Sea (NYSE:SE): Evaluating Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

Sea (SE) has seen its shares under pressure in recent weeks, which has caught the attention of investors interested in its longer-term performance. With the company posting annual revenue growth of 16% and net income climbing nearly 30%, many are watching to see if this recent dip presents an opportunity.

See our latest analysis for Sea.

After a strong start to the year, Sea’s share price momentum has cooled in recent weeks, with the stock slipping more than 15% over the past month. The stock still boasts a year-to-date share price return of over 49%. Despite the short-term pullback, the company’s longer-term total shareholder returns, including a 63% gain over the past year and a remarkable 232% over three years, show investors are still rewarding Sea’s ongoing growth story.

If you’re keeping an eye on market movers, this could be the perfect opportunity to broaden your scope and discover fast growing stocks with high insider ownership

This raises the big question for investors: Is Sea currently trading at a discount to its true value, or are the company’s strong fundamentals and future prospects already reflected in the price?

Most Popular Narrative: 20.4% Undervalued

Sea’s last close price of $156.51 sits well below the most widely followed fair value estimate of $196.66. The numbers behind this projection come from bold growth assumptions that have analysts divided, fueling debate on whether Sea’s current price leaves room for upside.

Ongoing transition towards cashless economies and advancement of digital payment infrastructure (including BNPL and QR code integration) in Sea's key markets is driving rapid expansion in Sea's fintech loan book and transaction volumes. This is improving monetization opportunities, recurring revenues, and paving the way for net margin expansion as the business scales.

Wondering what’s really powering this valuation? One financial lever stands out, hinting at ambitious expectations for both scale and profitability. Ready to see the dramatic earnings milestone and margin leap that justifies such a price target? Uncover how high the bar is set for Sea’s future performance.

Result: Fair Value of $196.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from local and global rivals or regulatory changes in core markets could quickly undermine Sea’s growth narrative and put pressure on future earnings.

Find out about the key risks to this Sea narrative.

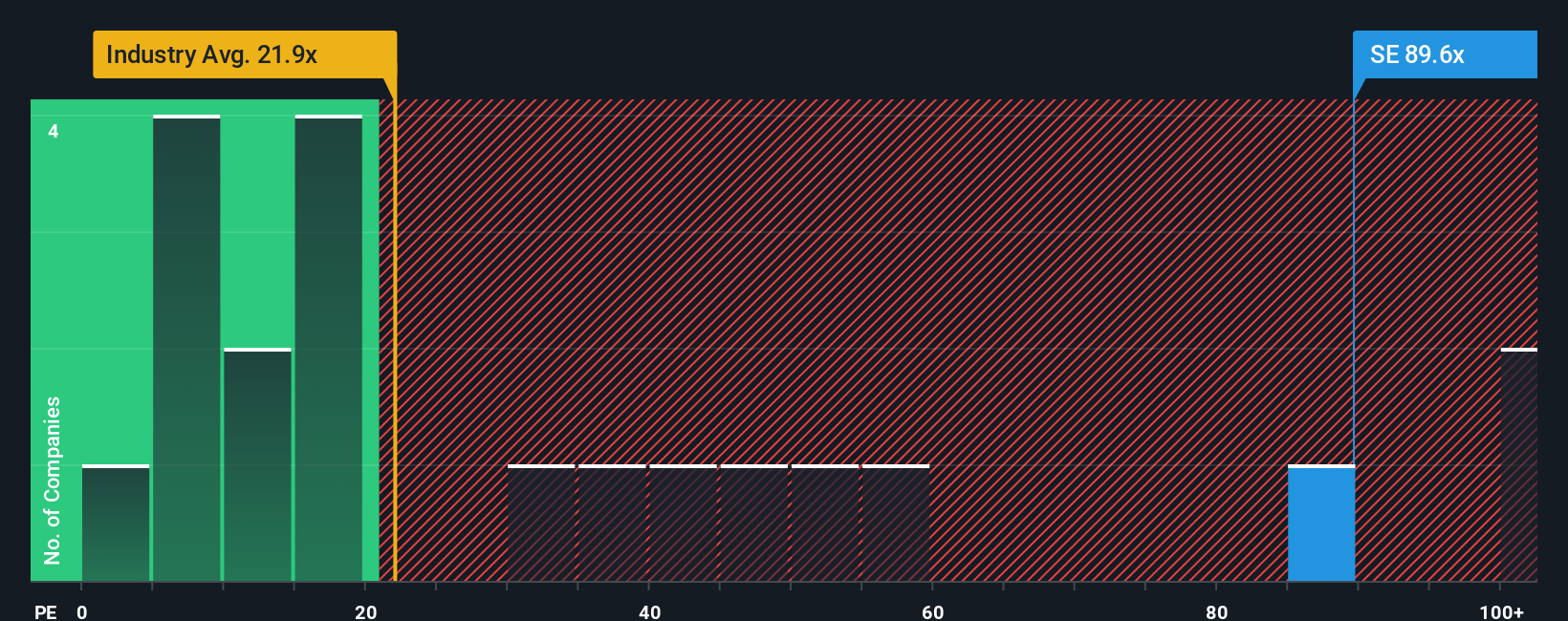

Another View: Multiples Tell a Different Story

While the fair value estimate points to Sea being significantly undervalued, traditional ratios paint a more cautious picture. Sea's price-to-earnings ratio sits at 77.5x, which is far above the global industry average of 19.5x and the fair ratio of 34.9x. This suggests investors expect dramatic growth ahead or are overpaying for the current performance. Which narrative holds more weight as the story unfolds?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sea Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own analysis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Sea.

Looking for More Standout Opportunities?

Smart investors always keep their options open. Don’t settle for one perspective when other high-potential stocks are just a click away on Simply Wall Street.

- Take action on high-yield potential with these 20 dividend stocks with yields > 3% to uncover companies with strong dividends and robust financial health.

- Stay ahead of the curve by spotting breakthrough innovation with these 28 quantum computing stocks, where pioneering quantum tech stocks are setting tomorrow’s standards.

- Unlock growth from the artificial intelligence boom by targeting the movers and shakers in these 26 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Through its subsidiaries, operates as a consumer internet company in Southeast Asia, Latin America, the rest of Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives