- United States

- /

- Semiconductors

- /

- NasdaqCM:AEHR

The Aehr Test Systems (NASDAQ:AEHR) Share Price Is Down 46% So Some Shareholders Are Getting Worried

While it may not be enough for some shareholders, we think it is good to see the Aehr Test Systems (NASDAQ:AEHR) share price up 21% in a single quarter. But that cannot eclipse the less-than-impressive returns over the last three years. In fact, the share price is down 46% in the last three years, falling well short of the market return.

View our latest analysis for Aehr Test Systems

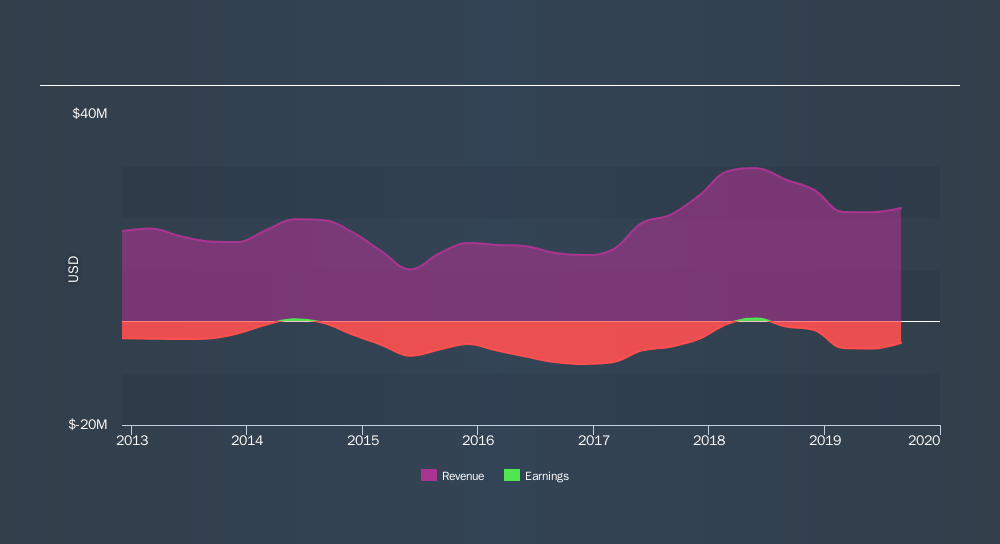

Given that Aehr Test Systems didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Aehr Test Systems saw its revenue grow by 16% per year, compound. That's a pretty good rate of top-line growth. Shareholders have seen the share price fall at 18% per year, for three years. So the market has definitely lost some love for the stock. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Aehr Test Systems stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Aehr Test Systems shareholders are down 21% for the year, but the market itself is up 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8.0% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you would like to research Aehr Test Systems in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like Aehr Test Systems better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:AEHR

Aehr Test Systems

Provides test solutions for testing, burning-in, and semiconductor devices in wafer level, singulated die, package part form, and installed systems worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives