- United States

- /

- Specialty Stores

- /

- NYSE:WRBY

With A 28% Price Drop For Warby Parker Inc. (NYSE:WRBY) You'll Still Get What You Pay For

Warby Parker Inc. (NYSE:WRBY) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 17%.

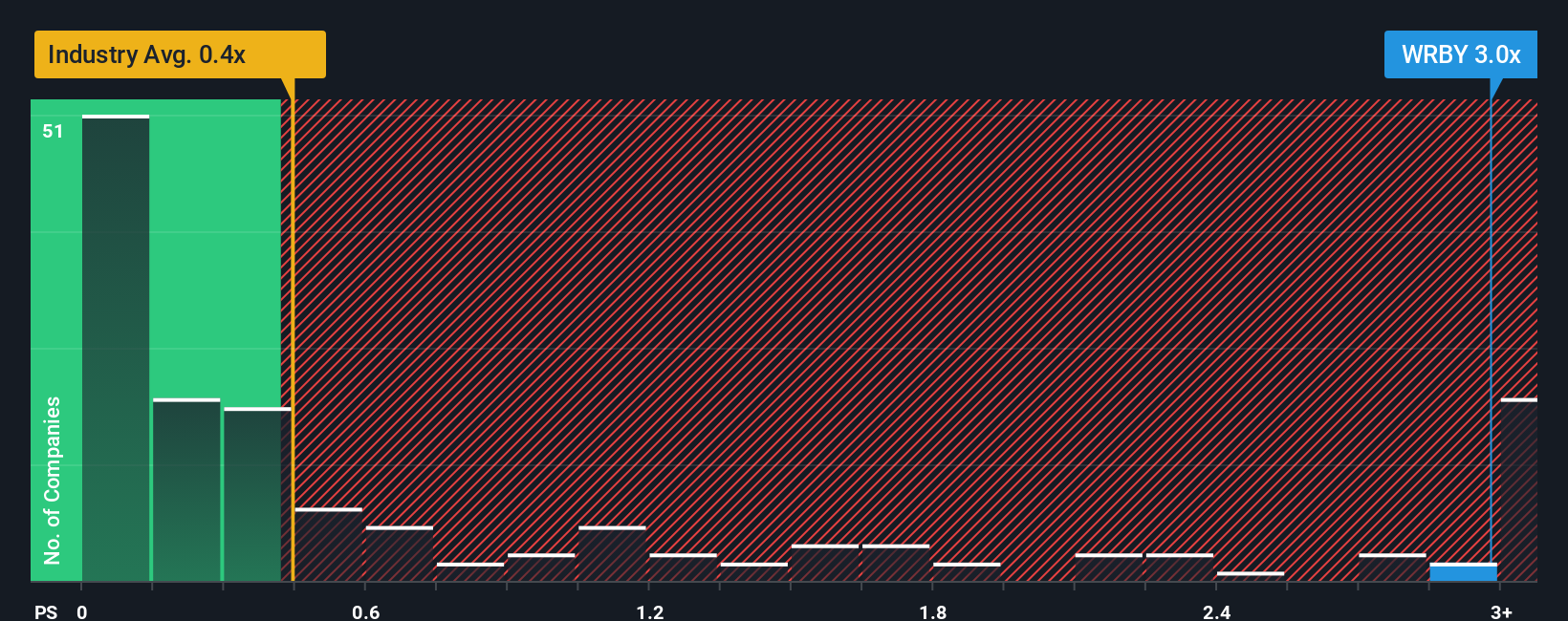

Even after such a large drop in price, you could still be forgiven for thinking Warby Parker is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3x, considering almost half the companies in the United States' Specialty Retail industry have P/S ratios below 0.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Warby Parker

How Warby Parker Has Been Performing

With revenue growth that's superior to most other companies of late, Warby Parker has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Warby Parker will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Warby Parker would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 43% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 16% as estimated by the analysts watching the company. That's shaping up to be materially higher than the 7.2% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Warby Parker's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Warby Parker's P/S?

A significant share price dive has done very little to deflate Warby Parker's very lofty P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Warby Parker's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for Warby Parker that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Warby Parker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WRBY

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives