- United States

- /

- Specialty Stores

- /

- NYSE:WRBY

Warby Parker (WRBY): Valuation Insights Following Strong Revenue Growth and Optimism Over Expansion Plans

Reviewed by Simply Wall St

Warby Parker (WRBY) is back in the spotlight as new coverage emphasizes its impressive revenue growth and healthy free cash flow. Questions about long-term profitability still linger. Investors are taking note of its direct-to-consumer approach and focus on expansion.

See our latest analysis for Warby Parker.

After a strong run earlier this year, Warby Parker's share price has cooled over the past month with a 21.7% pullback. However, its one-year total shareholder return of 29.1% points to meaningful long-term momentum. Positive news about robust revenue growth and expansion plans appears to be building fresh optimism, even as the market reassesses short-term risks and valuations.

If you’re looking for your next growth story, now is an ideal time to broaden your view and discover fast growing stocks with high insider ownership

With a 22% potential upside still forecast by analysts, is Warby Parker’s recent pullback a rare buying window, or has the market already accounted for all its future growth?

Most Popular Narrative: 16% Undervalued

At $22.16, Warby Parker trades notably below the most widely followed narrative's fair value estimate of $26.23. This sets a bullish tone for potential investors who are looking past the current market caution.

The partnership with Google to develop AI-powered intelligent eyewear positions Warby Parker to enter a substantially larger market. The company is leveraging advancements in wearable technology and artificial intelligence to drive new, higher-margin revenue streams in the future.

Curious how bold the projections are behind this valuation? Analysts are betting on a transformation in business model, with astonishing future earnings growth and margin expansion at the core of this narrative. Find out what makes the numbers behind Warby Parker’s story so different. See the full outlook and discover the pivotal assumptions for yourself.

Result: Fair Value of $26.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and the challenges of scaling new AI ventures could undermine Warby Parker’s growth expectations and place pressure on long-term margins.

Find out about the key risks to this Warby Parker narrative.

Another View: Multiples Signal Expensive Territory

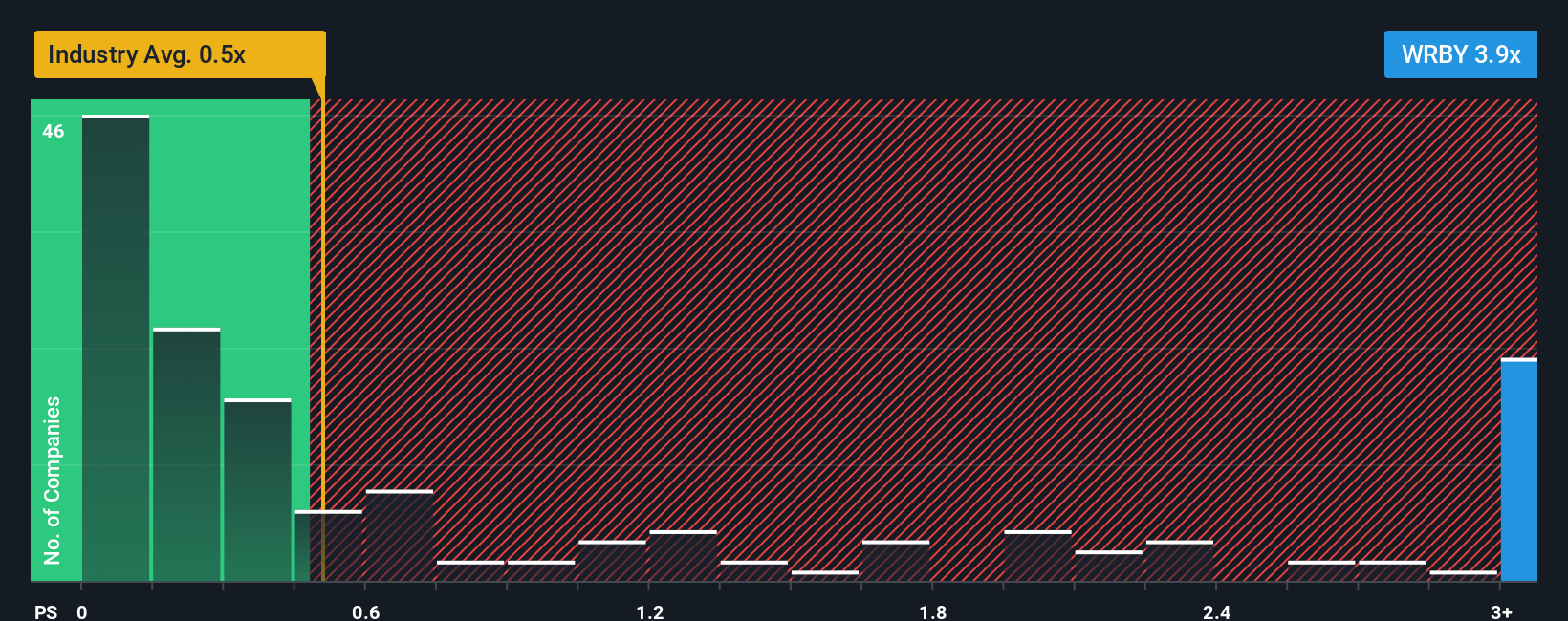

Looking at Warby Parker’s valuation through a different lens, its price-to-sales ratio stands at 3.3x, which is far above both the US Specialty Retail industry’s 0.5x and the market’s fair ratio estimate of 1.8x. This premium suggests that investors are expecting significant growth, but it also raises the risk if those expectations are not met. Could this optimism lead to disappointment, or is there room for the stock to grow into its valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Warby Parker Narrative

If you want to chart your own course or reach different conclusions based on the data, you can easily build your own perspective in just a few minutes using our tools. So why not Do it your way?

A great starting point for your Warby Parker research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make the most of your research time by checking out unique stocks you might miss elsewhere, tailored by strategy for today’s fast-moving markets.

- Tap into high-yield opportunities by reviewing these 17 dividend stocks with yields > 3% with solid returns and reliable payouts above 3%.

- Accelerate your portfolio’s growth with these 27 AI penny stocks that harness artificial intelligence to drive breakthroughs and market expansion.

- Secure your edge in emerging tech by spotting these 27 quantum computing stocks at the forefront of quantum computing innovation and commercial adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warby Parker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRBY

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives