- United States

- /

- Semiconductors

- /

- NasdaqGM:ACMR

ACM Research (ACMR) Is Up 14.1% After S&P Index Additions and 34.1% Backlog Growth

Reviewed by Sasha Jovanovic

- ACM Research was recently added to several S&P indices, including the SmallCap 600 and Composite 1500, after its Shanghai subsidiary reported a 34.1% year-over-year backlog increase to RMB 9.07 billion (US$1.27 billion) as of September 29, 2025.

- This surge in backlog highlights robust demand from the semiconductor sector and points to increased revenue visibility and market recognition for ACM Research.

- We'll examine how ACM Research's substantial backlog growth and index inclusions could influence its outlook and investment case.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ACM Research Investment Narrative Recap

To be a shareholder in ACM Research, you need to believe that demand for semiconductor manufacturing equipment will remain resilient, especially in China, where the company’s core customers operate, and that ACM’s ability to grow its order backlog signals revenue visibility despite ongoing risks around technology access and geopolitical constraints. The recent surge in backlog and S&P index inclusions may reinforce investor confidence ahead of upcoming earnings, but the most pressing near-term catalyst remains whether ACM can sustain growth while managing its high exposure to China and global supply chain uncertainties. These developments, while positive, do not fully offset the risks tied to export controls and market concentration.

Among recent announcements, the addition of ACM Research to several S&P indices stands out. This not only boosts market recognition but also triggers buying activity from index funds, potentially increasing liquidity and broadening ACM’s investor base at a time when the company’s backlog growth is under scrutiny as a driver for both short-term and long-term outlook.

In contrast, investors should be aware that continued over-reliance on China’s semiconductor market could pose...

Read the full narrative on ACM Research (it's free!)

ACM Research's narrative projects $1.4 billion in revenue and $189.6 million in earnings by 2028. This requires 19.1% yearly revenue growth and a $77.5 million earnings increase from the current $112.1 million.

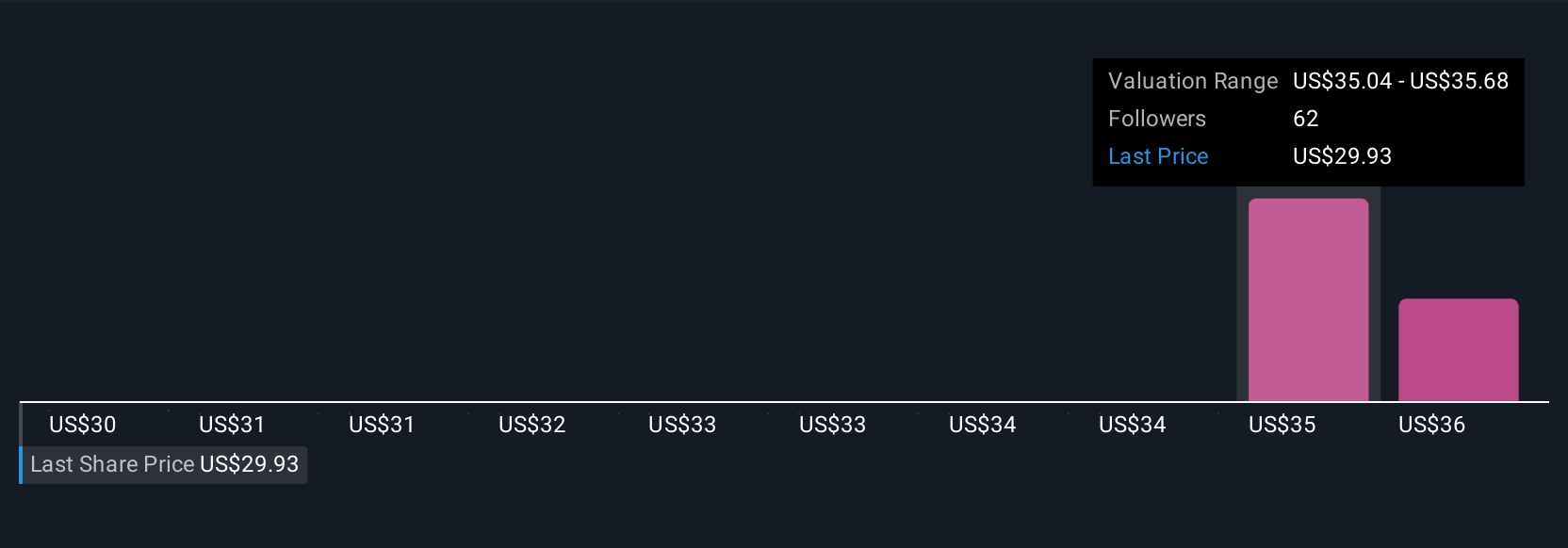

Uncover how ACM Research's forecasts yield a $36.08 fair value, a 17% downside to its current price.

Exploring Other Perspectives

Private fair value estimates from the Simply Wall St Community range from US$29.96 to US$40.89, across five perspectives. With ACM Research’s recent backlog surge centered in China, strong revenue visibility depends on that same concentrated regional demand.

Explore 5 other fair value estimates on ACM Research - why the stock might be worth as much as $40.89!

Build Your Own ACM Research Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ACM Research research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free ACM Research research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ACM Research's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ACMR

ACM Research

Develops, manufactures, and sells capital equipment worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives