- United States

- /

- Specialty Stores

- /

- NYSE:WRBY

3 US Growth Companies With Insider Ownership Up To 26%

Reviewed by Simply Wall St

As the U.S. stock market navigates a landscape marked by investor anticipation surrounding the presidential election and impending Federal Reserve interest rate decisions, attention remains focused on growth companies that demonstrate resilience and potential in uncertain times. In this context, companies with significant insider ownership often stand out as they may indicate confidence from those closest to the business, making them noteworthy considerations for investors seeking alignment of interests amid fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.6% | 26% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.5% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 33.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 25.4% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 37.4% |

| Coastal Financial (NasdaqGS:CCB) | 18.1% | 46.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Let's dive into some prime choices out of the screener.

Oddity Tech (NasdaqGM:ODD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Oddity Tech Ltd. is a consumer tech company that creates digital-first brands for the beauty and wellness sectors globally, with a market cap of $2.17 billion.

Operations: The company generates revenue of $596.12 million from its Personal Products segment within the beauty and wellness industries.

Insider Ownership: 26.5%

Oddity Tech demonstrates robust growth potential, with earnings forecasted to grow at 17.1% annually, surpassing the US market's average. Recent financial results show significant year-over-year improvements in revenue and net income, supported by raised earnings guidance for 2024. Despite trading below its estimated fair value, Oddity's revenue growth of 16.8% is slower than ideal but outpaces the broader market. Leadership changes and a recent share buyback may impact future strategic direction.

- Delve into the full analysis future growth report here for a deeper understanding of Oddity Tech.

- Our expertly prepared valuation report Oddity Tech implies its share price may be too high.

Pinterest (NYSE:PINS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pinterest, Inc. operates as a visual search and discovery platform both in the United States and internationally, with a market cap of approximately $21.97 billion.

Operations: The company's revenue is primarily generated from its Internet Information Providers segment, amounting to $3.34 billion.

Insider Ownership: 11.3%

Pinterest's growth outlook is promising, with earnings expected to rise significantly at 34.1% annually, outpacing the US market average. While revenue growth of 13.5% per year is slower than ideal, it exceeds the broader market rate. The company recently became profitable and trades at a substantial discount to its estimated fair value. Leadership changes include Sabrina Ellis transitioning to an advisory role, which may influence future strategic directions but not due to disagreements with management.

- Dive into the specifics of Pinterest here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Pinterest is trading behind its estimated value.

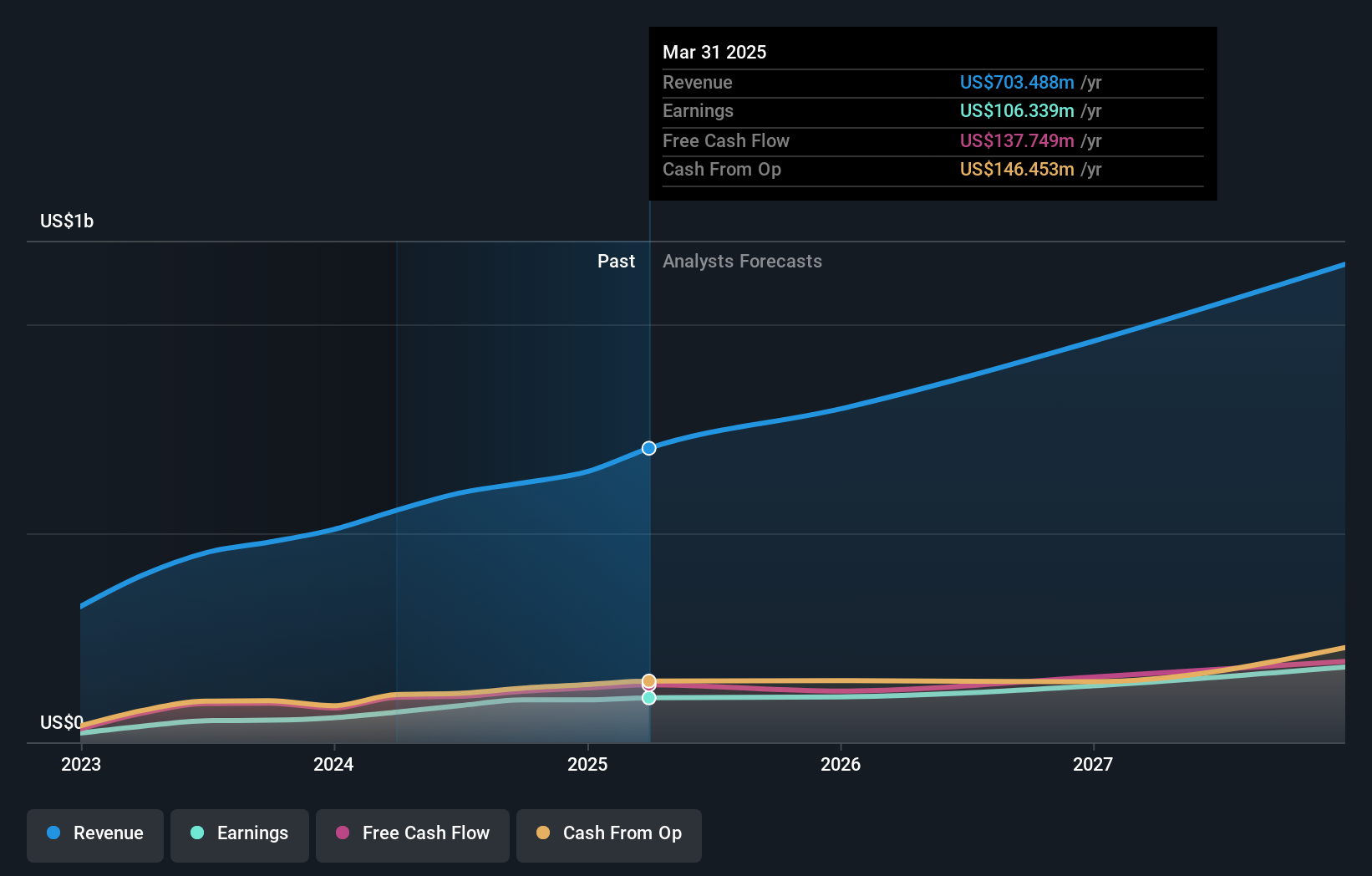

Warby Parker (NYSE:WRBY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Warby Parker Inc. is a company that offers eyewear products in the United States and Canada, with a market cap of approximately $2.09 billion.

Operations: The company generates revenue from its Medical - Optical Supplies segment, amounting to $719.93 million.

Insider Ownership: 19.3%

Warby Parker shows strong growth potential with earnings forecasted to grow significantly, becoming profitable within three years. Recent insider buying suggests confidence in its future, while no substantial selling occurred recently. Revenue is expected to outpace the US market at 11.5% annually but remains below high-growth benchmarks. The company reported improved financials with reduced net losses over recent quarters and updated its 2024 revenue guidance to US$757 million-US$762 million, reflecting a 13%-14% increase from 2023.

- Unlock comprehensive insights into our analysis of Warby Parker stock in this growth report.

- Our comprehensive valuation report raises the possibility that Warby Parker is priced higher than what may be justified by its financials.

Make It Happen

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 192 more companies for you to explore.Click here to unveil our expertly curated list of 195 Fast Growing US Companies With High Insider Ownership.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Warby Parker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRBY

Flawless balance sheet with reasonable growth potential.