- United States

- /

- Specialty Stores

- /

- NYSE:WSM

How Declining Store Traffic and Free Cash Flow Margins Will Impact Williams-Sonoma (WSM) Investors

Reviewed by Sasha Jovanovic

- In recent developments prior to November 7, 2025, Williams-Sonoma reported store closures averaging a 2% annual decline over the last two years and shrinking same-store sales by 2.8% annually, reflecting softer demand for its brick-and-mortar operations.

- An additional drop of 3.7 percentage points in free cash flow margin has heightened concerns about Williams-Sonoma’s ability to maintain profitability while pursuing potential growth initiatives.

- We'll look at how declining same-store sales could influence Williams-Sonoma's longer-term growth plans and market positioning.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Williams-Sonoma Investment Narrative Recap

Williams-Sonoma’s investment case has long centered on its ability to leverage digital innovation and product differentiation to offset the risks facing physical retail. The recent news of declining same-store sales and store closures confirms a key short-term risk to revenue growth, but has not materially altered the primary catalyst for shareholders: ongoing advances in omnichannel strategy and maintaining profitability amid shifting consumer trends.

Of the company’s recent announcements, the updated fiscal 2025 guidance delivered on August 27, 2025, stands out most in light of these trends. Williams-Sonoma modestly raised its expected net revenue growth range to +0.5% to +3.5% for the year, signaling management’s measured optimism despite headwinds in traditional retail and softening free cash flow margins.

Conversely, investors should pay particular attention to how weakening in-store performance could lead to...

Read the full narrative on Williams-Sonoma (it's free!)

Williams-Sonoma's outlook suggests revenues of $8.7 billion and earnings of $1.2 billion by 2028. This is based on an annual revenue growth rate of 3.4% and a $0.1 billion increase in earnings from the current $1.1 billion level.

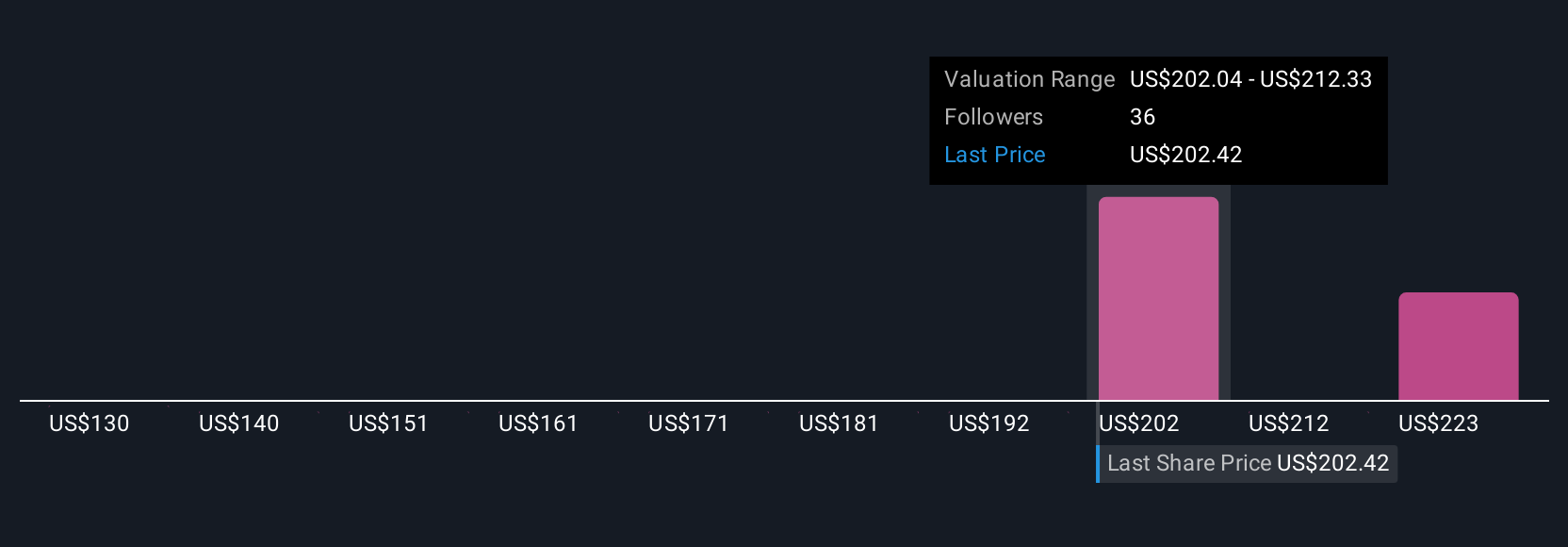

Uncover how Williams-Sonoma's forecasts yield a $204.32 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimated fair value for Williams-Sonoma between US$204 and US$237 per share. With physical store closures reflecting softer demand, your own outlook may differ sharply from others’ projections, consider exploring these alternative views before forming a conclusion.

Explore 3 other fair value estimates on Williams-Sonoma - why the stock might be worth as much as 24% more than the current price!

Build Your Own Williams-Sonoma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Williams-Sonoma research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Williams-Sonoma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Williams-Sonoma's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams-Sonoma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSM

Williams-Sonoma

Operates as an omni-channel specialty retailer of various products for home.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives