- United States

- /

- Semiconductors

- /

- NasdaqGS:ADI

Will Analog Devices (ADI) Power Studio Tools Deepen Its Competitive Lead in System Design Innovation?

Reviewed by Sasha Jovanovic

- Analog Devices recently announced the launch of ADI Power Studio, a comprehensive suite of web-based tools designed to streamline power system design and accelerate engineers’ development cycles.

- This initiative highlights the company’s drive to integrate advanced modeling, efficiency analysis, and guided workflows, giving engineers expanded capabilities for power-dense system applications.

- We'll explore how the new ADI Power Studio tools could enhance Analog Devices' long-term edge in design innovation and customer engagement.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Analog Devices Investment Narrative Recap

To own shares of Analog Devices today, investors need to believe in the company’s ability to lead in power management and automation, while managing global competition and geopolitical challenges. The launch of ADI Power Studio showcases Analog Devices’ ongoing focus on design innovation, but in the short term, this announcement isn’t likely to materially change the biggest catalyst, industrial automation demand, or the main risk, which remains supply chain and market access volatility. The core story stays centered on end-market normalization and margin management.

Among recent announcements, the introduction of ADI Power Studio is particularly relevant. It brings advanced modeling and design tools to engineers, aiming to shorten development cycles and streamline the entire power system workflow. This improved customer experience supports the long-term growth driver of increasing content per device in automation and robotics, tying directly into the critical catalysts for future expansion.

Yet, investors should also be aware that, in contrast, even the most cutting-edge tools might not fully offset the risks associated with ...

Read the full narrative on Analog Devices (it's free!)

Analog Devices' outlook forecasts $14.3 billion in revenue and $4.9 billion in earnings by 2028. This assumes an annual revenue growth rate of 11.3% and a $2.9 billion earnings increase from the current $2.0 billion.

Uncover how Analog Devices' forecasts yield a $267.47 fair value, a 10% upside to its current price.

Exploring Other Perspectives

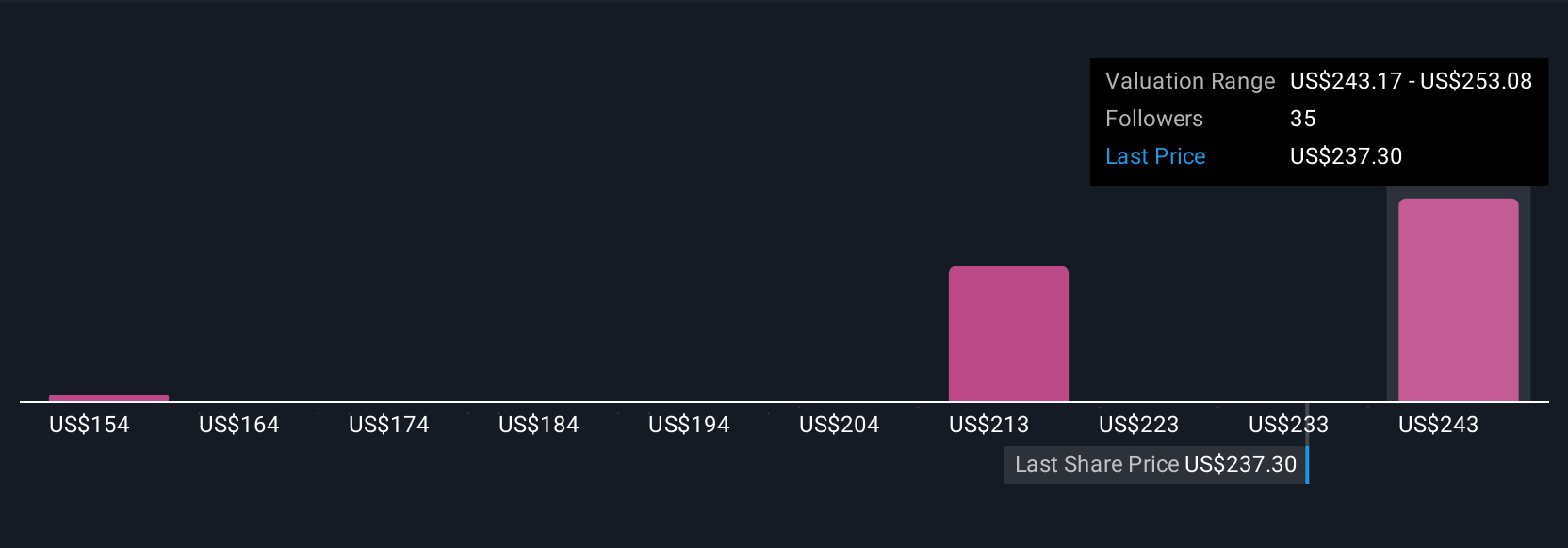

Nine members of the Simply Wall St Community provided fair value estimates for Analog Devices ranging from US$157.50 up to US$310. Supply chain and market access volatility continues to have meaningful implications for business stability, so consider the full scope of opinions before forming your view.

Explore 9 other fair value estimates on Analog Devices - why the stock might be worth 35% less than the current price!

Build Your Own Analog Devices Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Analog Devices research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Analog Devices research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Analog Devices' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADI

Analog Devices

Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives