- United States

- /

- Semiconductors

- /

- NasdaqGM:ACMR

ACM Research (ACMR) Is Up 5.1% After Analyst Projections Before Earnings Report Has The Bull Case Changed?

Reviewed by Simply Wall St

- ACM Research, Inc. recently outperformed its sector amid anticipation for its August 6 earnings report, with analysts projecting revenue growth despite an expected year-over-year decline in earnings.

- The company’s present Zacks Rank of #3 (Hold) indicates a mixed analyst outlook, highlighting both investor enthusiasm and uncertainty about ACM Research’s near-term business prospects ahead of its upcoming financial results.

- We'll examine how the upcoming earnings report and shifting analyst expectations could influence ACM Research’s investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ACM Research Investment Narrative Recap

To be a shareholder in ACM Research, investors need to believe that the company can sustain growth by successfully navigating both operational and regulatory challenges in the global semiconductor industry. The recent outperformance ahead of the August 6 earnings announcement has sparked optimism, but it does not materially change that the biggest short-term catalyst remains the company's ability to deliver on revenue growth expectations, while the key risk is ongoing exposure to U.S. export controls and supply chain restrictions.

Among recent announcements, the qualification of ACM’s Single-Wafer High-Temperature SPM tool by a major mainland China logic manufacturer is particularly relevant. This achievement aligns with ACM’s strategy to launch new products and strengthen relationships with key customers in China, which could prove crucial for future revenue growth as the company confronts export restrictions and shifting demand dynamics.

In contrast, one risk investors should keep in mind is the impact that further U.S. export controls or escalating geopolitical tensions could have on ACM's ability to serve its largest customers and maintain its revenue base...

Read the full narrative on ACM Research (it's free!)

ACM Research's narrative projects $1.3 billion in revenue and $175.3 million in earnings by 2028. This requires 17.9% yearly revenue growth and a $71.7 million increase in earnings from current earnings of $103.6 million.

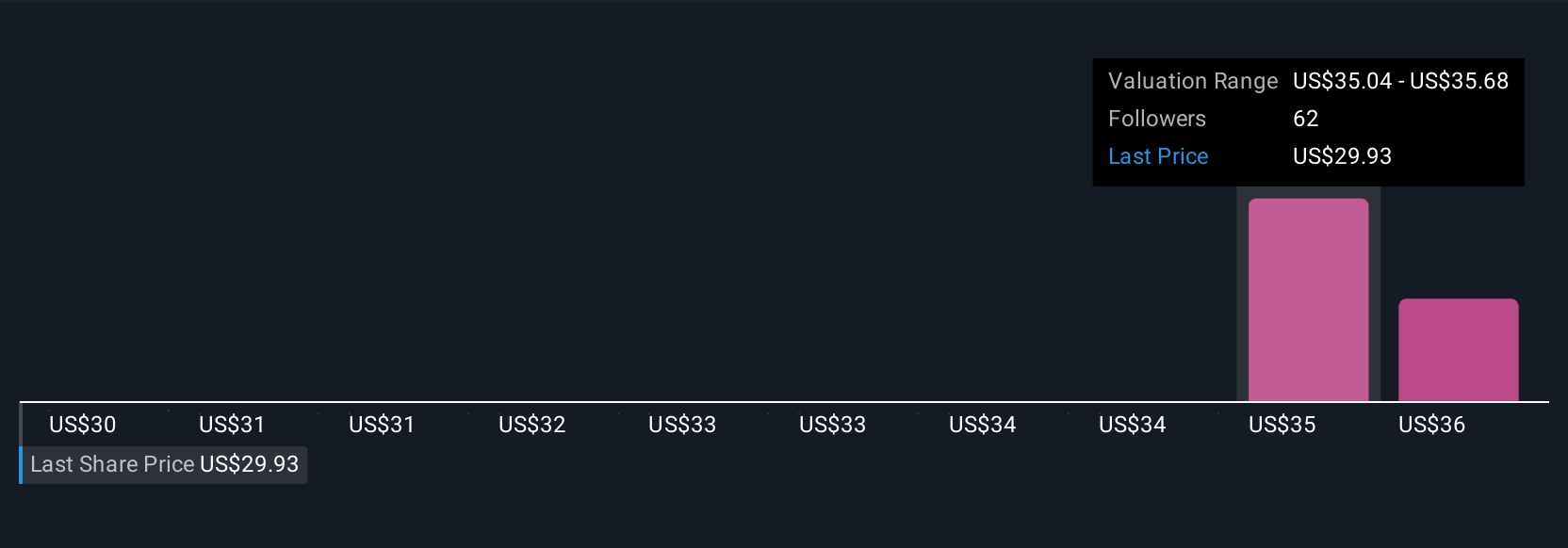

Uncover how ACM Research's forecasts yield a $35.83 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Four individual fair value estimates from the Simply Wall St Community lie between US$29.96 and US$36.41 per share. With export restrictions remaining a central risk, you can see opinions differ widely on ACM’s outlook, explore multiple viewpoints for a fuller picture.

Build Your Own ACM Research Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ACM Research research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free ACM Research research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ACM Research's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ACMR

ACM Research

Develops, manufactures, and sells capital equipment worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives