- United States

- /

- Specialty Stores

- /

- NYSE:TJX

TJX Companies' Valuation in Focus After Major Store Expansion and Growth Plans Announced

Reviewed by Simply Wall St

When TJX Companies (TJX) announced its ambitious plans to open more than 1,800 new stores, including entry into Spain and an aggressive remodeling schedule, investors took notice. The scale of this expansion, paired with upbeat remarks from management about global partnerships and consistent financial gains, has given the market plenty to digest. This is not just another retail update; it signals a company betting big on long-term growth in a changing landscape.

Momentum around TJX has steadily built over the last year, with the stock up nearly 18% and a 4% gain in the past month alone. In the background, positive sentiment has been reinforced by strong annual revenue and income growth, while technical analysis continues to flag persistent momentum. Still, there are whispers about the risk of overbought conditions and whether today’s optimism might be baking future successes into the price.

With all eyes on the scale and speed of TJX’s expansion, investors now have to weigh whether this run presents a new buying opportunity, or if the market has already priced in what comes next.

Most Popular Narrative: 6.7% Undervalued

The most widely followed narrative suggests that TJX Companies is currently undervalued by 6.7%. This assessment is anchored in analysts’ consensus expectations for future earnings and profit margin growth, balanced by key risks and a robust discount rate based on industry standards.

The company's uniquely flexible, discovery-driven in-store experience is driving higher store traffic from a wide demographic range, including increased engagement from younger customers. This approach capitalizes on consumer desire for experiential shopping and repeat visits, thus supporting both top-line revenue and frequency of purchases.

The numbers behind this rating are not typical Wall Street guesswork. They are built on aggressive growth projections and a premium profit multiple, which is typically reserved for the market’s most prominent names. Are you curious which top-line and bottom-line improvements analysts are considering to justify a high target price? The details inside could change your outlook on the future of off-price retail.

Result: Fair Value of $149.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifting consumer preferences toward e-commerce and rising labor costs could present challenges to TJX’s sustained growth story, despite its current momentum.

Find out about the key risks to this TJX Companies narrative.Another View: Are Shares Actually Pricey?

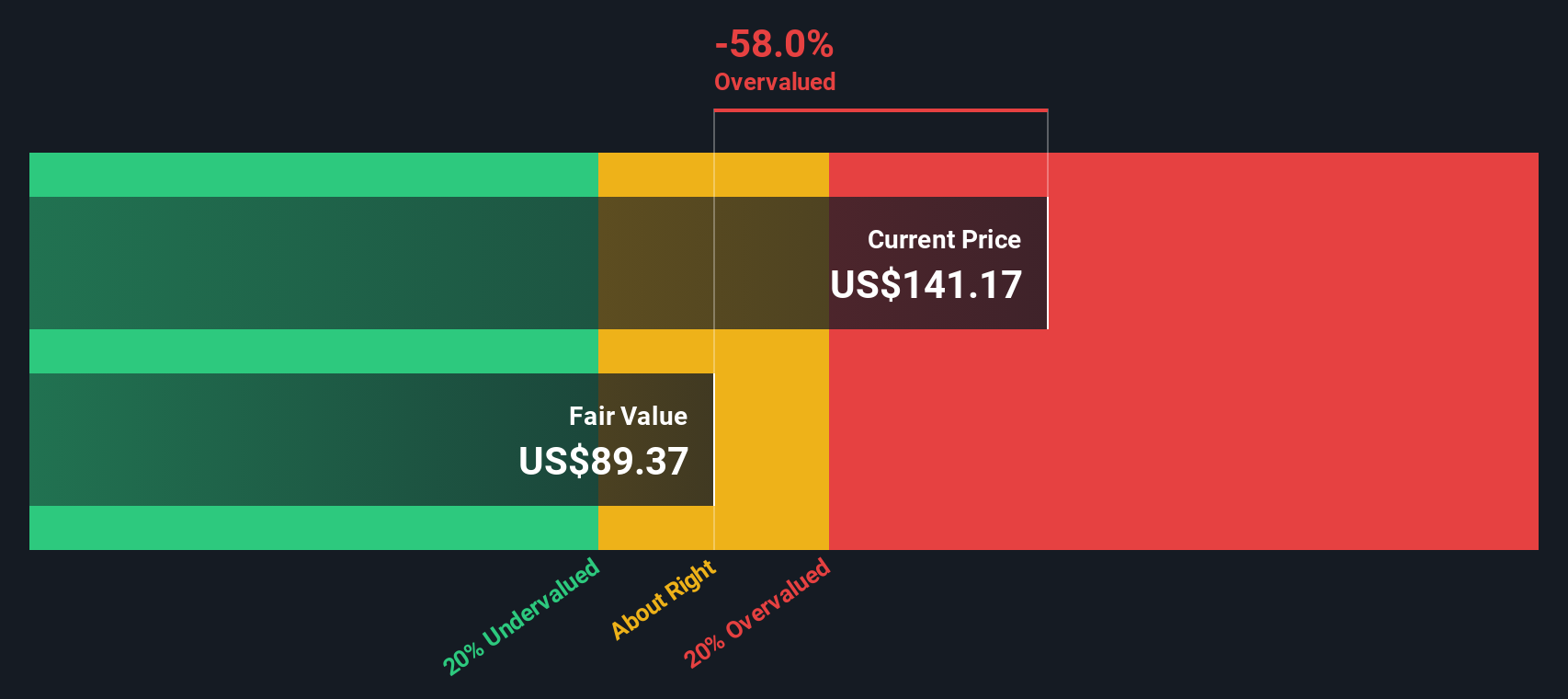

While the consensus suggests TJX is undervalued, our DCF model takes a stricter view and indicates the shares may be trading above their fair value. Is the market overconfident about future growth?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding TJX Companies to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own TJX Companies Narrative

If you see things differently or want to dig into the data yourself, you can easily craft your own take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding TJX Companies.

Looking for More Investment Ideas?

Smart investors never stop at just one opportunity. Uncover new ways to put your capital to work by checking out these handpicked stock ideas designed to help you stay ahead.

- Boost your income outlook as you target companies paying solid yields with dividend stocks with yields > 3%.

- Ride the innovation wave by tapping into future-shaping breakthroughs with quantum computing stocks.

- Unlock overlooked gems trading below intrinsic value through our selection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TJX Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TJX

TJX Companies

Operates as an off-price apparel and home fashions retailer worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives