- United States

- /

- Interactive Media and Services

- /

- NYSE:SSTK

Pandemic Could Be Masking Underlying Challenges For Shutterstock's (NYSE:SSTK) Revenues

Shutterstock (NYSE:SSTK) is one of the many unfortunate companies that have seen their revenues negatively impacted by the COVID-19 pandemic. However, there is a deeper underlying trend that has been somewhat camouflaged by the effects of the pandemic and might be concerning to some investors. If this underlying trend continues, there is no guarantee that the company's revenue growth will simply bounce back once the pandemic ends.

Check out our latest analysis for Shutterstock

Revenue Growth Has Stagnated Even Before The Pandemic

Many online content and retail platforms have received a revenue boost due to the “stay-at-home” trend prevalent right now. However, Shutterstock's content is used heavily for marketing and ad campaigns. A recent report by PQ Media has indicated that global marketing spending is set to drop 6.8% during 2020, the first decline in 11 years. This goes a long way to explaining the dynamics behind Shutterstock's apparent inability to grow during the last year, despite other platforms managing to thrive.

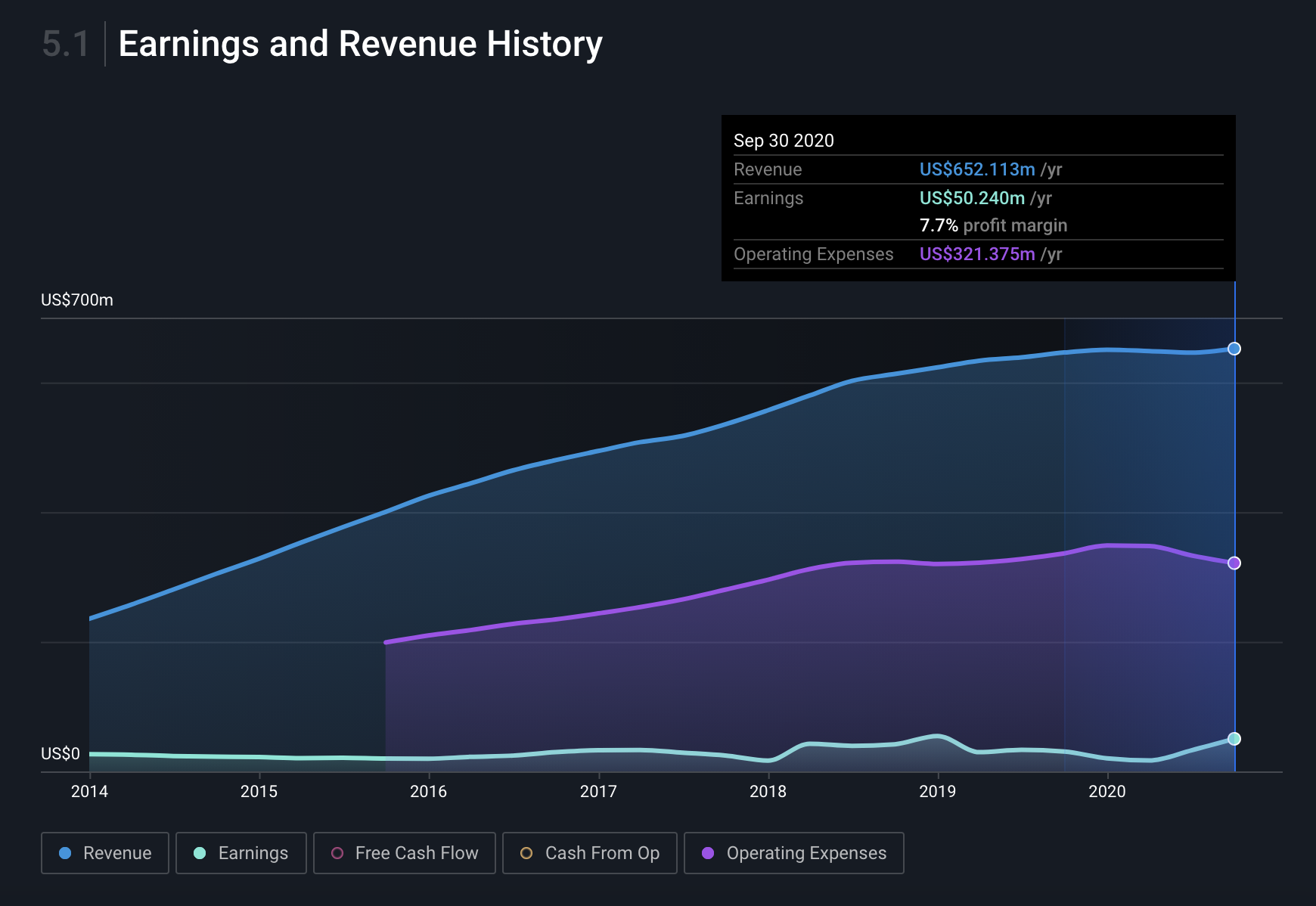

However, this impact only explains the last 9 months of performance for the company. The fact is that revenue has started to plateau since the middle of 2018 when the quarterly trailing-twelve-month revenue growth rate dropped well below 2%. For a stock that trades on a price-to-earnings multiple of 48x trailing-twelve-month earnings, typical of high growth companies, these revenue growth rates are definitely on the low side.

NYSE:SSTK Earnings and Revenue History as at 1 Dec 2020. Source: Simply Wall St

NYSE:SSTK Earnings and Revenue History as at 1 Dec 2020. Source: Simply Wall St

Meanwhile, earnings have improved recently. But we can see in the earnings and revenue chart above, the reason is that Shutterstock has also pulled back on some of its own operating expenses in-line with the slowing business environment. Perhaps ironically, most of this reduction has come from lower sales and marketing investments, in keeping with the actions of their client base who are also cutting back on investment in these areas.

What Has Caused Revenue To Plateau

There appear to be a couple of factors that are affecting Shutterstock's underlying revenue growth troubles.

1. Enterprise customer revenue growth

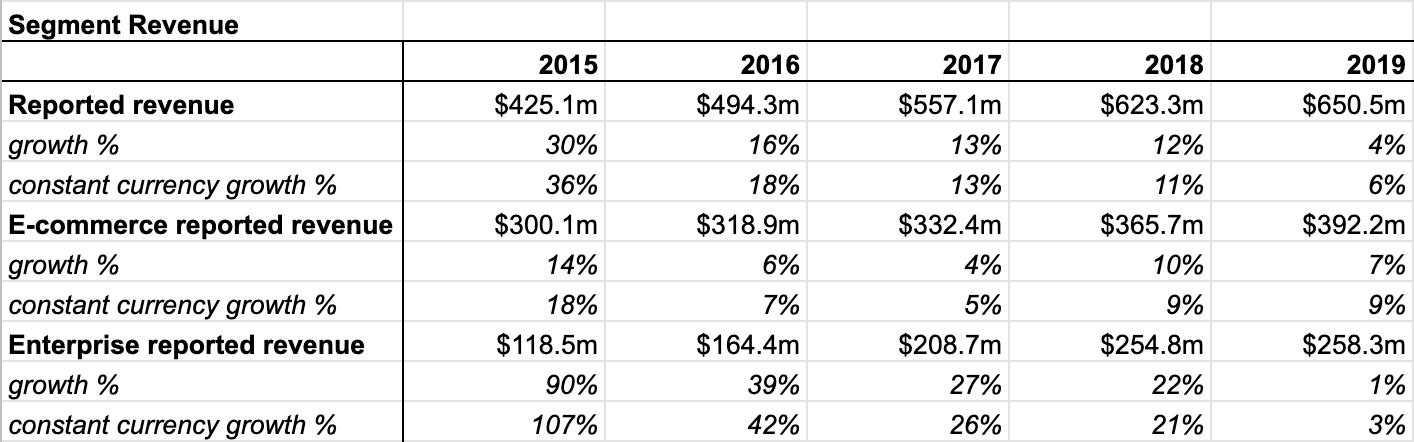

Shutterstock has two main types of customers, e-commerce and enterprise customers. E-commerce customers are usually individuals or small businesses that typically self-serve and primarily use the company's standard offerings. Enterprise customers on the other hand are larger companies that often have unique content, licensing and workflow needs.

While the e-commerce segment has traditionally been the largest, the enterprise segment was by far the fastest growing over the last few years. However, that growth has tapered off completely and with COVID-19, is now going backwards.

NYSE:SSTK Company filings

NYSE:SSTK Company filings

We can see in this table from the company's 2019 10-K filing that on a constant currency basis enterprise revenue growth has been steadily declining since 2015, when it was an impressive 107%. But during the 2019 fiscal year, it only grew a paltry 3%. The company has blamed the slowdown on some issues within their sales teams, which they believe they have identified and will turn around. Regardless, there are increasing risks that this segment may not be all that healthy.

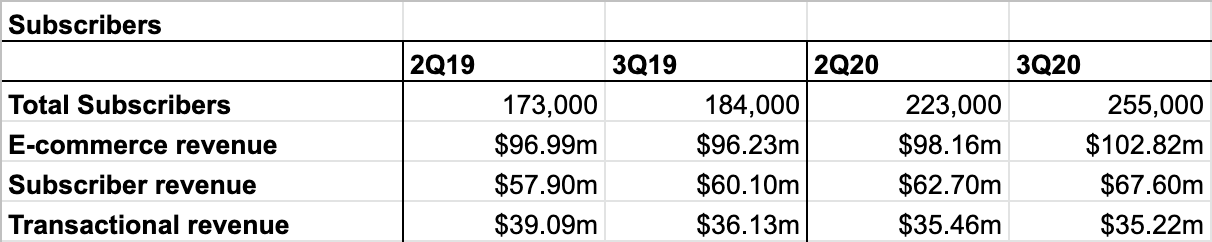

2. Transactional revenues declining

Aside from slowing enterprise business, transactional revenues also appear to be falling. These are revenues the company generates from its e-commerce customer base where the customer is not on a subscription but a “pay as you go” option.

Shutterstock has only in the last two quarters begun reporting its total subscribers and the revenue generated from that cohort, so we don't have a lot of historical data. However, we can deduce the revenues for the non-subscription cohort by comparing subscription revenue with total e-commerce revenue. Transactional revenue has fallen year on year for the last 2 quarters.

NYSE:SSTK Company filings

NYSE:SSTK Company filings

This isn't necessarily a bad thing, as it may mean these customers are being sold onto subscriptions, which means they will bring in recurring revenues and have a greater life-time value. However, the growth in e-commerce subscription revenue hasn't been strong enough to make up for losses in transactional revenue and enterprise revenue.

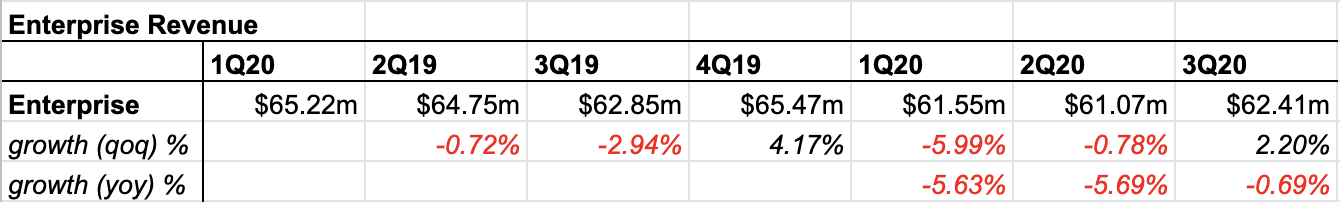

What The Company Is Doing To Fix It

During Shutterstock's FY 2019 earnings call, the management team admitted the enterprise segment was having some problems. They alluded to potentially too many new products being released and not having enough sales staff to help customers through the options. However, they were confident that by the end of 2020 the business would turn around and return to year-on-year growth. The plan was to achieve this by investing in and “reinvigorating” the sales team. By investing, they meant that more staff would be added. But by “reinvigorating”, they seemed to imply the sales team were not all that motivated to sell. We don't find comments like that very encouraging.

We've now arrived at the end of 2020 and to the management team's credit, the enterprise segment is looking better. Q3 saw a quarter-on-quarter increase in enterprise revenue, even though Q3 is usually the company's weakest quarter and revenues tend to fall due to seasonality. Unfortunately, they are still not seeing “year-on-year” growth as expected, but the decline in year-on-year revenue has at least reduced significantly.

NYSE:SSTK Company filings

NYSE:SSTK Company filings

While the latest trends are encouraging, we would like to see a few more quarters of results to confirm that sales in the enterprise segment have actually turned the corner. The investments in enterprise reinvigoration may not pay off over the medium-term as sales staff would not have had as much opportunity to get in front of customers due to the pandemic. With customers disengaging in recent times, this poses a longer-term risk if the company doesn't succeed in re-connecting with them soon.

A good idea might be to see what analysts think the future might deliver for Shutterstock's earnings and revenues, which you can check out by clicking here .

Conclusion

It is good to see that Shutterstock's enterprise business is looking healthier than it has for a while. However, the company is facing a conundrum. It initially reduced spending in sales and marketing to deal with the pandemic, but its strategy to deal with the problematic enterprise segment requires it to increase this investment again.

The new investments in the enterprise sales teams mean that the recent cost reductions achieved may not be long-lived and this may impact profits in the short-term. These investments are also being made counter-cyclically as Shutterstock's clients have all been doing the opposite since the pandemic took hold, which is a risk in and of itself.

Certainly the company finds itself in a bit of a predicament. So while some investors have focussed solely on the impacts of the pandemic, there are other problems that they may be ignoring that could be exacerbated by COVID-19. Revenues may take a longer time than some expect to return to normal, even after the pandemic is brought under control.

If it does take a while for Shutterstock to get back on track, its financial health will be of utmost importance to make sure it can ride out this difficult period. You can see what the company's overall financial health is by accessing our free report here .

Promoted

When trading Shutterstock or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers . You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.

Neither Simply Wall St analyst Sasha Jovanovic nor Simply Wall St hold any position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Sasha Jovanovic

Sasha is an Equity Analyst at Simply Wall St with 15 years financial markets experience. He is a CFA Charterholder and holds Bachelor degrees in Mathematics and International Studies from the University of Technology, Sydney, Australia. He worked at CommSec Investment Management as an Investment Analyst from 2014 and later at Sequoia Financial Group as a Portfolio Analyst from 2018.

About NYSE:SSTK

Shutterstock

Provides platform to connect brands and businesses to high quality content in North America, Europe, and internationally.

Very undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)