014 per share, marking its 129th consecutive payout to shareholders.

- Unlock comprehensive insights into our analysis of Artesian Resources stock in this health report.

Assess Artesian Resources' past performance with our detailed historical performance reports.

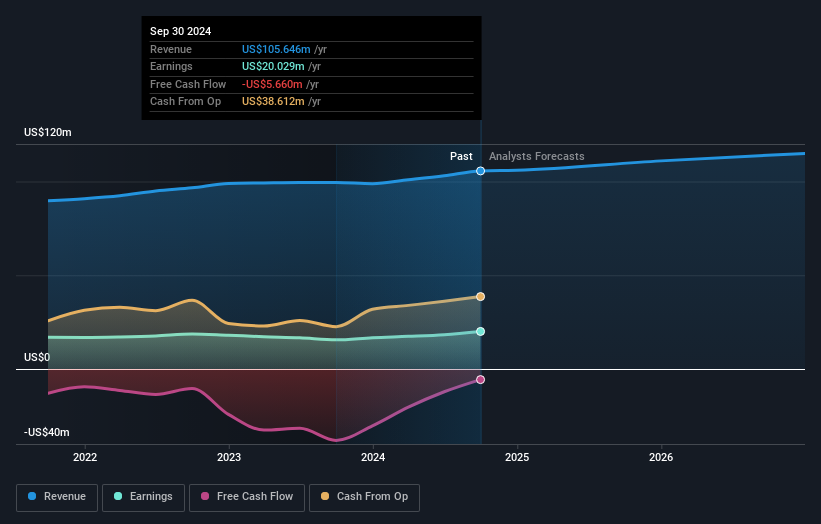

Ituran Location and Control (NasdaqGS:ITRN)

Simply Wall St Value Rating: ★★★★★★

Overview: Ituran Location and Control Ltd. offers location-based telematics services and machine-to-machine telematics products, with a market capitalization of approximately $707.81 million.

Operations: Ituran generates revenue primarily from telematics services, accounting for $240.37 million, and telematics products, contributing $90.81 million. The company's net profit margin is a key financial metric to consider in evaluating its profitability.

Ituran Location and Control, a smaller-scale player in the telematics sector, is making strides with strategic partnerships and subscriber growth. The company recently inked a five-year deal with Nissan Chile, following success in Mexico, which could drive vehicle installations and renewals. Ituran added 40,000 subscribers lately, indicating strong revenue potential. With cash reserves of US$67 million and well-covered interest payments by EBIT (380x), it offers an appealing dividend yield. However, challenges like currency fluctuations and socio-economic issues in emerging markets pose risks to future earnings growth despite promising projections for margin improvements.

Seize The Opportunity

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 277 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ARTN.A

Artesian Resources

Provides water, wastewater, and other services in Delaware, Maryland, and Pennsylvania.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives