- United States

- /

- Food and Staples Retail

- /

- NYSE:TGT

Target Corporation (NYSE:TGT) is Behind the Curve on Cost Adjustments

Even in crunch times, some sectors traditionally do well since they provide essential goods and services.

However, with inflation, escalating labor costs, runaway energy prices, and a strained supply chain – a lot can go wrong even with traditionally defensive stocks like Target Corporation (NYSE: TGT).

Q1 Earnings Results

- Non-GAAP EPS: US$2.19 (miss by US$0.87)

- Revenue: US$25.17b (beat by US$690m)

- Revenue growth: +4% Y/Y

Other highlights

- Comparable sales: +3.3%

- FY2022 revenue growth: low to mid-single-digit

- FY 2022 operating margin rate: around 6%

See our latest analysis for Target

So far, the interesting fact behind the retailers earning season is that the revenue growth is well below the inflation. Arguably, retailers were slow to raise their prices, and demand growth did not cover the difference.

Meanwhile, Target's cost of operation has been going up. Labor market pressures bumped the wages up, raising the minimum wage as much as US$24/hour. Over the course of the year, the cost of sales went up by 10.4%, while selling, general and administrative expenses ramped up by 5.6%.

Cost of sales includes things such as transportation, which due to supply chain issues, hit a record level in the recent past. In turn, this depressed the gross margin rate by 430 basis points.

Is Target now cheap?

At the moment, Target is now below its historical price-to-earnings average of 15x. The stock's ratio of 11x is currently in line with its industry peers' ratio, which means if you buy Target today, you'd be paying a relatively reasonable price.

In addition to this, it seems like Target's share price is relatively stable, which could mean fewer chances to buy low in the future now that it's trading around the price multiples of other industry peers. This is because the stock is less volatile than the broader market, given its low beta.

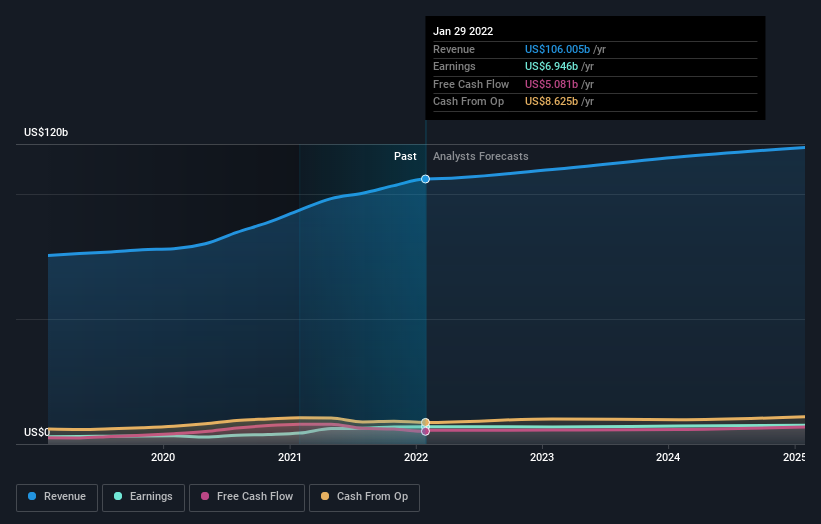

What kind of growth will Target generate?

Investors looking for growth in their portfolio may want to consider a company's prospects before buying its shares. Although value investors would argue that it's the intrinsic value relative to the price that matters the most, a more compelling investment thesis would be high growth potential at a low price.

In the case of Target, it is expected to deliver a relatively unexciting earnings growth of 7.5%, which doesn't help build up its investment thesis. Growth doesn't appear to be the main reason for a buy decision for the company, at least in the near term.

What this means for you:

Are you a shareholder? TGT's future growth appears to have been factored into the current share price, with shares trading around industry price multiples. While the industry seems to have been late on the ball, not following the inflation trajectory, Target remains a solid company trading at a fair value even at rather conservative estimates.

Are you a potential investor? If you've been keeping tabs on TGT, the crash might tempt you to get in, but you should not be trying to catch a falling knife. While there are arguments for "averaging down" - a technique where a buyer systematically buys in tranches and not in one single move - it is always better to wait for the dust to settle. Some investors call this a 3 day-rule - waiting for at least 3 days before considering buying.

If you'd like to know more about Target as a business, it's important to be aware of any risks. For example - Target has 3 warning signs we think you should be aware of.

If you are no longer interested in Target, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Valuation is complex, but we're here to simplify it.

Discover if Target might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:TGT

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives