- United States

- /

- Semiconductors

- /

- NasdaqGS:ADI

Broad-Based Q3 Beat Could Be a Game Changer for Analog Devices (ADI)

Reviewed by Simply Wall St

- Analog Devices recently reported fiscal third-quarter 2025 results that surpassed expectations, with revenue growth across all major segments and optimistic fourth-quarter guidance outlined by management.

- The company also enhanced investor engagement by releasing a new presentation highlighting its long-term strategy, sustainability initiatives, and executive alignment with shareholder interests.

- We'll examine how Analog Devices' broad-based revenue growth and positive management outlook reinforce its investment narrative focused on innovation and earnings strength.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Analog Devices Investment Narrative Recap

Analog Devices’ investment case hinges on long-term growth from industrial automation, automotive electrification, and high-value analog solutions, supported by recent robust multi-segment revenue gains and strong fourth-quarter guidance. While this earnings beat is encouraging, the key short-term catalyst remains sustainable demand in core industrial and auto markets; however, risks tied to cyclical inventory normalization and global competition have not changed materially in light of the latest results.

Analog Devices’ upcoming investor presentation, showcasing its sustainability focus and executive-shareholder alignment, is especially relevant, as it underscores management’s commitment to capital discipline and innovation, two drivers analysts flag as crucial for resilience against end-market volatility and margin pressure.

In contrast, investors should also be aware that cyclical swings in inventory levels could rapidly shift earnings visibility and near-term momentum if...

Read the full narrative on Analog Devices (it's free!)

Analog Devices' outlook suggests revenues of $14.3 billion and earnings of $4.9 billion by 2028. This reflects an expected annual revenue growth rate of 11.3%, and an earnings increase of $2.9 billion from the current $2.0 billion level.

Uncover how Analog Devices' forecasts yield a $267.47 fair value, a 9% upside to its current price.

Exploring Other Perspectives

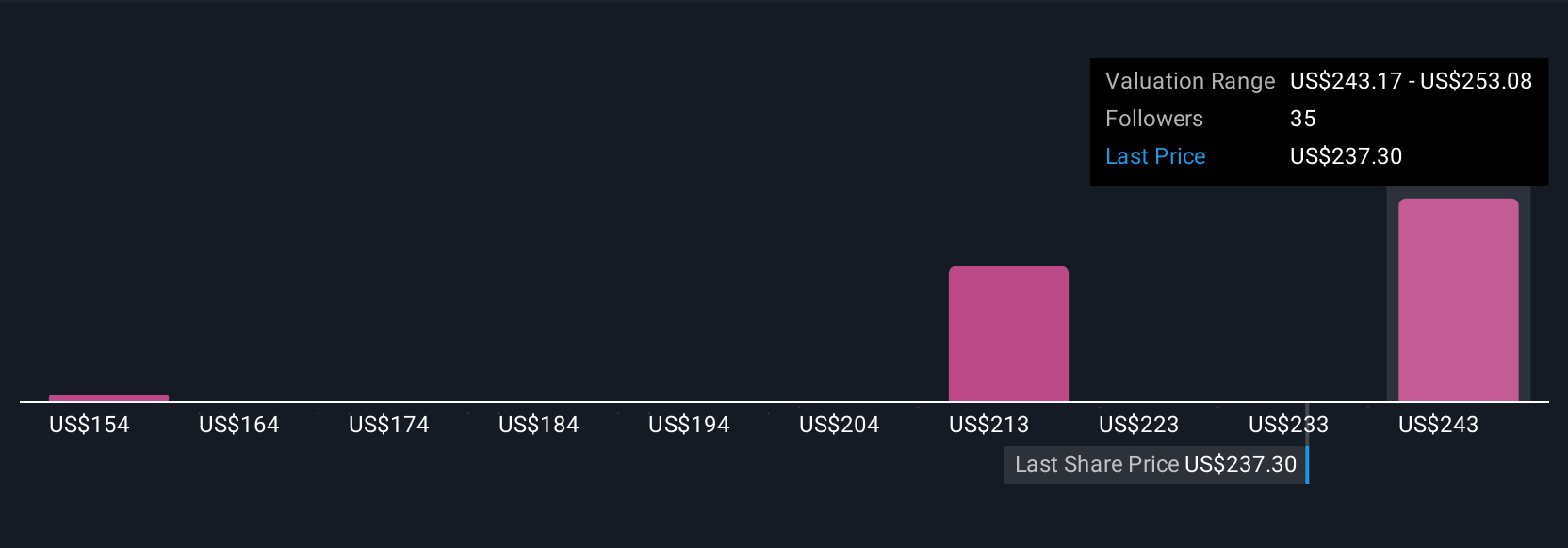

Simply Wall St Community participants estimate fair value for Analog Devices between US$157.50 and US$310.00, based on 9 independent analyses. With end-market risks and inventory corrections still factors, you can compare these viewpoints to enrich your understanding.

Explore 9 other fair value estimates on Analog Devices - why the stock might be worth 36% less than the current price!

Build Your Own Analog Devices Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Analog Devices research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Analog Devices research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Analog Devices' overall financial health at a glance.

No Opportunity In Analog Devices?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADI

Analog Devices

Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives