- United States

- /

- Interactive Media and Services

- /

- NYSE:VTEX

Top Growth Stocks With Significant Insider Ownership In June 2025

Reviewed by Simply Wall St

The United States market has shown a steady performance, remaining flat over the last week but achieving an 11% increase over the past year, with earnings projected to grow by 15% annually. In this environment, identifying growth companies with significant insider ownership can be particularly appealing as it often signals confidence from those closest to the business in its future potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 39.1% |

| Similarweb (SMWB) | 14.9% | 69.7% |

| Ryan Specialty Holdings (RYAN) | 15.5% | 91% |

| Prairie Operating (PROP) | 34.6% | 75.7% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Credo Technology Group Holding (CRDO) | 12% | 45% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 24.1% |

| Astera Labs (ALAB) | 14.8% | 44.4% |

| ARS Pharmaceuticals (SPRY) | 14.3% | 60.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Ramaco Resources (METC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ramaco Resources, Inc. is involved in the development, operation, and sale of metallurgical coal and has a market cap of $595.79 million.

Operations: The company's revenue is primarily derived from its Metals & Mining - Coal segment, which generated $628.28 million.

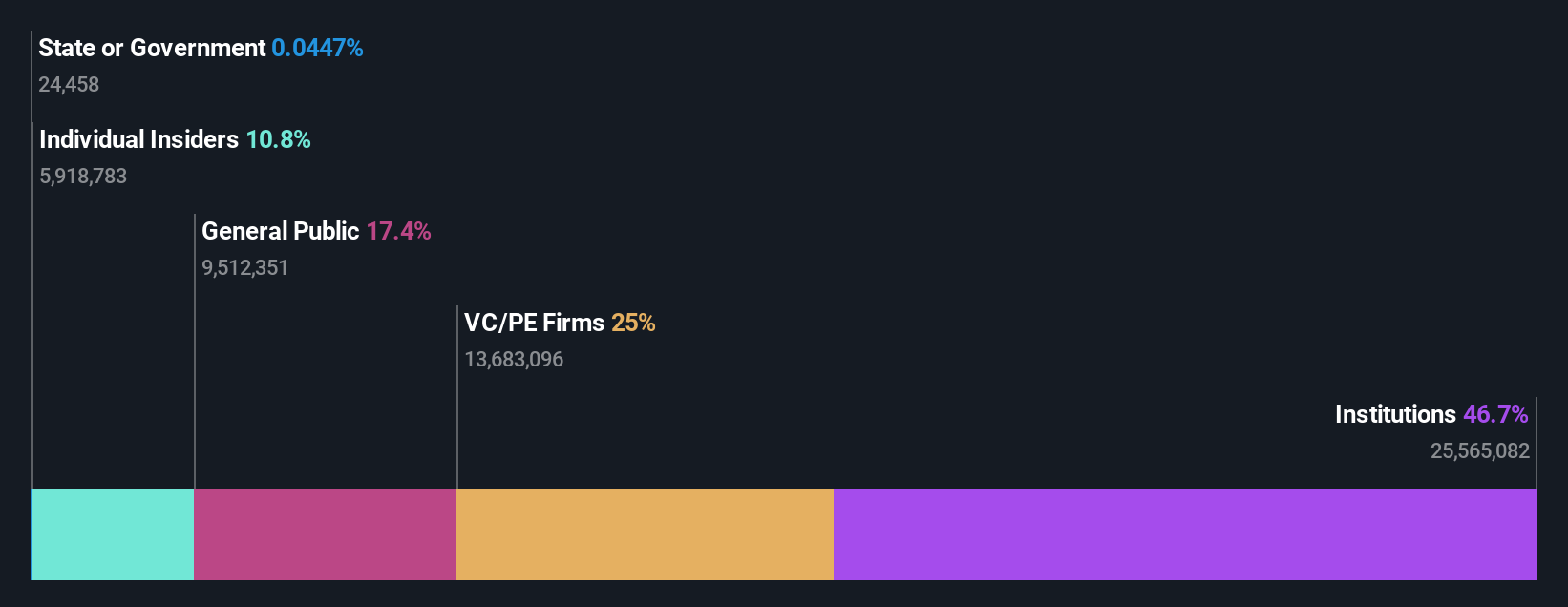

Insider Ownership: 10.8%

Earnings Growth Forecast: 78.5% p.a.

Ramaco Resources, Inc. is experiencing growth potential with forecasted earnings to grow significantly per year, despite recent lowered sales and production guidance for 2025. The company has appointed Michael Woloschuk as EVP for Critical Mineral Operations to advance its Brook Mine project, enhancing strategic capabilities in critical minerals. Former U.S. Senator Joseph Manchin joined the board, bringing valuable energy policy expertise. Despite a quarterly net loss of US$9.46 million and reduced dividends, insider ownership remains high.

- Click here and access our complete growth analysis report to understand the dynamics of Ramaco Resources.

- Our valuation report here indicates Ramaco Resources may be undervalued.

VTEX (VTEX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VTEX, along with its subsidiaries, offers a software-as-a-service digital commerce platform for enterprise brands and retailers, with a market cap of $1.19 billion.

Operations: The company's revenue comes from its Internet Software & Services segment, amounting to $228.24 million.

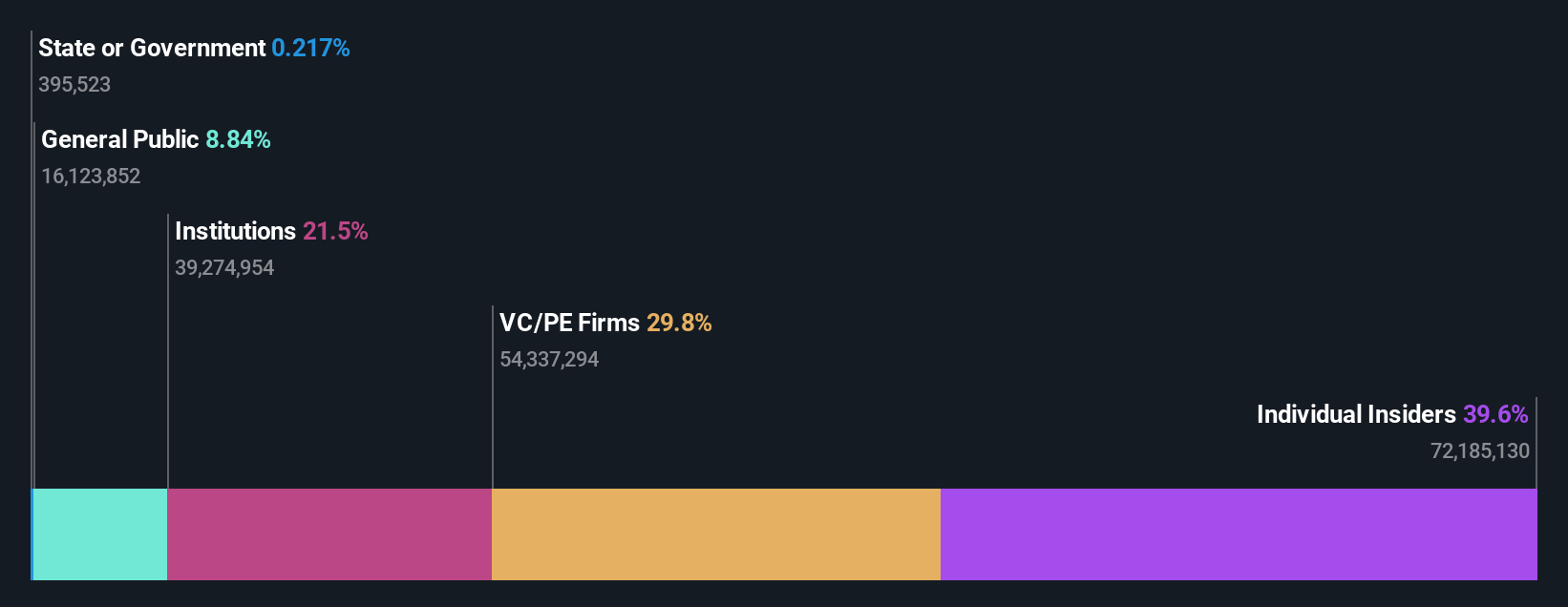

Insider Ownership: 39.6%

Earnings Growth Forecast: 33.6% p.a.

VTEX is trading at a substantial discount to its fair value, with earnings expected to grow significantly, outpacing the US market. The company recently turned profitable, reporting a net income of US$0.86 million for Q1 2025 and targeting subscription revenue growth of 12.5% to 15.5% for Q2 2025. Despite no recent insider trading activity, VTEX has completed a share buyback program worth US$30.48 million, reflecting confidence in its future prospects amidst high insider ownership levels.

- Take a closer look at VTEX's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, VTEX's share price might be too optimistic.

Warby Parker (WRBY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Warby Parker Inc. operates in the United States and Canada, offering eyewear products with a market cap of approximately $2.66 billion.

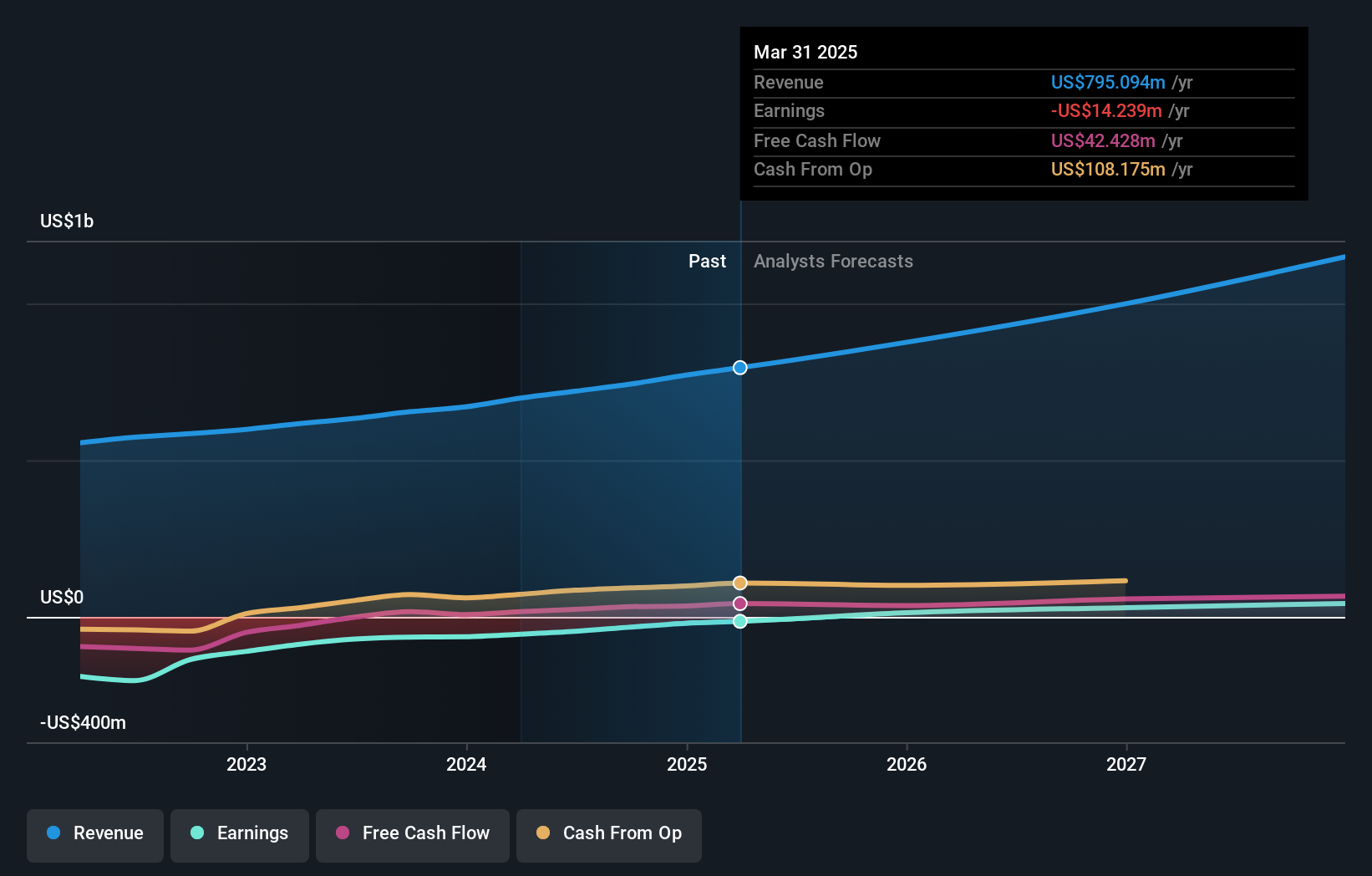

Operations: The company generates revenue from its Medical - Optical Supplies segment, amounting to $795.09 million.

Insider Ownership: 17.2%

Earnings Growth Forecast: 88.4% p.a.

Warby Parker's growth trajectory is underscored by its strategic alliance with Google, aiming to launch AI-powered eyewear, supported by Google's US$75 million investment. Despite a lack of substantial insider buying recently, the company's earnings have improved significantly, turning a profit in Q1 2025 with US$3.47 million net income. Revenue is forecast to grow at 11.4% annually, surpassing market averages and aligning with Warby Parker's guidance of up to US$886 million for 2025.

- Get an in-depth perspective on Warby Parker's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Warby Parker's shares may be trading at a premium.

Make It Happen

- Investigate our full lineup of 193 Fast Growing US Companies With High Insider Ownership right here.

- Interested In Other Possibilities? These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTEX

VTEX

Provides software-as-a-service digital commerce platform for enterprise brands and retailers.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives