A Fresh Look at MINISO (NYSE:MNSO) Valuation After Earnings, Dividend Declaration, and Share Buybacks

Reviewed by Simply Wall St

Most Popular Narrative: 43.6% Undervalued

According to user SuEric, the prevailing view is that MINISO Group Holding is significantly undervalued relative to its fair value, with a potential for outsized future gains. The narrative sets a target based on robust earnings projections and ambitious multi-year growth plans.

Strong Q1 2024 Performance: In Q1 2024, $MNSO revenue surged 26% year-on-year to $515.7 million, with adjusted EBITDA margin expanding by 200 basis points to 25.9%. This growth was fueled by a robust strategy of opening new stores globally. Aggressive Expansion Plans: $MNSO plans to open 900 to 1,100 stores annually from 2024 to 2028, aiming for a revenue CAGR of over 20%. As operational efficiency improves, sustained EBITDA margin growth is expected, enhancing the potential for higher dividends.

Think MINISO’s rally is over? Think again. This narrative relies on future growth assumptions that are more ambitious than you might expect. Which financial leap drives this eye-catching fair value? The secret lies in its expansion blueprint and profit targets, but only a deep dive reveals the boldest assumptions fueling this price tag.

Result: Fair Value of $44.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain as global expansion may slow or margins could contract. This could potentially challenge the optimistic assumptions underpinning MINISO’s undervaluation case.

Find out about the key risks to this MINISO Group Holding narrative.Another View: Multiples Raise a Question

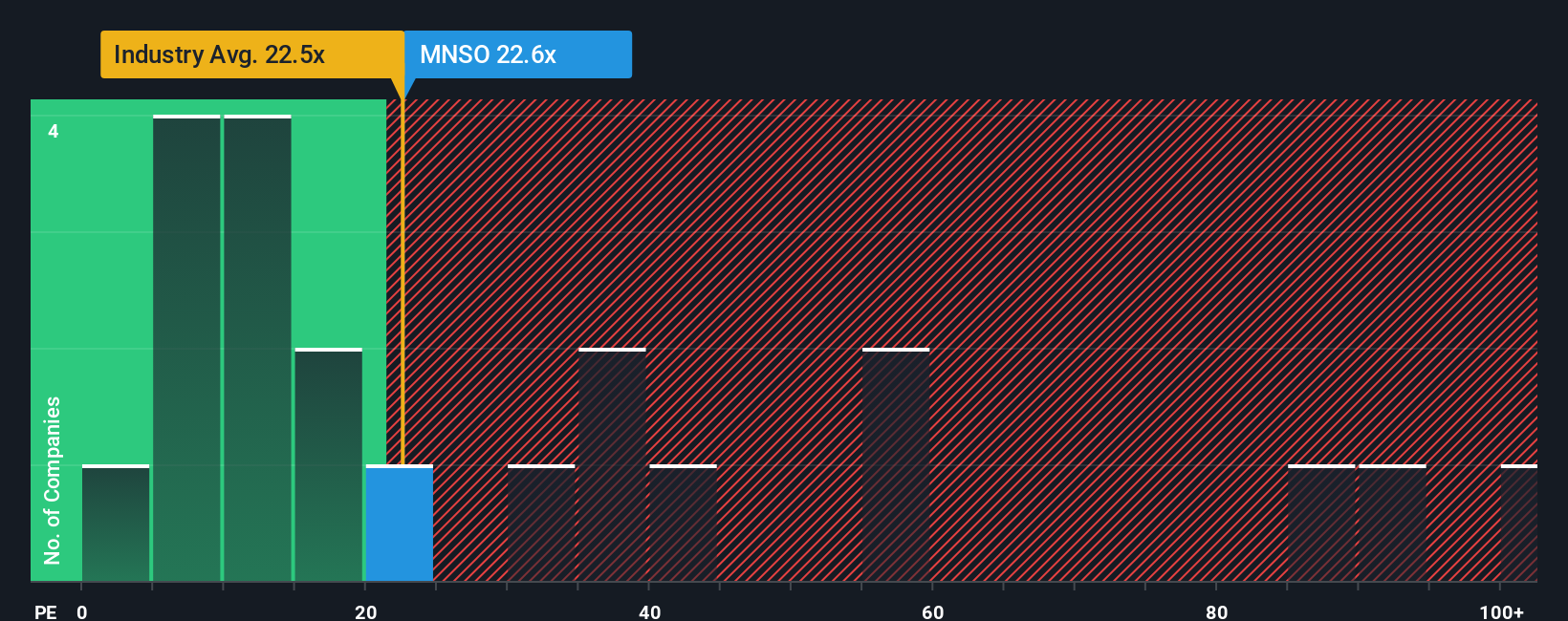

Stepping away from fair value estimates, a look at how the company's price compares to industry norms paints a different picture. Using this approach, the shares appear a bit more expensive. Could the market be running ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding MINISO Group Holding to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own MINISO Group Holding Narrative

If you see the story differently or want to weigh the facts for yourself, you can craft your own narrative in just a few minutes. So why not Do it your way?

A great starting point for your MINISO Group Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve by hunting for quality stocks across new frontiers with powerful tools at your fingertips. The market rewards the curious, and these opportunities are too valuable to ignore.

- Build your portfolio with confidence by targeting companies offering steady payouts and growth potential in our selection of dividend stocks with yields > 3%.

- Level up your tech exposure by following the innovators leading advancements in artificial intelligence through our list of AI penny stocks.

- Seize an edge by searching for shares priced well below their intrinsic worth via our screen for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:MNSO

MINISO Group Holding

An investment holding company, engages in the retail and wholesale of design-led lifestyle and pop toy products in China, the rest of Asia, the Americas, Europe, Indonesia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives