Macy's (M): Assessing Valuation After Recent Share Price Surge and Renewed Investor Interest

Reviewed by Simply Wall St

Macy's (M) shares have seen some recent movement, piquing investor attention as the company navigates changes in the retail sector. The stock’s performance over the past month shows a clear uptick. This has encouraged fresh discussion around the brand’s valuation and outlook.

See our latest analysis for Macy's.

Over the last year, Macy's has delivered a total shareholder return of 35.5%, with momentum building lately as its 90-day share price return topped 51%. Recent gains indicate renewed optimism, especially as the company continues navigating broader industry shifts and evolving consumer sentiment.

If Macy's rebound has you rethinking your playbook, it could be the perfect moment to broaden your horizons and discover fast growing stocks with high insider ownership

But with shares surging and recent results in focus, investors face a crucial question: Is Macy’s still trading at a bargain, or has the market already factored in its growth prospects?

Most Popular Narrative: 20.1% Undervalued

The narrative from user julio sees Macy's trading below what it could be worth, with the fair value set higher than where the stock most recently closed. This sets up a sharp debate about what might unlock that extra upside and where the market is overlooking potential catalysts.

Macy’s owns significant real estate that can be sold to provide liquidity, pay down debt, and finance new investments. The firm intends to raise about $600 million to $750 million from real estate sales over the next three years.

Want to find out why this valuation is so much higher than today’s market price? The secret is a controversial blend of margin assumptions and cautious revenue growth. What happens if retail headwinds shift or bold moves on asset sales succeed? The details could surprise you.

Result: Fair Value of $24.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Macy’s faces ongoing challenges in store closures as well as persistent downward trends in sales and profit margins, which could quickly shift investor sentiment.

Find out about the key risks to this Macy's narrative.

Another View: What Do Earnings Ratios Say?

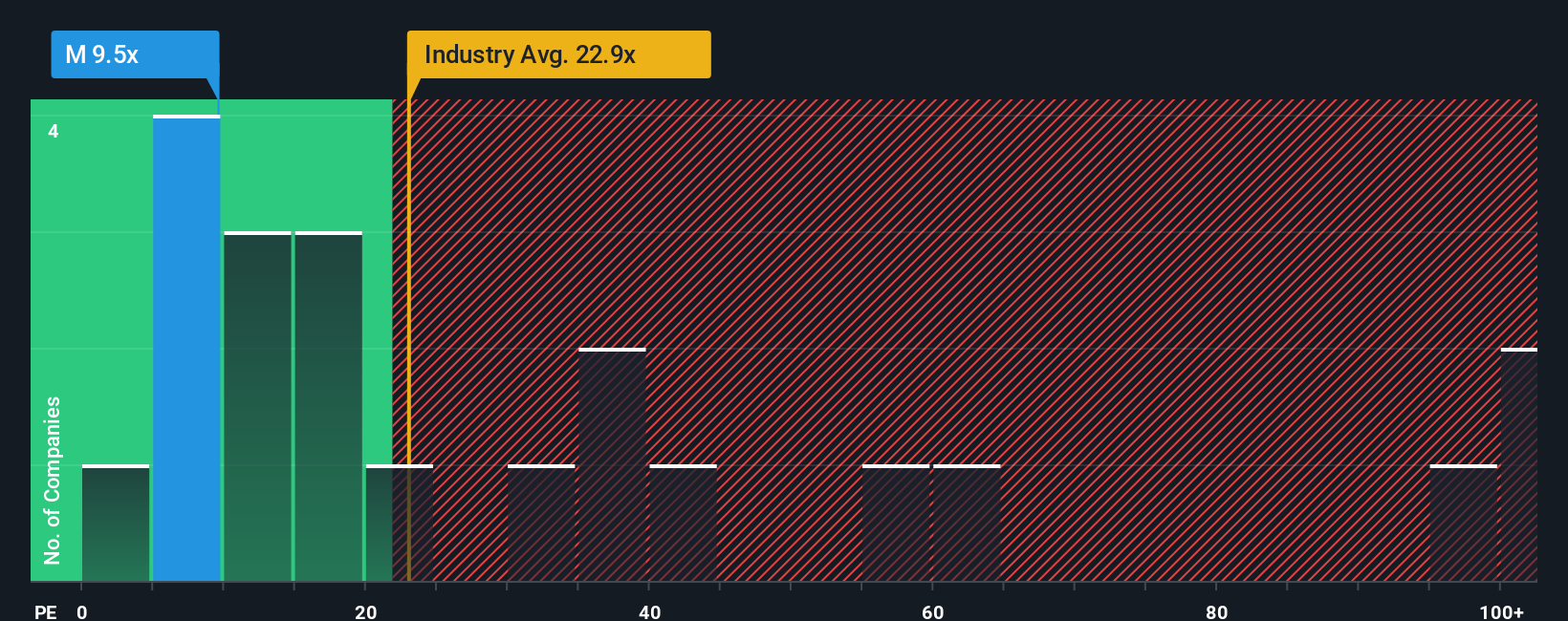

Looking at Macy’s through the lens of earnings ratios reveals a different side to the story. With a price-to-earnings ratio of 10.6, the stock is not only below the industry average of 19.5, but also below the peer group at 22.7. It is also under its own fair ratio benchmark of 16.9. This suggests there could be room for sentiment to shift if investors begin valuing Macy’s more in line with peers or a potential turnaround strengthens. Yet, does this gap signal real upside, or is it a warning about risks others are seeing?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Macy's for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Macy's Narrative

Not convinced by the arguments or want to shape your own outlook? You can review the data and craft a fresh take in just minutes. Do it your way

A great starting point for your Macy's research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't wait for opportunities to pass you by. Use the Simply Wall Street Screener to target companies that align with your personal investing goals and interests.

- Tap into the momentum of emerging technologies and seize opportunities by checking out these 27 AI penny stocks with rapid growth potential.

- Secure your portfolio with steady income by reviewing these 18 dividend stocks with yields > 3% offering yields above 3% and strong fundamentals.

- Get ahead of Wall Street by uncovering companies positioned to outperform due to attractive valuations in these 908 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:M

Macy's

An omni-channel retail organization, operates stores, websites, and mobile applications in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives