- United States

- /

- Marine and Shipping

- /

- NasdaqCM:PSHG

US Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the U.S. market anticipates the Federal Reserve's decision on interest rates, stock futures are pointing to a higher open, suggesting a potential rebound from recent downturns. For investors looking beyond large-cap stocks, penny stocks—often representing smaller or newer companies—remain an intriguing area of exploration despite their historical connotations. These stocks can offer hidden value when backed by strong financials and growth potential, and this article will highlight three such opportunities that could provide both stability and upside in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.39 | $1.94B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $120.12M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.9075 | $6.35M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.88 | $87.05M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2392 | $8.46M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.9971 | $15.52M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.859 | $75.24M | ★★★★★☆ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.57 | $387.6M | ★★★★☆☆ |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Lixte Biotechnology Holdings (NasdaqCM:LIXT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lixte Biotechnology Holdings, Inc. is a clinical-stage pharmaceutical company dedicated to identifying targets for cancer drug development and commercializing cancer therapies, with a market cap of $4.72 million.

Operations: Lixte Biotechnology Holdings, Inc. does not currently report any revenue segments.

Market Cap: $4.72M

Lixte Biotechnology Holdings, with a market cap of US$4.72 million, is currently pre-revenue and unprofitable, facing challenges typical for penny stocks in the biotech sector. The company has less than a year of cash runway and no long-term liabilities, but its short-term assets exceed short-term liabilities by US$1.37 million. Recent amendments to its collaboration with the Netherlands Cancer Institute indicate strategic focus but also entail financial constraints with a reduced budget commitment of €100,000 annually. Lixte is working to regain Nasdaq compliance through equity offerings after failing to meet stockholders’ equity requirements, highlighting both risk and potential opportunity for investors aware of volatility and regulatory pressures inherent in such investments.

- Jump into the full analysis health report here for a deeper understanding of Lixte Biotechnology Holdings.

- Explore historical data to track Lixte Biotechnology Holdings' performance over time in our past results report.

Performance Shipping (NasdaqCM:PSHG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Performance Shipping Inc. offers global shipping transportation services using its tanker vessels, with a market cap of $21.26 million.

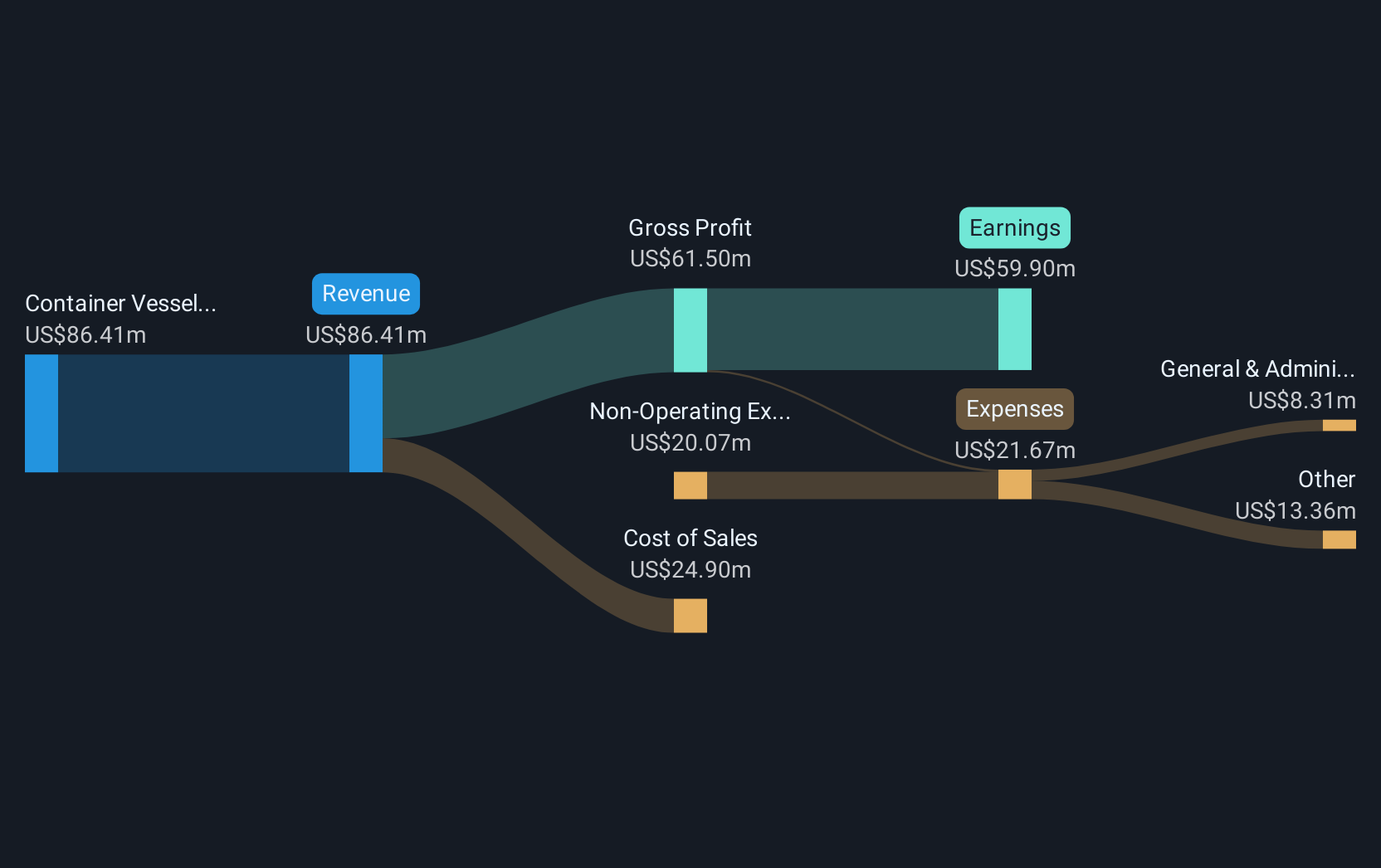

Operations: The company generated $89.61 million in revenue from its container vessels segment.

Market Cap: $21.26M

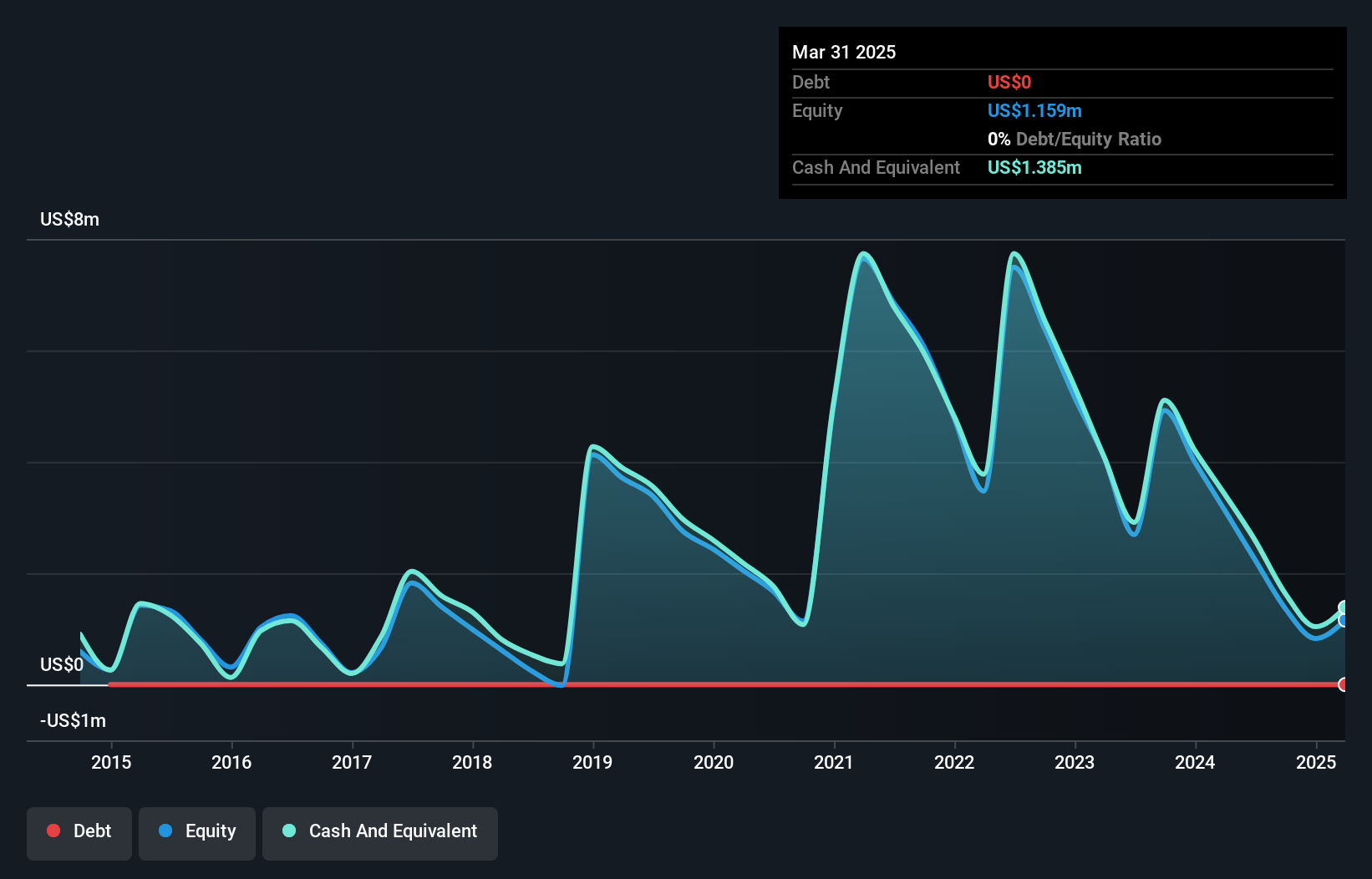

Performance Shipping Inc., with a market cap of US$21.26 million, has shown profitability over the past five years, although recent earnings growth of 36.6% is below its historical average. The company recently secured a time charter contract with SeaRiver Maritime LLC for its tanker vessel M/T P. Aliki, expected to generate approximately US$6.6 million in gross revenue over seven months beginning December 2024. Despite shareholder dilution and low return on equity at 17.5%, Performance Shipping's short-term assets exceed both short-term and long-term liabilities, and it maintains good debt coverage by cash flow and EBIT interest coverage at 3.8 times.

- Click here and access our complete financial health analysis report to understand the dynamics of Performance Shipping.

- Gain insights into Performance Shipping's future direction by reviewing our growth report.

DAVIDsTEA (OTCPK:DTEA.F)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DAVIDsTEA Inc. is a tea retailer operating in Canada and the United States, with a market cap of $8 million.

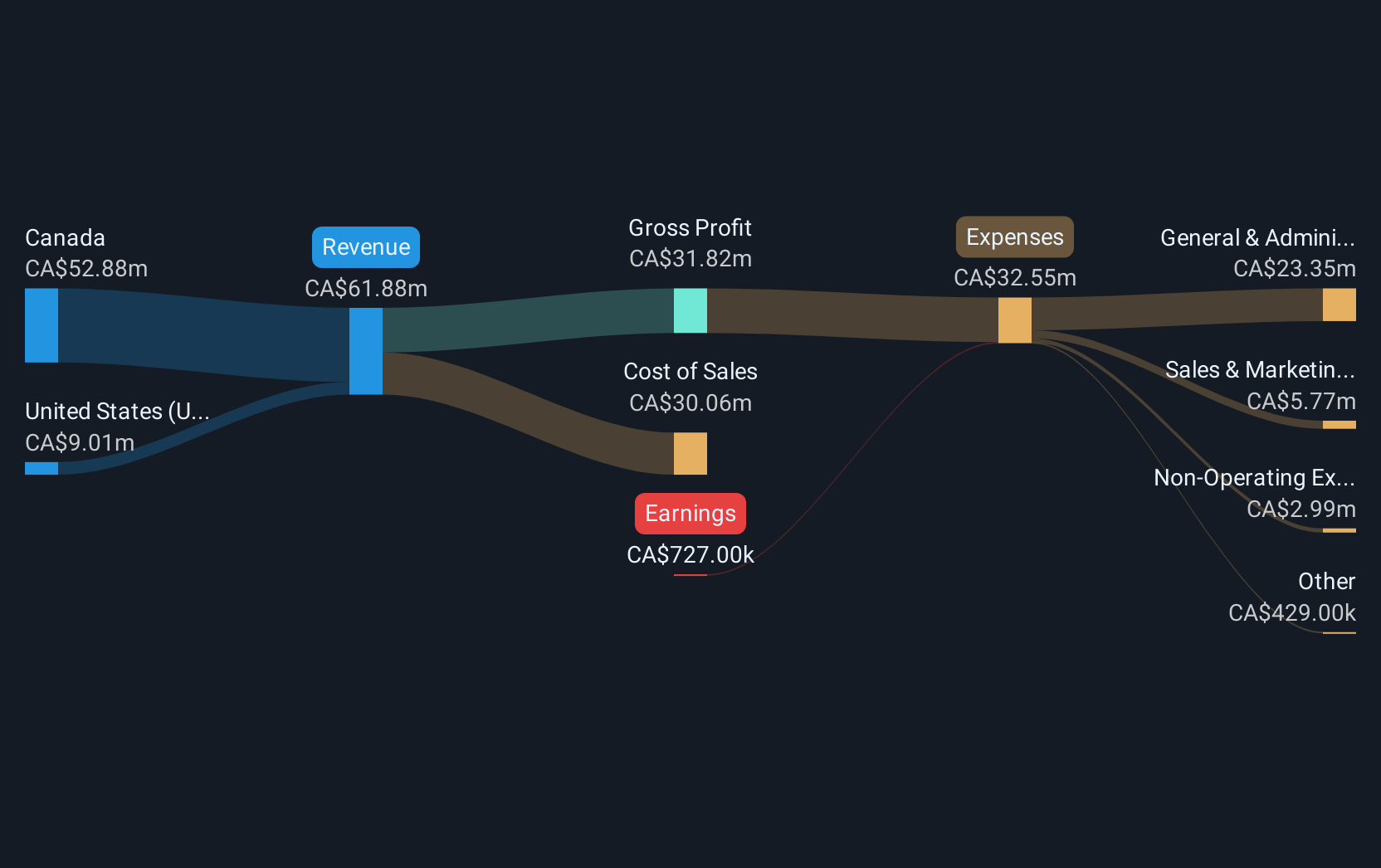

Operations: The company generates revenue of CA$61.02 million from its retail presence in grocery stores.

Market Cap: $8.01M

DAVIDsTEA Inc., with a market cap of CA$8 million, has shown improvement in reducing losses despite being unprofitable. Its short-term assets of CA$28.6 million comfortably cover both short-term and long-term liabilities, and the company remains debt-free. Recent earnings reports show an increase in sales to CA$14.04 million for Q3 2024, up from CA$12.15 million the previous year, while net losses have narrowed significantly from CA$3.73 million to CA$1.58 million over the same period. The management team is experienced with an average tenure of 4.1 years, although share price volatility remains high compared to industry peers.

- Unlock comprehensive insights into our analysis of DAVIDsTEA stock in this financial health report.

- Review our historical performance report to gain insights into DAVIDsTEA's track record.

Seize The Opportunity

- Unlock our comprehensive list of 720 US Penny Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PSHG

Performance Shipping

Provides shipping transportation services through its tanker vessels worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives