- United States

- /

- Specialty Stores

- /

- NYSE:TJX

TJX (TJX): Evaluating Valuation After Upbeat Q2 Earnings and Raised Guidance

Reviewed by Kshitija Bhandaru

TJX Companies (TJX) delivered a strong second quarter, topping earnings forecasts thanks to increased same-store sales and improved margins. The retailer also raised its full-year guidance for profit margins and earnings per share.

See our latest analysis for TJX Companies.

With TJX hitting an all-time high of $145.65 this month, momentum is clearly building. The stock’s solid recent run, up 17.7% over the past three months, and a standout one-year total shareholder return of 23.7% highlight ongoing confidence in its growth trajectory, especially after management raised full-year guidance and consistently beat expectations.

If the strength of TJX's performance has you looking for what else could be gaining traction, it could be a great time to discover fast growing stocks with high insider ownership.

With shares sitting near record highs and analysts lifting their outlooks, the key question now is whether TJX remains undervalued or if recent gains have already factored in all of its future potential. Could there still be room to buy, or is the market a step ahead?

Most Popular Narrative: 3.8% Undervalued

With TJX Companies closing at $143.84 and the most widely followed narrative assigning a fair value of $149.44, the analyst consensus sees modest upside from current levels. The narrative hinges on recent sales strength, resilient margins, and a multi-year growth blueprint that sets expectations for continued outperformance.

The company's uniquely flexible, discovery-driven in-store experience is driving higher store traffic from a wide demographic range, including increased engagement from younger customers. This capitalizes on consumer desire for experiential shopping and repeat visits, thus supporting both top-line revenue and frequency of purchases.

What is behind this rare retailer optimism? The heart of the narrative is a forecast that banks on expanding profit margins, strong customer engagement, and a bold upward march in earnings. The catch is that only a select set of financial assumptions support this valuation. Craving the specifics? See the eye-opening projections that underpin the case for further gains.

Result: Fair Value of $149.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained e-commerce growth and tighter inventory controls by brands could limit TJX's store traffic and access to off-price merchandise, which may challenge future outperformance.

Find out about the key risks to this TJX Companies narrative.

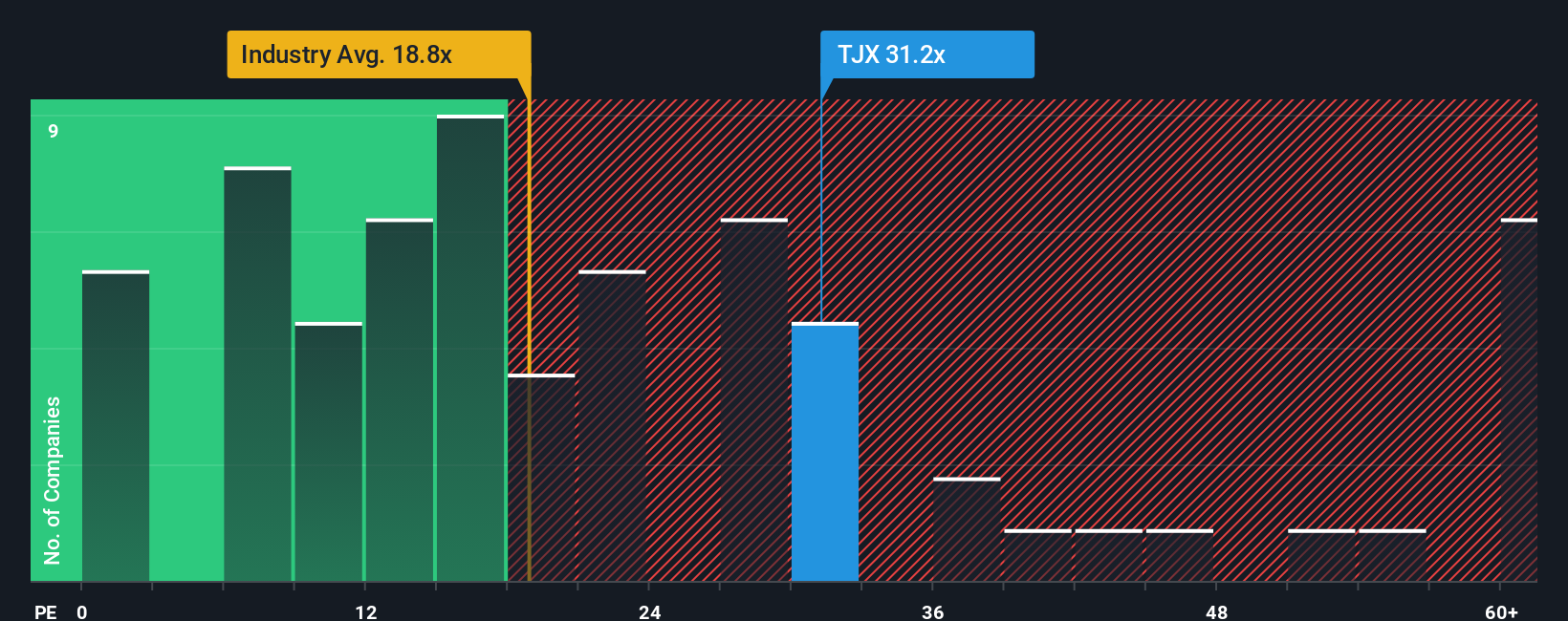

Another View: Multiples Suggest Caution

While analysts see upside, looking at the price-to-earnings ratio reveals another story. TJX trades at 32.2 times earnings, which is far above both industry peers (19.4x) and what would be considered a fair ratio (21x). This sizable gap means investors face much higher valuation risk at today's prices. Could the market be getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TJX Companies Narrative

If you think your take on TJX might differ, or want to dive into the numbers yourself, it's easy to build your perspective in minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding TJX Companies.

Looking for More Investment Ideas?

Don’t miss your chance to uncover other smart opportunities. Why stop with TJX when you could be exploring tomorrow’s top performers right now?

- Catch impressive yields and stable returns by evaluating these 18 dividend stocks with yields > 3%, which delivers above-average income potential for your portfolio.

- Spot early movers in revolutionary tech by checking out these 24 AI penny stocks, as these companies power advances in artificial intelligence and automation.

- Unlock the upside of overlooked value by accessing these 26 quantum computing stocks, which brings breakthroughs in computing and innovation to investors ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TJX Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TJX

TJX Companies

Operates as an off-price apparel and home fashions retailer worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives