- United States

- /

- Semiconductors

- /

- NasdaqGS:ADI

Analog Devices (NasdaqGS:ADI) Completes US$12 Billion Buyback and Declares US$0.99 Dividend

Reviewed by Simply Wall St

Analog Devices (NasdaqGS:ADI) has shown strong performance with a Q2 sales increase to $2.64 billion and a significant rise in net income, alongside the announcement of a $0.99 per share dividend. The company also provided robust earnings guidance for the upcoming quarter. These positive developments have likely supported Analog Devices' 19% share price surge over the past month, contrasting sharply with the broader tech sector's downward trend amid renewed trade tension fears. Despite the general market seeing declines, Analog Devices' decisive financial results and shareholder-friendly actions may have provided a strong counterforce.

Analog Devices has 3 risks we think you should know about.

The recent surge in Analog Devices' share price, driven by a robust Q2 sales increase to US$2.64 billion, a dividend announcement of US$0.99 per share, and strong earnings guidance, points to a positive short-term sentiment. This upward trend contrasts with the broader tech sector's struggle amid geopolitical concerns, showcasing ADI's resilience. Over the longer term, from 2020 to 2025, ADI's total shareholder return was 107.92%, a result of both share price appreciation and sustained dividend policies.

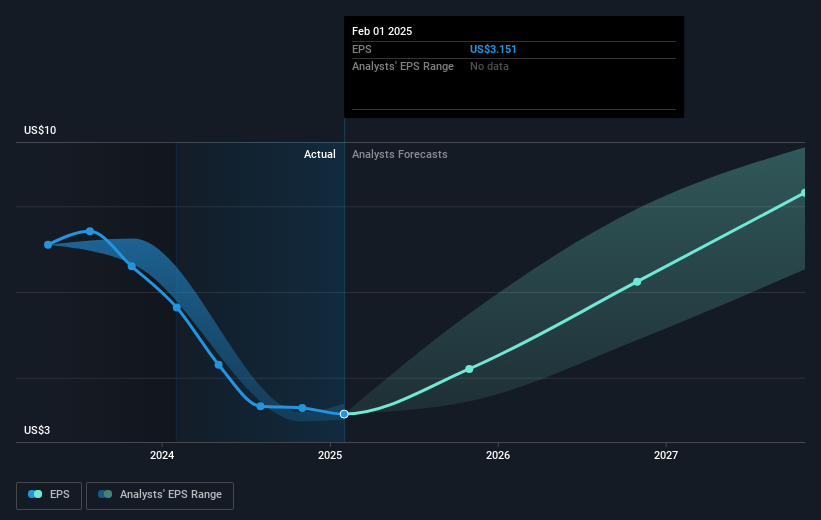

While the company underperformed the US market's 10.5% return over the past year, its commitment to advancements in AI and automation, as highlighted in the narrative, suggests continuous revenue and earnings growth potential. However, analysts project earnings to grow significantly over the coming years. This optimism could be at risk if macroeconomic or geopolitical uncertainties affect key growth markets. Investors and analysts are closely eyeing the current share price of US$195.6 against the consensus price target of US$240.94, indicating room for potential appreciation.

Considering the revenue growth narrative driven by software-defined connectivity and industrial automation, the expectations for revenue and earnings forecasts remain high. Analog Devices' investments in these areas could bolster long-term growth, positioning the company to capitalize on AI and automotive opportunities. As the company endeavors to sustain this trajectory, maintaining a competitive edge amid intensifying industry competition will be crucial.

Assess Analog Devices' previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADI

Analog Devices

Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives