- United States

- /

- Specialty Stores

- /

- NYSE:LOW

Lowe’s (LOW) Valuation: Is There Untapped Value After Recent Share Price Dip?

Reviewed by Simply Wall St

See our latest analysis for Lowe's Companies.

Lowe's share price has given up some ground recently, sliding 5.85% over the past month, while its year-to-date move is now in the red. However, the longer-term picture shows the company still boasts a healthy 36% total return over three years and 55% over five years. This suggests that while momentum is shaky right now, long-term investors have been well rewarded.

If you're interested in spotting more resilient performers beyond giants like Lowe's, this is a prime opportunity to discover fast growing stocks with high insider ownership

With the stock currently trading about 18% below analyst price targets, the question now is whether Lowe's still has untapped value or if its future growth prospects are already fully reflected in the share price.

Most Popular Narrative: 15.4% Undervalued

Lowe’s most popular narrative places its fair value at $281.84, about $43 ahead of its last close at $238.49. The stage is set as bullish analysts point to digital expansions and strategic acquisitions as a powerful formula the current share price may not fully reflect.

The acquisition of Foundation Building Materials (FBM) sharply accelerates Lowe's access to the large Pro contractor market, especially in key underserved regions (California, Northeast, Midwest), unlocking new revenue streams, greater ticket sizes, and a larger share of the $250 billion Pro market, which is expected to drive above-market sales growth and improved diversification of revenue over the coming years.

What’s the secret fuel behind this double-digit upside? Insiders are betting on transformative margin gains, scale-driven bargaining power, and a profit trajectory that rivals major disruptors. Want to see which numbers bold analysts are actually using in their math? Dive into the narrative and discover what could tip the scales for Lowe’s future value.

Result: Fair Value of $281.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integration missteps from recent acquisitions or persistent labor cost pressures could undermine Lowe's profit margins and challenge the growth narrative.

Find out about the key risks to this Lowe's Companies narrative.

Another View: SWS DCF Model Challenges the Upside

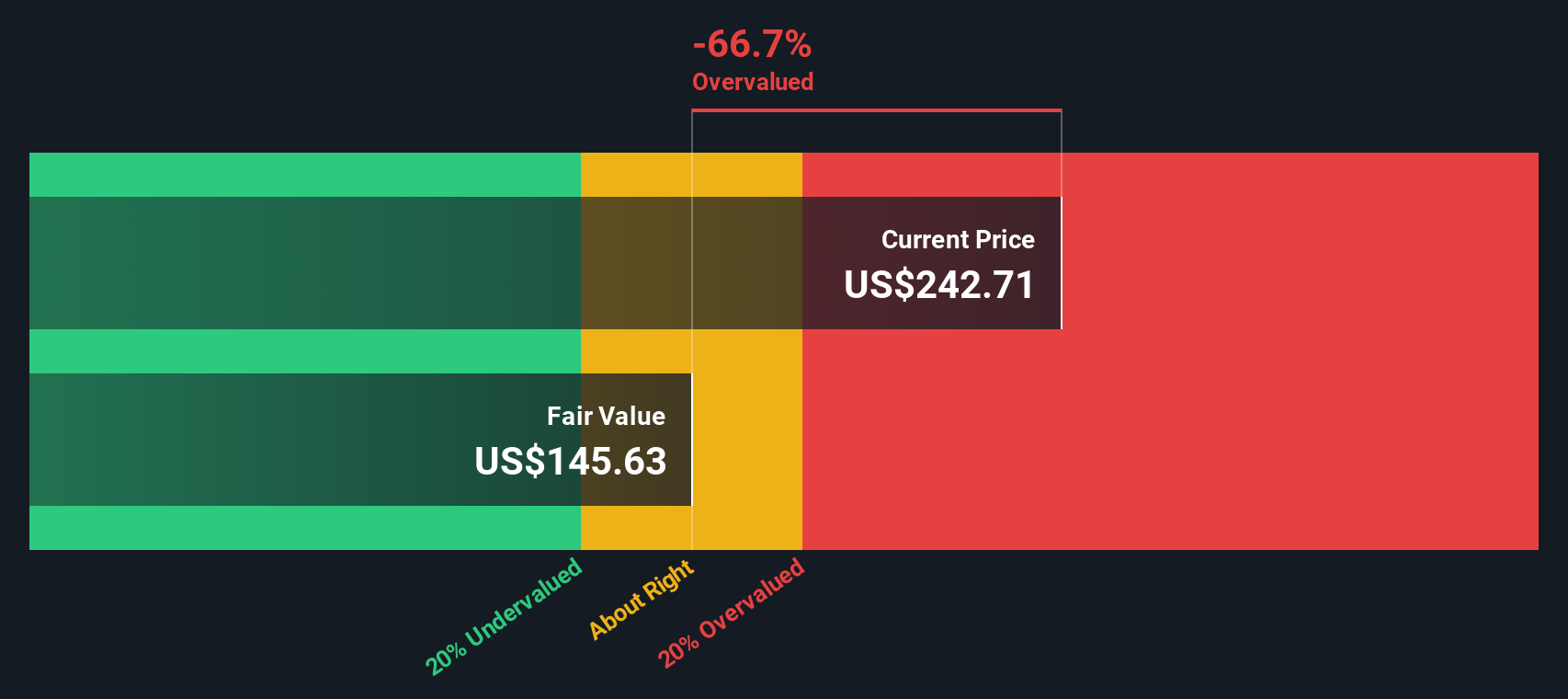

While analyst consensus suggests Lowe’s is undervalued, our SWS DCF model tells a different story. Based on projected cash flows, it estimates a fair value closer to $144.85, which is far below the current share price. Could the market be too optimistic about future growth and margin expansion?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lowe's Companies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 856 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lowe's Companies Narrative

If you want to take a more hands-on approach or bring a different perspective to the table, it's fast and simple to craft your own view. Do it your way.

A great starting point for your Lowe's Companies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit themselves to just one stock or sector. Expand your portfolio's potential by uncovering top-rated stocks for 2024 with tailored screeners from Simply Wall Street.

- Supercharge your returns and access exclusive opportunities by checking out these 856 undervalued stocks based on cash flows that analysts believe are trading below their true worth right now.

- Capture tomorrow’s growth by finding these 26 AI penny stocks already making waves in artificial intelligence applications across multiple industries.

- Boost your income with these 21 dividend stocks with yields > 3% designed to spotlight strong yields and reliable payouts above 3%, so you never miss a cash-generating winner.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOW

Lowe's Companies

Operates as a home improvement retailer in the United States.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives