- United States

- /

- Specialty Stores

- /

- NYSE:RERE

A Look at ATRenew (NYSE:RERE) Valuation Following Earthshot Prize Recognition and Global Expansion Efforts

Reviewed by Kshitija Bhandaru

ATRenew (NYSE:RERE) was just named a finalist for The Earthshot Prize, drawing attention to its AI-driven approach to e-waste reduction as well as its expansion into Southeast Asia and the Middle East. This recognition puts global focus on the company’s evolving business model.

See our latest analysis for ATRenew.

ATRenew’s short-term share price has been largely steady, but the 1-year total shareholder return of 0.49% and an impressive 3-year total shareholder return of 0.96% suggest the company’s momentum is quietly building as its AI-powered expansion receives global validation from accolades such as The Earthshot Prize.

If ATRenew’s recognition for smart growth has you interested in other ambitious companies, now’s a great opportunity to discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst targets despite strong revenue and net income growth, investors are left to consider whether ATRenew represents an underappreciated value or if the market already anticipates its future gains.

Most Popular Narrative: 37.9% Undervalued

With ATRenew’s fair value estimated at $7.00 according to the most widely followed narrative, the latest closing price of $4.35 is seen as a substantial discount. Such a gap points to high expectations for growth and profitability, making it a compelling setup for further exploration.

Ongoing investment in refurbishment capacity and multi-category recycling, including for laptops and wearables, is enabling higher-margin value-added services to account for a growing share of revenue. This supports further gross margin expansion and ultimately improves net margins. The company's scale-driven efficiency improvements, enhanced by AI-enabled order dispatch, in-store and to-door fulfillment, and a rapidly growing nationwide store network, are expected to lower per-unit fulfillment and operational costs. Over time, this would expand profitability and operating margins.

Want to know what’s behind this bullish price target? The growth story hinges on rapid profitability gains, bigger margins, and aggressive revenue expansion. The narrative assumes a bold blend of increasing earnings and efficiency. Are you curious which projections drive that valuation? Dive into the full narrative to see the model’s core assumptions revealed.

Result: Fair Value of $7.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in Chinese government subsidies or an uptick in competition from digital-first rivals could challenge ATRenew’s growth trajectory and profitability outlook.

Find out about the key risks to this ATRenew narrative.

Another View: What About Market Comparisons?

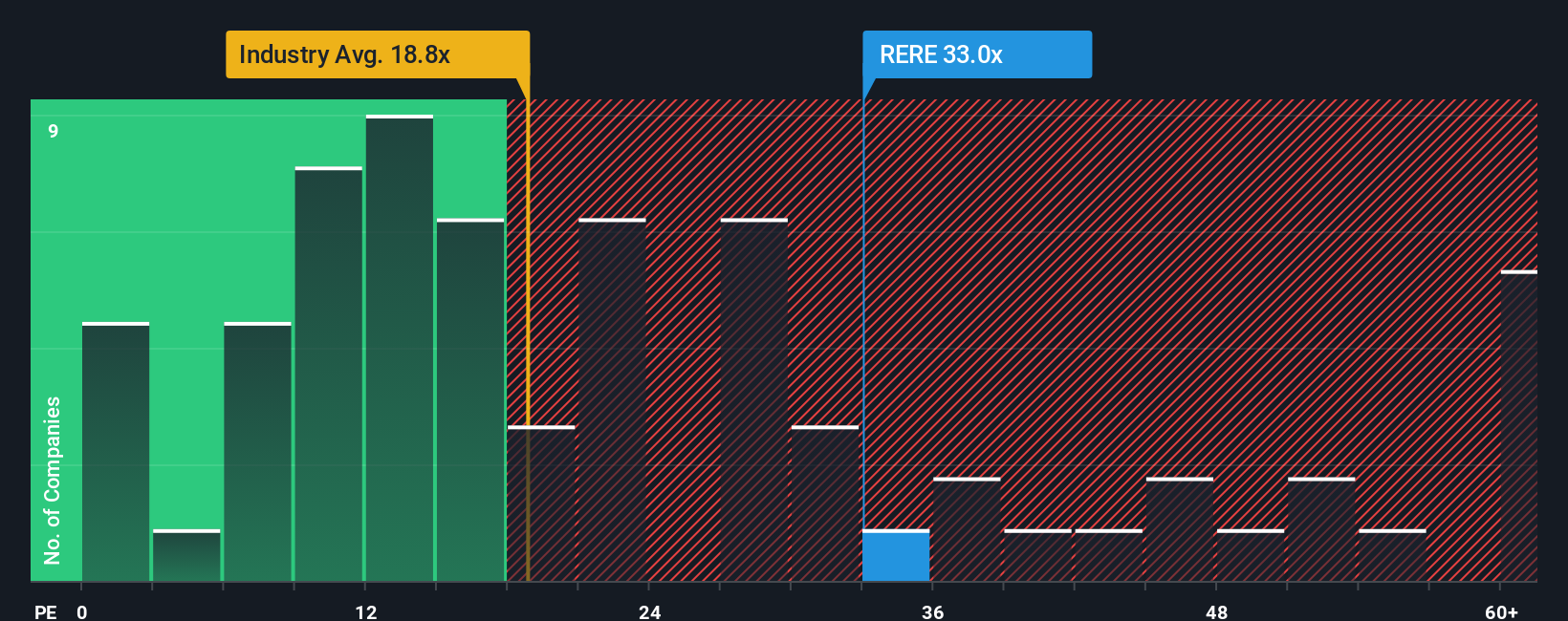

Looking at ATRenew’s valuation through the lens of its price-to-earnings ratio, a different picture emerges. The company’s P/E sits at 32.9x, substantially above both its peer average of 20.6x and the US Specialty Retail industry average of 17.3x. This premium suggests the market is pricing in high expectations or simply sees more risk. Is the upside already reflected in the price, or could there be further potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ATRenew Narrative

If you see things differently or enjoy diving into the numbers yourself, it takes less than three minutes to build your own story: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding ATRenew.

Ready for More Opportunities?

Don’t let your ambitions end here. Smart investors always keep an eye out for the next opportunity. Use these handpicked ideas to stay one step ahead.

- Tap into the future with these 24 AI penny stocks and find companies transforming industries through artificial intelligence-powered innovation and intelligent automation.

- Unlock the potential of passive income with these 19 dividend stocks with yields > 3%, featuring stocks known for their strong yields and consistent payouts above 3%.

- Jump into a technology breakthrough by browsing these 26 quantum computing stocks and discover businesses pioneering quantum computing and the next wave of digital solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RERE

ATRenew

Operates pre-owned consumer electronics transactions and services platform in the People’s Republic of China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives