- United States

- /

- Semiconductors

- /

- NasdaqCM:AEHR

How Aehr Test Systems' (AEHR) Profit Swing and Lower Revenue Are Shaping Its Investment Story

Reviewed by Sasha Jovanovic

- Aehr Test Systems reported first quarter 2025 earnings earlier this month, with sales of US$10.97 million compared to US$13.12 million a year earlier, and a move from net income of US$660,000 to a net loss of US$2.08 million.

- An interesting aspect is that the company shifted from profitability to a loss year-over-year, highlighting recent operational challenges in a competitive sector.

- We'll examine how reduced revenue and a swing to losses could influence Aehr Test Systems' investment narrative going forward.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Aehr Test Systems' Investment Narrative?

To understand the big picture for Aehr Test Systems, investors really need to believe in the company's ability to convert its promising technology and customer wins, particularly in the automotive and AI semiconductor testing space, into steady, profitable growth. The latest earnings marked a clear setback, with sales dropping and a meaningful shift from profit to loss, signaling that operational headwinds or demand delays may be more immediate than previously expected. While robust revenue growth had been forecast and several new production orders were previously announced, this reversal raises questions about the timing of those catalysts converting into tangible financial results. Not only does this impact confidence in short-term growth, but it also brings execution risk and volatility into sharper focus, especially given Aehr’s high valuation multiples, insider selling, and ongoing legal issues. It’s a moment where the company’s near-term execution (and client follow-through) could matter more than optimistic market forecasts.

On the flipside, the volatility in recent quarters is something investors shouldn’t ignore.

Exploring Other Perspectives

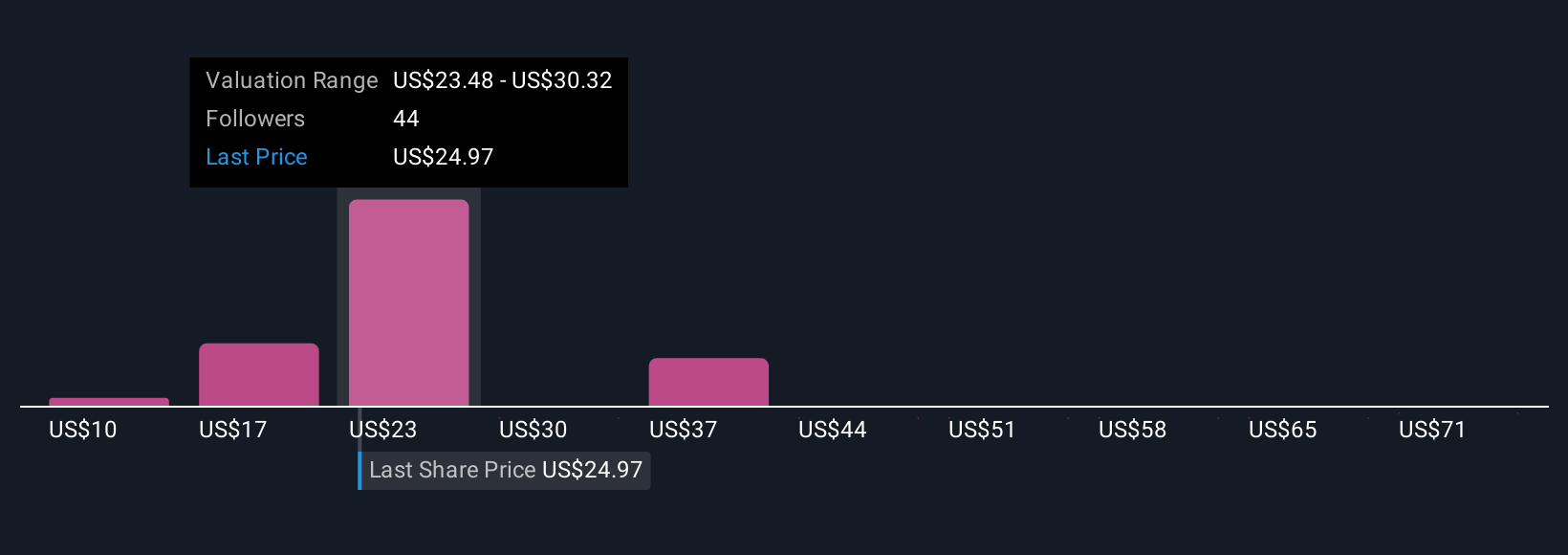

Explore 11 other fair value estimates on Aehr Test Systems - why the stock might be worth less than half the current price!

Build Your Own Aehr Test Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aehr Test Systems research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Aehr Test Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aehr Test Systems' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AEHR

Aehr Test Systems

Provides test solutions for testing, burning-in, and semiconductor devices in wafer level, singulated die, package part form, and installed systems in the United States, Asia, and Europe.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives