- United States

- /

- Specialty Stores

- /

- NYSE:VSCO

Not Many Are Piling Into Victoria's Secret & Co. (NYSE:VSCO) Stock Yet As It Plummets 29%

The Victoria's Secret & Co. (NYSE:VSCO) share price has fared very poorly over the last month, falling by a substantial 29%. Longer-term shareholders would now have taken a real hit with the stock declining 5.9% in the last year.

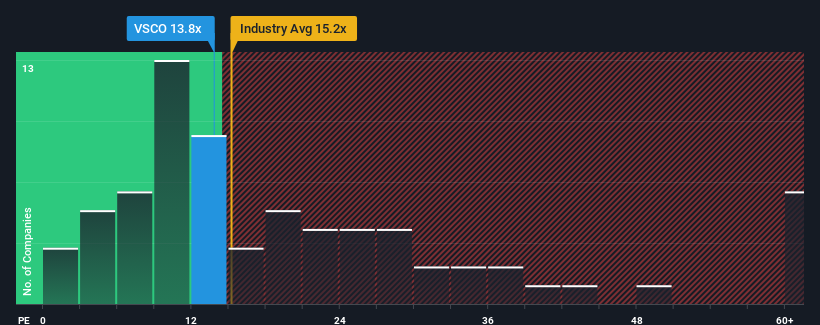

Although its price has dipped substantially, Victoria's Secret may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 13.8x, since almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 33x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Victoria's Secret has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Victoria's Secret

How Is Victoria's Secret's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Victoria's Secret's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 51% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 75% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 21% during the coming year according to the ten analysts following the company. With the market only predicted to deliver 14%, the company is positioned for a stronger earnings result.

With this information, we find it odd that Victoria's Secret is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Victoria's Secret's P/E

Victoria's Secret's P/E has taken a tumble along with its share price. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Victoria's Secret's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Victoria's Secret that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:VSCO

Victoria's Secret

Operates as a specialty retailer of women’s intimate, and other apparel and beauty products worldwide.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.