- United States

- /

- Specialty Stores

- /

- NYSE:VSCO

Victoria’s Secret (VSCO) Q2: 4% Same-Store Sales Growth Reinforces Turnaround Narrative

Reviewed by Simply Wall St

Victoria's Secret (VSCO) kicked off its latest earnings update with Q2 2026 revenue of about $1.5 billion and basic EPS of $0.20, supported by net income of $16 million and a 4% same store sales uptick that marks a cleaner read on underlying demand. The company has seen quarterly revenue move from $1.35 billion in Q1 2025 to $1.46 billion in Q2 2026, while EPS has swung from a loss of $0.71 in Q3 2025 to the current $0.20. This sets the stage for investors to focus on whether recent margin traction can hold through the rest of the year.

See our full analysis for Victoria's Secret.With the headline numbers on the table, the next step is to compare these results with the most widely held narratives about Victoria's Secret to see which stories the latest margins support and which ones the data starts to undermine.

See what the community is saying about Victoria's Secret

TTM earnings up 9.7 percent despite modest 3 percent sales growth

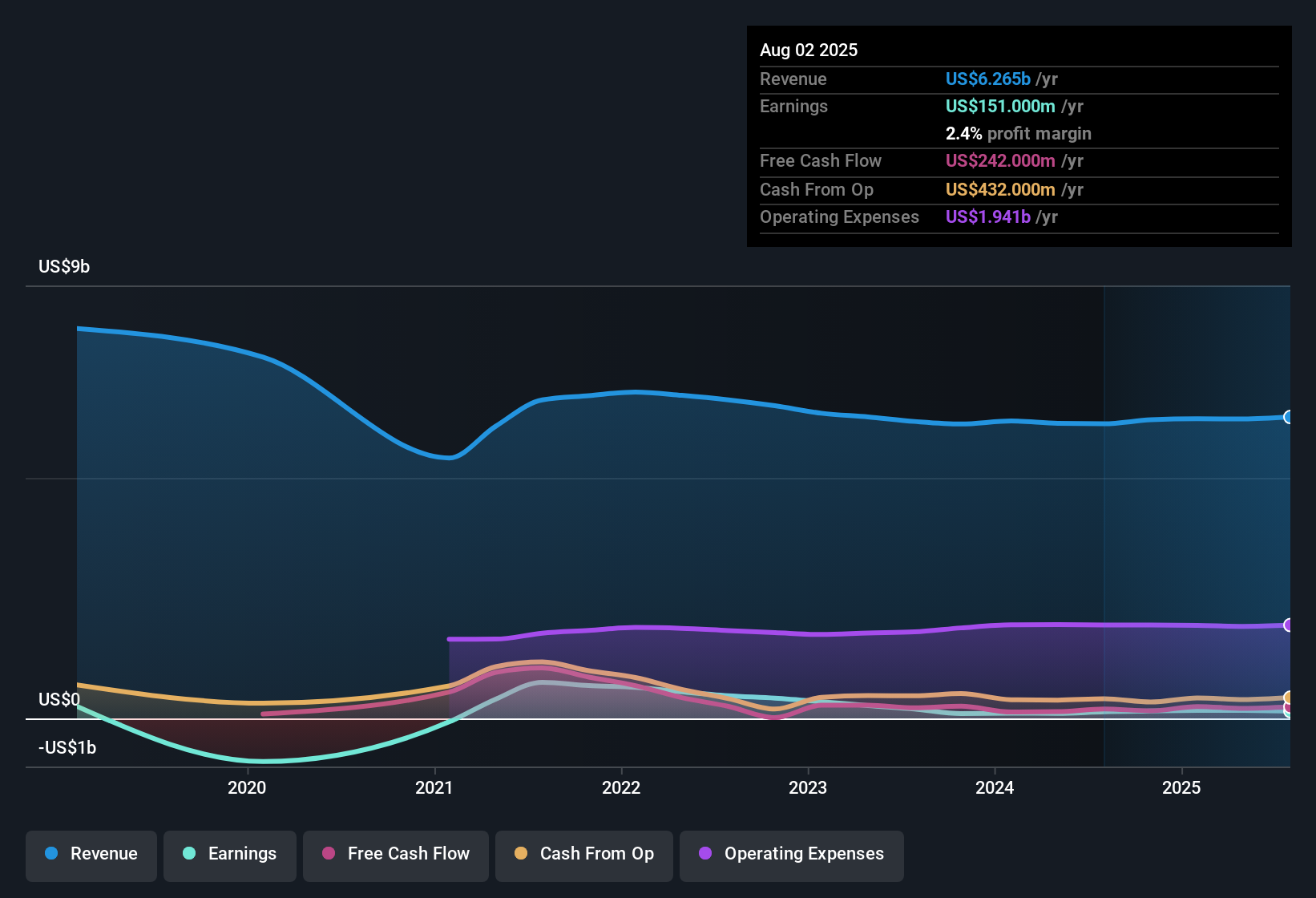

- Over the last 12 months, Victoria's Secret grew revenue about 3 percent per year while earnings rose 9.7 percent and net margin nudged up to 2.4 percent from 2.2 percent, so profits improved faster than sales.

- Analysts' consensus view expects brand transformation and omnichannel expansion to drive sustained growth. However, the modest 3 percent revenue pace and only slightly higher 2.4 percent margin highlight how much of that bullish story still depends on future execution rather than what has already shown up in the recent numbers.

- Consensus highlights younger customer gains and fewer promotions as margin drivers, which lines up with the 9.7 percent earnings growth but not with a growth profile that still trails the broader US market's 10.6 percent forecast.

- The move from earlier quarterly losses, like the 2025 Q3 net loss of 56 million dollars, to 16 million dollars of profit in 2026 Q2 is consistent with a turnaround narrative, but the small net margin shows the profit base is still relatively thin.

Turnaround from five year earnings declines

- Trailing 12 month earnings growth of 9.7 percent compares to a five year average decline of about 30.2 percent per year, so the business has shifted from multi year contraction into positive growth over the latest year.

- Bulls argue that product innovation and faster fashion cycles will keep lifting regular priced sales. This sharp swing from long term earnings declines to recent growth heavily supports that bullish case while also showing why they are watching for consistency over more than just one year.

- The TTM net income of 151 million dollars in 2026 Q2 versus 104 million dollars in 2025 Q1 demonstrates that the improvement has built up over several recent quarters, not just a one off spike.

- Quarterly volatility, with EPS moving from a loss of 0.71 dollars in 2025 Q3 to a gain of 2.32 dollars in 2025 Q4 and then 0.20 dollars in 2026 Q2, shows execution progress but also reminds investors that earnings can still swing around from period to period.

Premium 26x P/E with slower growth and high debt

- The stock trades at about 26 times trailing earnings, above the US specialty retail average of 18.4 times and peer average of 18.6 times, even though revenue is only expected to grow around 3 percent per year and the company carries a high level of debt.

- Bears argue that tariff exposure, mall heavy stores, and competition from nimbler brands could pressure margins. This combination of a premium 26x multiple, only modest 3 percent revenue growth, and elevated leverage meaningfully supports that bearish concern that investors are paying up for a business still facing structural headwinds.

- The DCF fair value of about 59.31 dollars is higher than the current 49.05 dollar share price, but the rich P/E relative to slower growth gives skeptics room to say the apparent discount depends on optimistic long term assumptions.

- With net margin at just 2.4 percent, any hit from higher tariffs or weaker mall traffic would have limited cushion, which lines up with worries about brick and mortar reliance and potential supply chain inefficiencies weighing on profitability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Victoria's Secret on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use that perspective to shape your own view in just a few minutes and capture it as a fresh narrative: Do it your way.

A great starting point for your Victoria's Secret research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Victoria's Secret combines thin margins, a premium valuation, and elevated debt, which can leave investors more exposed if growth stalls or macro pressures affect profitability again.

If that mix feels too fragile, consider looking for companies with stronger cushions and healthier leverage by scanning our solid balance sheet and fundamentals stocks screener (1941 results) today before the next bout of volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSCO

Victoria's Secret

Operates as a specialty retailer of women’s intimate, and other apparel and beauty products worldwide.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026