- United States

- /

- Specialty Stores

- /

- NYSE:RH

Why RH (RH) Is Down 6.0% After Trump Tariff Probe Sparks New Supply Chain Uncertainty

Reviewed by Sasha Jovanovic

- Earlier this week, President Trump announced a federal investigation into furniture imports that could lead to tariffs at an as-yet-undetermined rate on items brought into the United States.

- Even though RH has shifted much of its manufacturing away from China to Vietnam and its own US factory, uncertainty remains regarding how the potential tariffs could still affect its supply chain and cost structure.

- With fresh tariff uncertainties on furniture imports, we'll explore how this development could alter RH's investment outlook and risk profile.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

RH Investment Narrative Recap

To be a shareholder in RH, you need to believe in its premium brand position, expansion into new galleries, and the ability to manage costs amid a volatile housing market. The federal investigation into furniture imports introduces more near-term uncertainty around tariffs, which could threaten margin improvement, a key short-term catalyst, while amplifying the largest current risk: supply chain cost pressures. If the resulting tariffs are limited or exclude RH’s main sourcing countries, the impact may remain manageable, but the lingering ambiguity is front and center for investors right now.

In the wake of this tariff news, RH’s recent expansion with RH Manhasset, The Gallery at Americana, stands out. This 19,000 square foot immersive retail concept showcases RH’s ongoing investment in brand experience and broadening its physical presence, which remains a core catalyst for potential sales growth, even as shifting import costs may present hurdles to its profitability targets in the near term.

On the other hand, investors will need to watch closely how rising supply chain costs from possible tariffs could impact RH’s ability to...

Read the full narrative on RH (it's free!)

RH's outlook anticipates $4.3 billion in revenue and $442.6 million in earnings by 2028. Achieving this would require annual revenue growth of 9.6% and an increase in earnings of $358.5 million from the current $84.1 million.

Uncover how RH's forecasts yield a $262.25 fair value, a 62% upside to its current price.

Exploring Other Perspectives

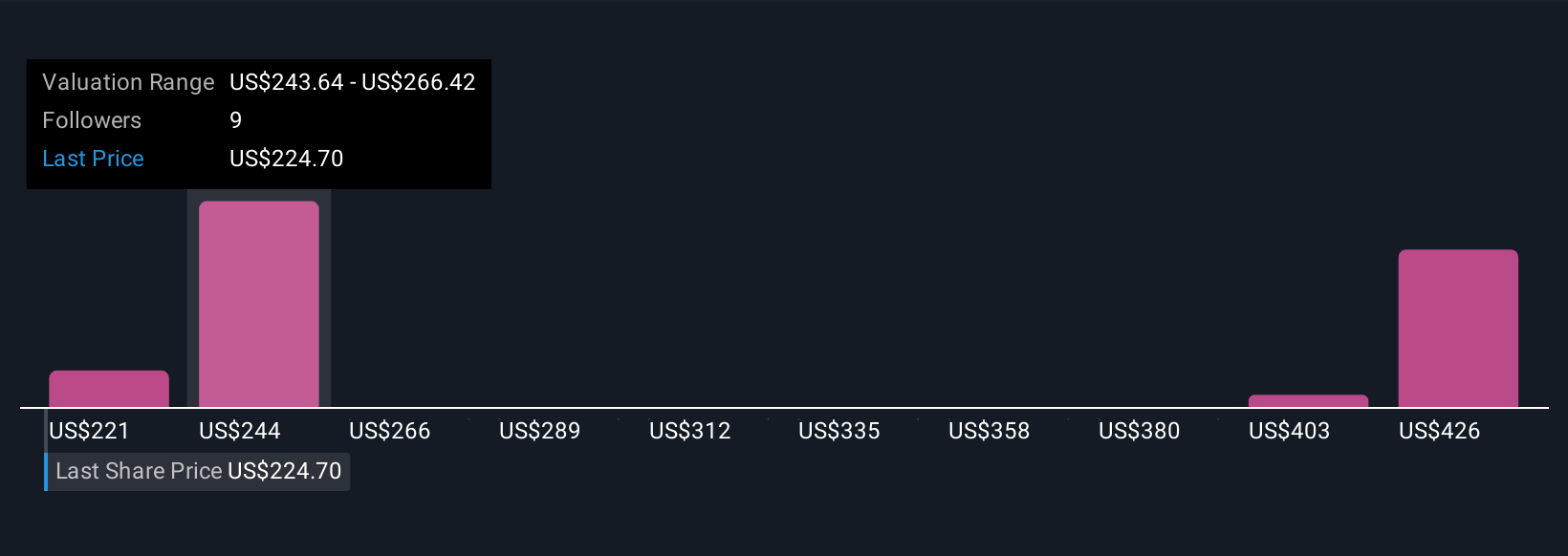

Five fair value estimates from the Simply Wall St Community put RH’s potential between US$220.85 and US$420.02 per share. With tariff uncertainties rising, these wide-ranging opinions highlight just how much views on margin risks and future earnings can differ, prompting you to consider more than one angle when making your own assessment.

Explore 5 other fair value estimates on RH - why the stock might be worth just $220.85!

Build Your Own RH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RH research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free RH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RH's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RH

RH

Operates as a retailer and lifestyle brand in the home furnishings market in the United States, Canada, the United Kingdom, Germany, Belgium, and Spain.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives