- United States

- /

- Semiconductors

- /

- NasdaqGS:ADI

Does Analog Devices’ 11% Weekly Surge Signal a Disconnect From Intrinsic Value?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Analog Devices stock is trading for more or less than it is really worth, you are in the right place to get clarity without the jargon.

- In just the past week, shares of Analog Devices have jumped by 11.0%, adding to a strong year-to-date return of 22.0% that has caught the attention of investors.

- Fueling that momentum, the chipmaker continues to benefit from expanding applications in industrial automation and automotive tech. Both of these areas have been making headlines as sectors hungry for advanced semiconductors. Big-name partnerships and increased demand for analog chips have been major talking points in recent industry news driving interest in Analog Devices.

- With a valuation score of 1 out of 6, there are clear signals that will be important to unpack. We will dig into the numbers using widely used valuation approaches next, but stick around to learn about an alternative perspective worth considering by the end of this article.

Analog Devices scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Analog Devices Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to today's value. For Analog Devices, this approach provides a detailed look at how the company may perform over time based on free cash flow projections.

Analog Devices currently generates $3.96 Billion in Free Cash Flow (FCF). Analysts forecast FCF will continue growing, reaching $6.31 Billion by 2029. While analysts provide estimates for up to five years, future cash flows beyond that point are extrapolated by Simply Wall St. This offers a comprehensive projection over the next decade.

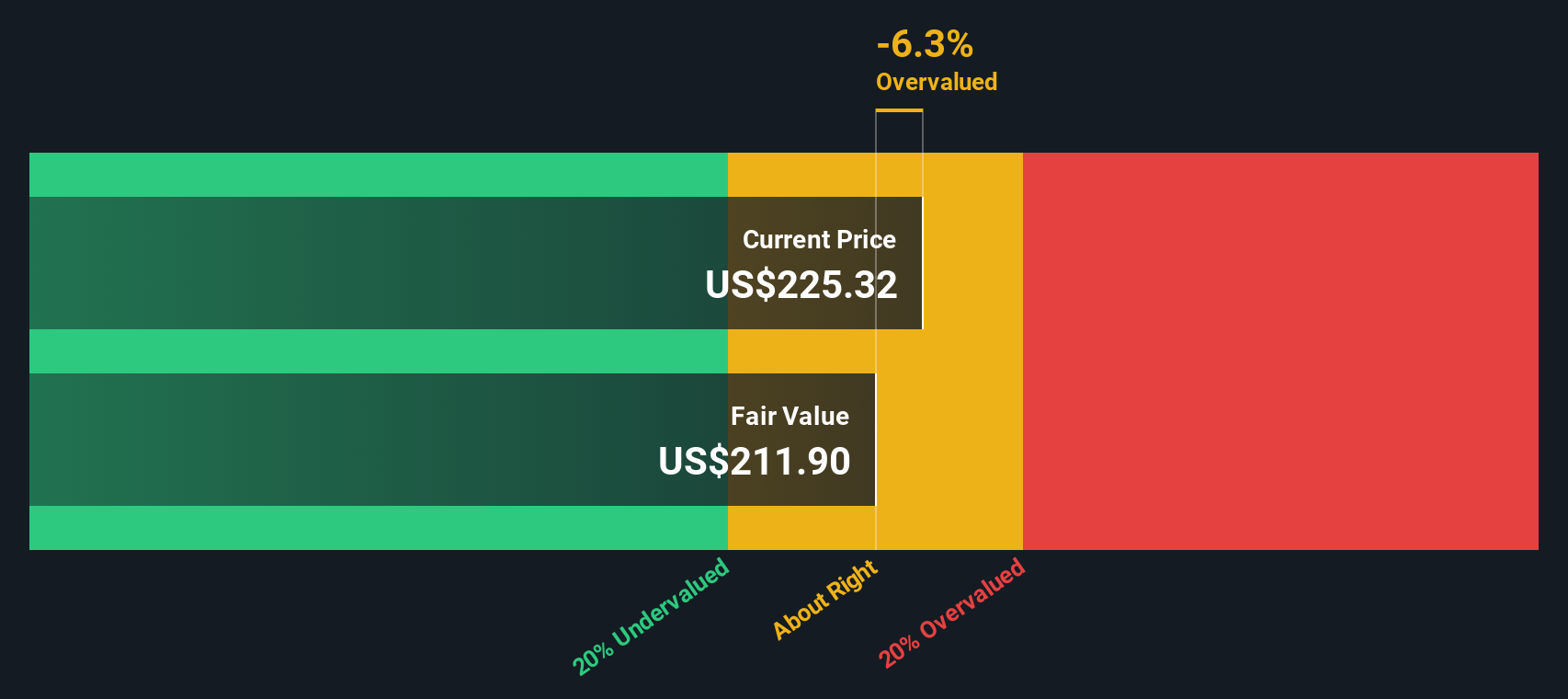

According to the DCF calculation, the estimated intrinsic value of Analog Devices shares is $162.59. Based on this valuation, the stock is trading at a 58.6% premium to its intrinsic value, implying it is considerably overvalued at current market prices.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Analog Devices may be overvalued by 58.6%. Discover 926 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Analog Devices Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it tells investors how much they are paying for each dollar of earnings. Since Analog Devices is consistently profitable, PE is a relevant and intuitive way to measure how the market values its earnings power.

It is important to note that companies with higher expected growth and lower risk usually trade at higher PE ratios, while more mature or volatile businesses tend to command lower multiples. The appropriate PE ratio depends on factors such as earnings growth, stability, and how the company compares to its industry and peers.

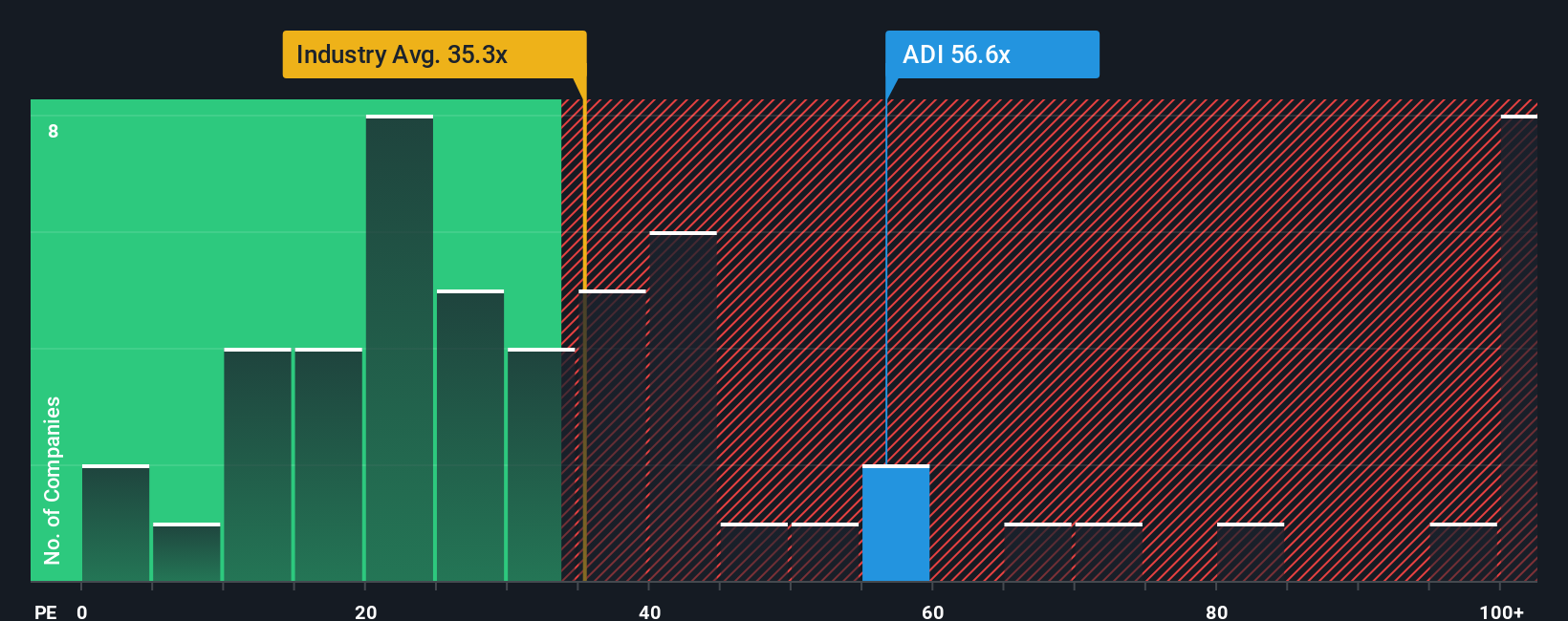

Currently, Analog Devices trades at a PE ratio of 55.7x, which is higher than the semiconductor industry average of 35.8x and the average for its closest peers at 63.8x. At first glance, this might seem expensive relative to the broader semiconductor space.

However, Simply Wall St’s “Fair Ratio” for Analog Devices is 37.9x. This proprietary metric improves on simple industry or peer benchmarks by factoring in the company’s unique earnings growth, profit margins, risk profile, market cap, and its specific position within the industry. This makes it a more tailored and reliable measure for valuation comparisons.

Comparing Analog Devices’ current PE ratio of 55.7x to its Fair Ratio of 37.9x underscores that the stock is trading at a significant premium to what would be considered fair given its underlying fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Analog Devices Narrative

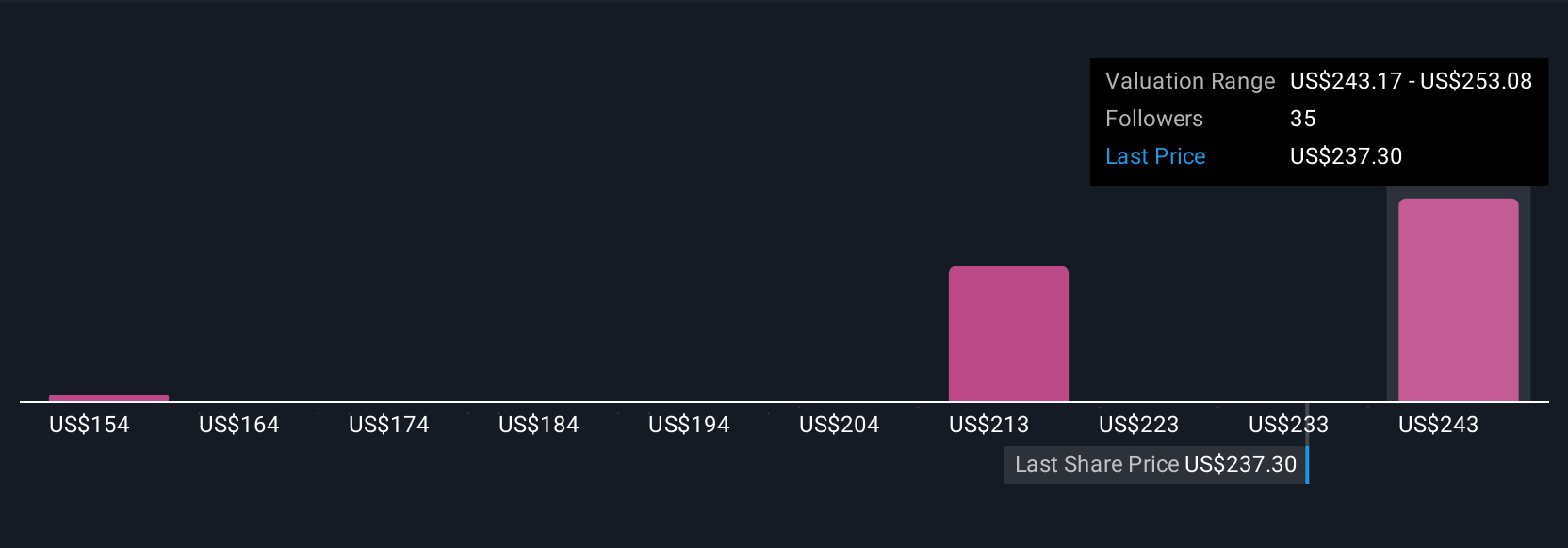

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative goes beyond traditional numbers by allowing you to define your own story and perspective about a company. This approach connects your view of its future revenue, earnings, and profit margins to a fair value estimate.

Narratives offer a straightforward and interactive way to see how your expectations, or those from the broader investor community, compare with current market pricing. On Simply Wall St's Community page, millions of investors use Narratives every day as a tool for layering their unique insights over the financials to inform their buy or sell decisions.

With Narratives, you can quickly update your forecast when fresh news or earnings reports are released. This ensures your fair value view always reflects the latest information. For instance, some investors believe Analog Devices will deliver exceptional growth driven by AI and industrial automation, setting their Narrative Fair Value as high as $310 per share. Others, more cautious about industry risks, see fair value nearer to $155. By choosing and following your preferred Narrative, you can invest smarter, using a story that makes sense to you and backing it up with dynamic, up-to-date analysis.

Do you think there's more to the story for Analog Devices? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADI

Analog Devices

Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.