- United States

- /

- Specialty Stores

- /

- NYSE:SAH

Sonic Automotive (SAH): Evaluating Valuation After Recent Share Price Strength

Reviewed by Simply Wall St

See our latest analysis for Sonic Automotive.

While today’s modest gain pushes Sonic Automotive’s share price to $77.49, it comes on the back of robust year-to-date momentum with a 24.3% share price return. The one-year total shareholder return stands at an impressive 45.7%, pointing to sustained interest from investors and suggesting the company’s longer-term story is still building strength.

If the steady climb in auto retail piques your interest, explore more opportunities by checking out See the full list for free..

With shares trading just below analyst targets and boasting strong earnings growth, the question for investors becomes clear: is Sonic Automotive undervalued with upside left, or is its recent outperformance already fully priced in?

Most Popular Narrative: 5.9% Undervalued

Sonic Automotive’s last close of $77.49 stands below the narrative fair value estimate of $82.33, suggesting potential upside if key growth assumptions hold true. The conversation continues on whether the company’s investments and expansion efforts can unlock further value as forecasted by the consensus.

Expansion and enhancement of EchoPark, Sonic's used vehicle platform, is positioned to capitalize on the growing U.S. vehicle parc and a high-growth, higher-margin used car market. Improved access to lease returns in 2026, 2027, and 2028 is expected to drive volume and earnings growth at EchoPark, which could directly boost overall company revenue and EBITDA.

Do you want to discover the financial levers behind this bullish outlook? The narrative is built on bold predictions about profit margin expansion, higher recurring revenue, and a shrinking share count. Find out why these aggressive assumptions could make all the difference in how Sonic Automotive is valued.

Result: Fair Value of $82.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, surging EV adoption and tightening industry margins remain key risks that could challenge Sonic Automotive's current growth assumptions and valuation potential.

Find out about the key risks to this Sonic Automotive narrative.

Another View: Market Comparisons Paint a Different Picture

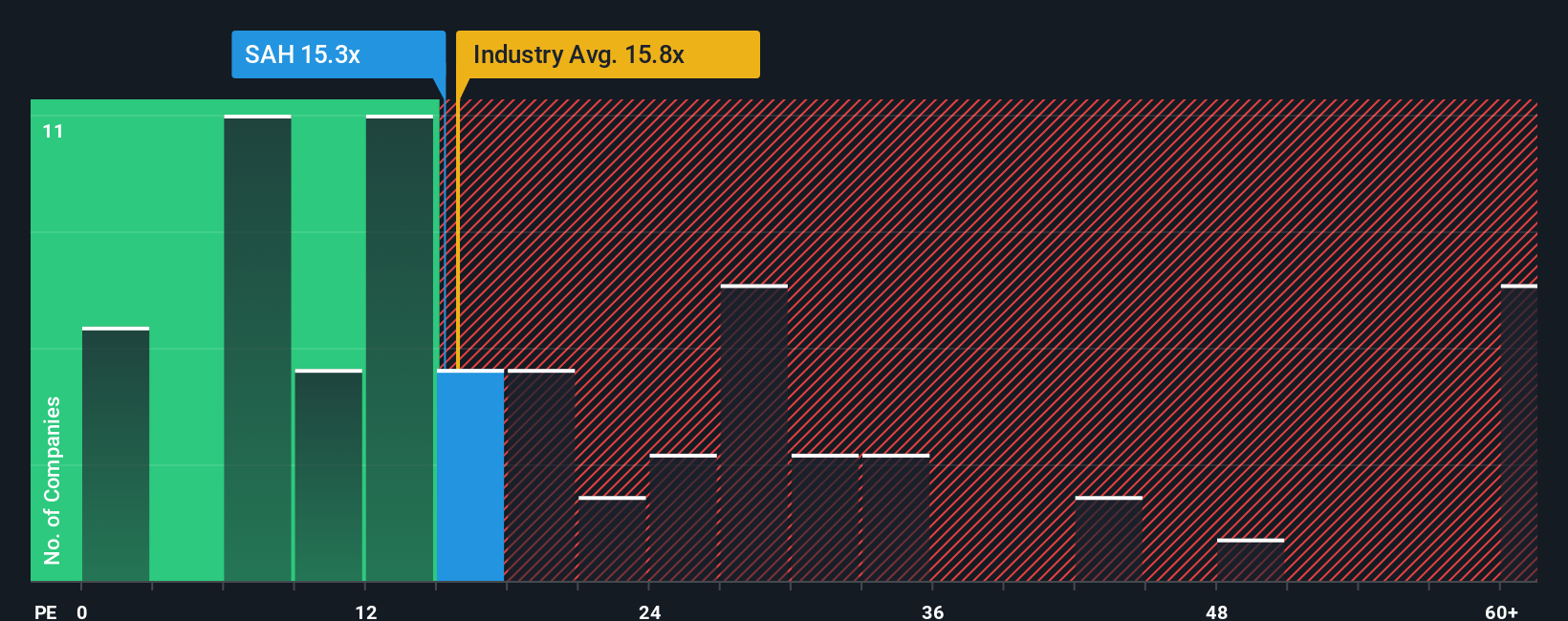

Looking beyond narrative-driven fair value estimates, Sonic Automotive’s price-to-earnings ratio stands at 16.8x, which is higher than both the US Specialty Retail industry average (16.7x) and its peer average (12.5x). At the same time, the fair ratio suggests a market multiple of 18.2x could be justified. Does this premium hint at future upside, or does it raise the risk that investors are paying too much for current performance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sonic Automotive Narrative

If you have a different perspective or want to analyze the numbers firsthand, you can build your own custom narrative in just a few minutes. Do it your way.

A great starting point for your Sonic Automotive research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Seize your edge by searching beyond the obvious and find tomorrow’s winners before everyone else. Use these curated ideas to spark your portfolio’s next breakthrough.

- Capitalize on fast-growing technologies by tracking potential leaders among these 24 AI penny stocks driving game-changing innovations in artificial intelligence.

- Maximize your returns with steady income by scanning these 17 dividend stocks with yields > 3% offering yields above 3% and attractive financial fundamentals.

- Ride the trend of digital finance by finding companies spearheading blockchain growth on these 79 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SAH

Sonic Automotive

Operates as an automotive retailer in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives