- United States

- /

- Semiconductors

- /

- NasdaqGS:ACLS

Axcelis Technologies (ACLS): Examining Valuation as Shares Gain Momentum

Reviewed by Kshitija Bhandaru

Axcelis Technologies (ACLS) stock recently caught the attention of investors, as share price activity showed double-digit gains over the past month. Many are watching to see if this momentum can continue.

See our latest analysis for Axcelis Technologies.

Axcelis Technologies has had a choppy year, but momentum is starting to build after a strong 1-month share price return and with its stock now at $93.57. Long-term holders have still enjoyed a substantial 3-year total shareholder return of over 40%.

If you’re keen to spot what else is gaining traction in the market, now is the perfect chance to broaden your search and discover fast growing stocks with high insider ownership

With Axcelis Technologies trading near its analysts' price target and showing signs of renewed momentum, the key question is whether the current valuation leaves any room for upside or if the future growth story is already reflected in the price.

Most Popular Narrative: 2% Undervalued

With Axcelis Technologies closing at $93.57 and the narrative's fair value estimate at $95.20, the latest market price trails the consensus assessment. The setup for upside or downside hinges on how much confidence you place in the underlying financial assumptions.

Leadership in high-energy ion implantation and advanced R&D enables Axcelis to win share in premium segments and benefit from rising silicon carbide adoption. Growing installed base and geographic diversification boost high-margin recurring revenue and provide greater resilience amid cyclical downturns.

Curious about the numbers building this nearly fair valuation? There is one scenario at the heart of the narrative: an earnings trajectory and profit outlook that leave little room for error. Wondering which forward metrics are powering this optimistic price target? Click to reveal the narrative’s full set of underlying forecasts and bold assumptions.

Result: Fair Value of $95.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant customer concentration in China and muted demand for advanced technologies could challenge Axcelis's ability to sustain its growth narrative.

Find out about the key risks to this Axcelis Technologies narrative.

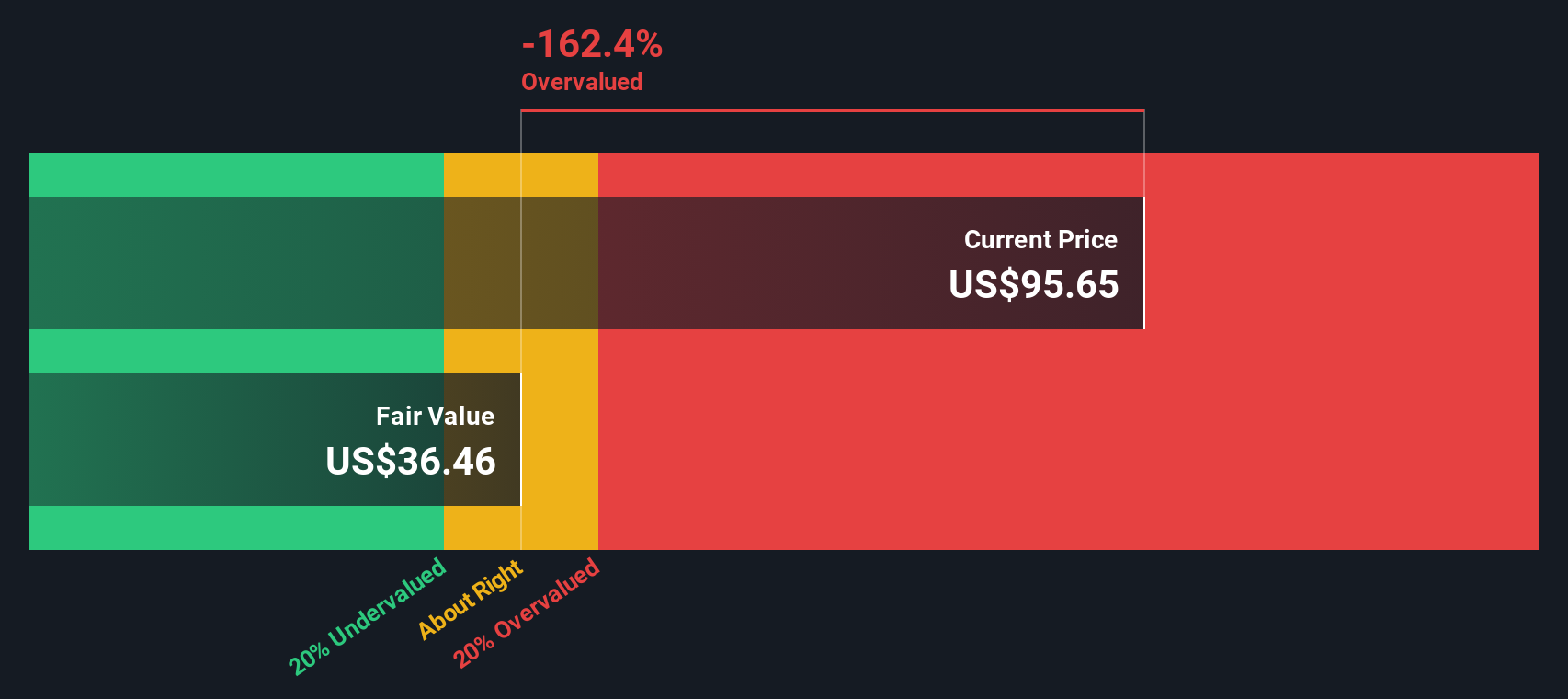

Another View: A Look at Discounted Cash Flow

However, a different lens comes from the SWS DCF model, which estimates Axcelis Technologies' fair value at just $35.85 per share. This is well below the current trading price of $93.57. This stark difference raises a critical question: Are market expectations running ahead of the company’s underlying fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Axcelis Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Axcelis Technologies Narrative

If you'd rather chart your own course or dig deeper into the numbers, you can put together your personal narrative in just a few minutes, so why not Do it your way?

A great starting point for your Axcelis Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunity waits for no one, so don’t let the best stocks pass you by. The right screener can put tomorrow’s big winners on your radar today.

- Take advantage of generous yields by checking out these 19 dividend stocks with yields > 3% with payouts above 3 percent and consistent performance.

- Uncover potential upside in the market with these 909 undervalued stocks based on cash flows, which spotlights companies that may be trading below their true worth.

- Position yourself ahead of tech innovation and browse these 24 AI penny stocks to see how artificial intelligence breakthroughs are reshaping industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLS

Axcelis Technologies

Designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026