How Investors May Respond To Sea (SE) Pursuing Trillion-Dollar Ambitions Through AI and Long-Term Investment

Reviewed by Sasha Jovanovic

- In recent weeks, Sea Limited's founder Forrest Li expressed a bold vision to transform the company into a trillion-dollar business by leveraging AI technologies and accelerating long-term investments in its e-commerce and fintech divisions.

- This ambition is unfolding even as the company faces pressures on near-term growth and profitability, highlighting a strong commitment to future sustainability over immediate gains.

- We'll explore how Sea's focus on AI-driven growth and long-term sector leadership is influencing its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Sea Investment Narrative Recap

To be a shareholder in Sea Limited, an investor needs to believe in the company's ability to translate its AI-driven and fintech ambitions into sustained leadership in Southeast Asia and Brazil, despite significant competitive and margin pressures. The recent news of Forrest Li’s trillion-dollar vision and ongoing investments does not materially alter the biggest near-term catalyst, profitable growth in Shopee’s core and emerging markets, nor does it eliminate the primary risk of mounting competition from both local and global rivals.

Among recent company announcements, the upcoming Q3 2025 earnings report, scheduled for November 11, stands out as the most relevant, as it will shed light on how Sea's AI initiatives and long-term investments are showing up in financial performance. Investors will be closely watching for any signs that near-term profitability or margins are being sacrificed in pursuit of future growth.

However, against the backdrop of an ambitious vision, investors should also keep in mind the persistent risk from intensifying competition, particularly in...

Read the full narrative on Sea (it's free!)

Sea's outlook anticipates $33.2 billion in revenue and $4.7 billion in earnings by 2028. This reflects a 19.7% annual revenue growth rate and a $3.5 billion increase in earnings from the current $1.2 billion.

Uncover how Sea's forecasts yield a $196.66 fair value, a 25% upside to its current price.

Exploring Other Perspectives

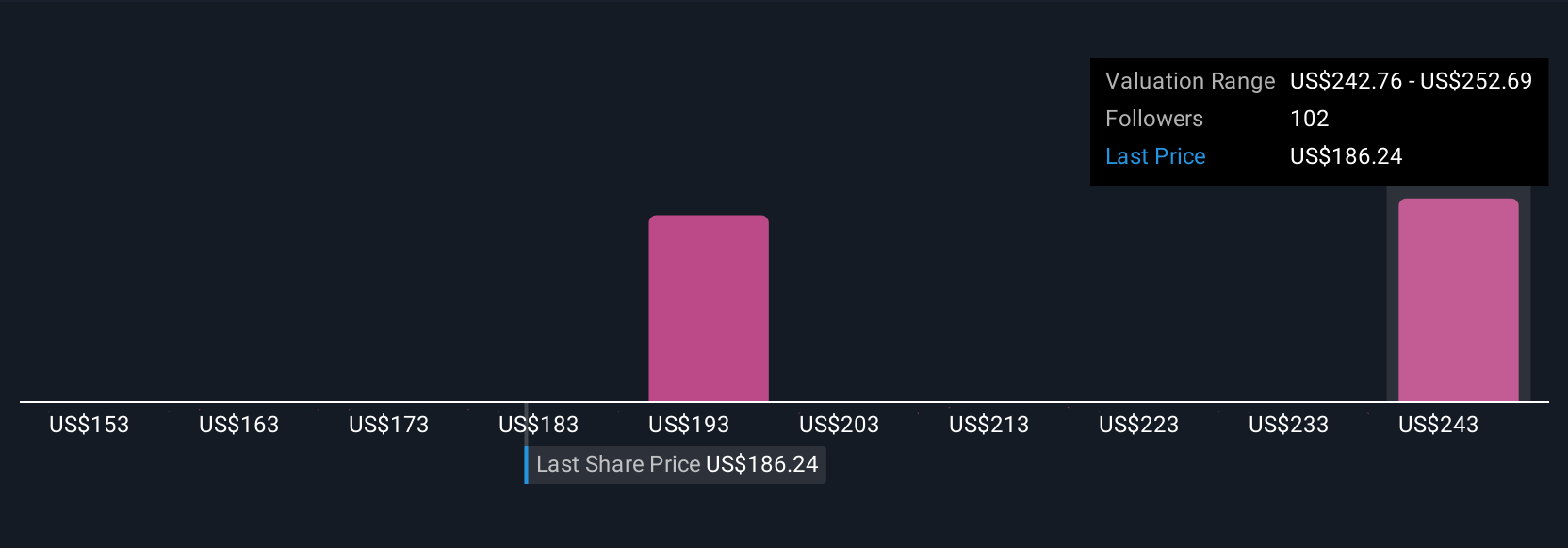

Eighteen different fair value estimates from the Simply Wall St Community span US$151.88 to US$294.24. With risks from deepening competition in key markets, you may see performance expectations diverge sharply.

Explore 18 other fair value estimates on Sea - why the stock might be worth just $151.88!

Build Your Own Sea Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sea research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Sea research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sea's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Through its subsidiaries, operates as a consumer internet company in Southeast Asia, Latin America, the rest of Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives