- United States

- /

- Specialty Stores

- /

- NYSE:LOW

How Lowe’s Stock Measures Up After Housing Demand News and Recent Price Slides

Reviewed by Bailey Pemberton

Deciding what to do with your Lowe's Companies stock? You’re definitely not alone. Whether you’re weighing a new investment or wondering whether to hold on to what you have, it’s been a perplexing year for the stock. With a last close of $242.71, Lowe’s has seen its fair share of ups and downs lately. The share price is down about 0.8% in the last week, and has slipped 5.7% over the last month. If you zoom out further, it’s lagged behind the broader market, negative 1.7% year-to-date and off 7.5% over the past year. Yet here is the twist: those multi-year numbers are still strong, up 29.6% for three years, and a hefty 68.3% over five.

Context is everything, and a recent flurry of news around shifting housing demand and ongoing home improvement trends has been hard to ignore. Many investors are clearly rethinking the true risk and reward balance for home improvement leaders like Lowe’s. That nervous energy is reflected in the stock’s recent choppiness and may signal greater uncertainty about where housing-related businesses are headed next.

So, is Lowe’s undervalued, or just fairly priced in a market full of mixed signals? Across six different valuation checks, the company scores a 2, meaning it’s only undervalued by two classic measures. Over the next sections, we’ll break down how these valuations stack up and where they might miss the bigger picture. And at the end, I’ll reveal the approach I think actually gives investors the best read on Lowe’s underlying value.

Lowe's Companies scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lowe's Companies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to the present using an appropriate rate. For Lowe's Companies, this approach uses a 2 Stage Free Cash Flow to Equity model to provide a best-guess value based on expected profits and financial health.

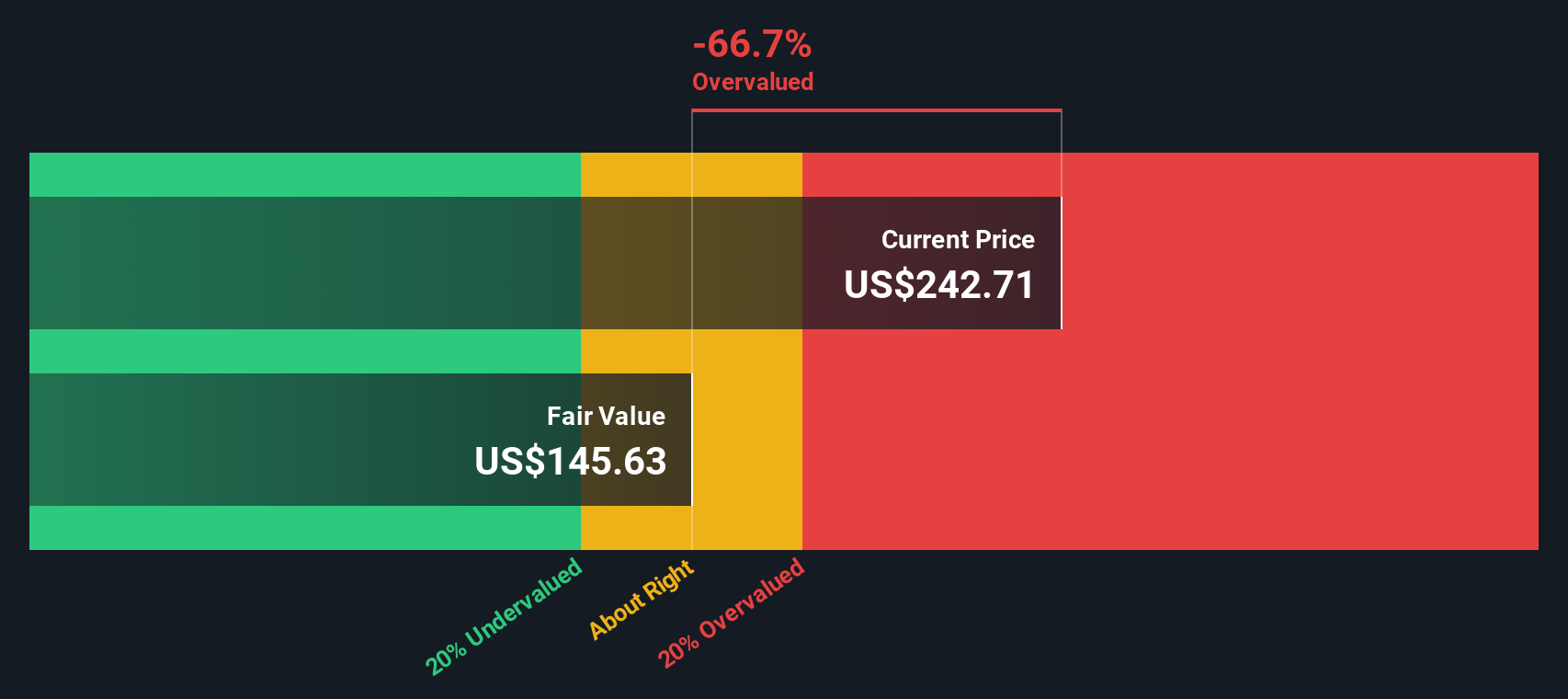

Currently, Lowe’s delivers an annual Free Cash Flow of about $7.88 Billion. According to analyst projections, its Free Cash Flow is expected to fluctuate over the next decade, with specific forecasts of $8.27 Billion in 2026, $6.30 Billion in 2027, $8.31 Billion in 2028, and $5.66 Billion in 2029. After analyst-disclosed estimates, further cash flow projections are extrapolated by Simply Wall St through 2035, showing a modest long-term decline before gradual stabilization.

Based on these projections and the cash flows discounted to today’s value, the intrinsic value per share is estimated at $145.90. With a recent share price of $242.71, this implies the stock is about 66.4% above what a DCF model considers fair value. This means it is significantly overvalued by this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lowe's Companies may be overvalued by 66.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Lowe's Companies Price vs Earnings

For companies with steady profitability, the price-to-earnings (PE) ratio remains the gold standard for quick valuations. The PE ratio reflects what investors are willing to pay today for each dollar of future earnings. It also naturally captures the market’s expectations around how fast earnings will grow and what risks lie ahead, with higher growth justifying a higher PE and elevated risks pulling it lower.

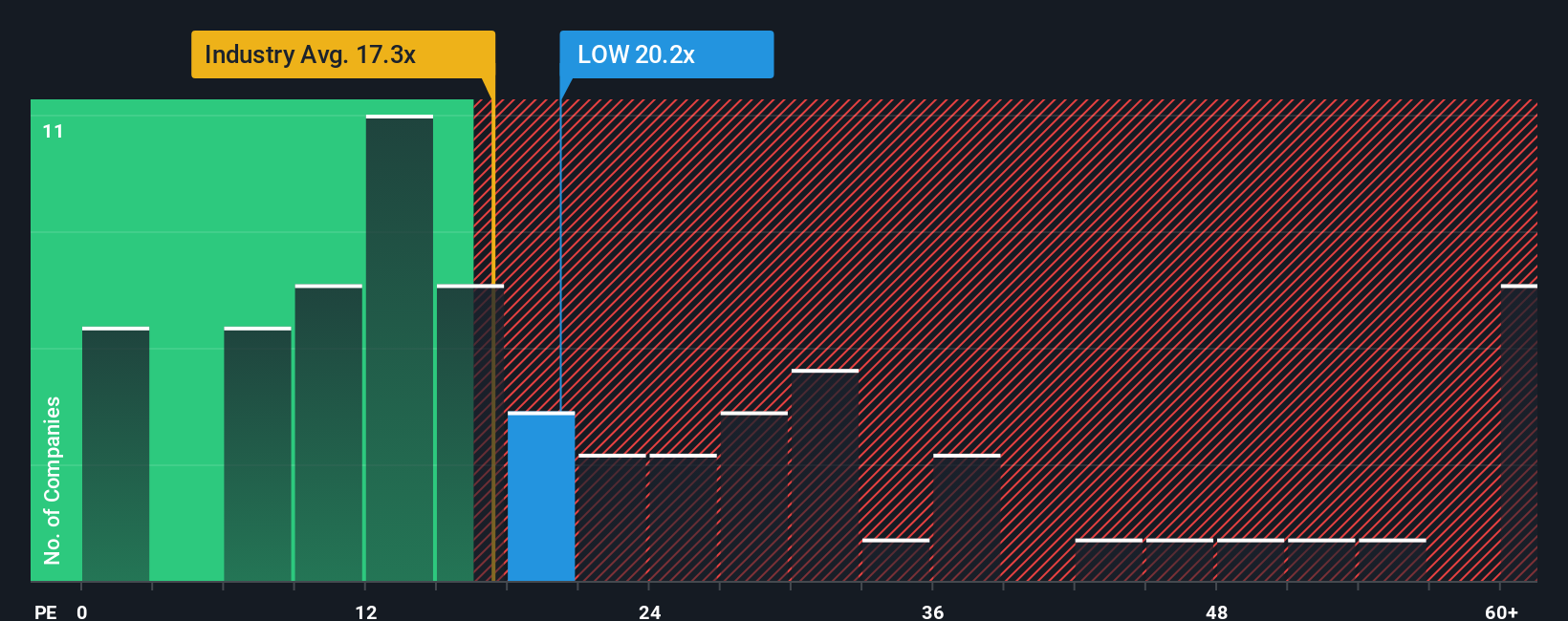

Currently, Lowe’s trades at a PE ratio of 19.9x, meaning investors are paying nearly 20 times the company's trailing earnings. When stacked against the Specialty Retail industry’s average PE of 16.9x, and the average among close peers of 32x, Lowe’s sits in somewhat of a sweet spot, neither at the market’s lowest nor at the most optimistic end.

Simply Wall St’s proprietary “Fair Ratio” for Lowe’s is 21x. This measure goes a step further than the basic industry or peer comparisons, as it analyzes what a reasonable PE ratio should look like for Lowe’s by combining growth outlook, company size, risk, profit margins, and its place within the industry. Because it looks at company specifics as well as market trends, the Fair Ratio offers a more nuanced and practical benchmark for investors than a broad-brush industry average.

With the actual PE at 19.9x and the Fair Ratio at 21x, Lowe’s shares are about in line with where you would expect, given everything we know today.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lowe's Companies Narrative

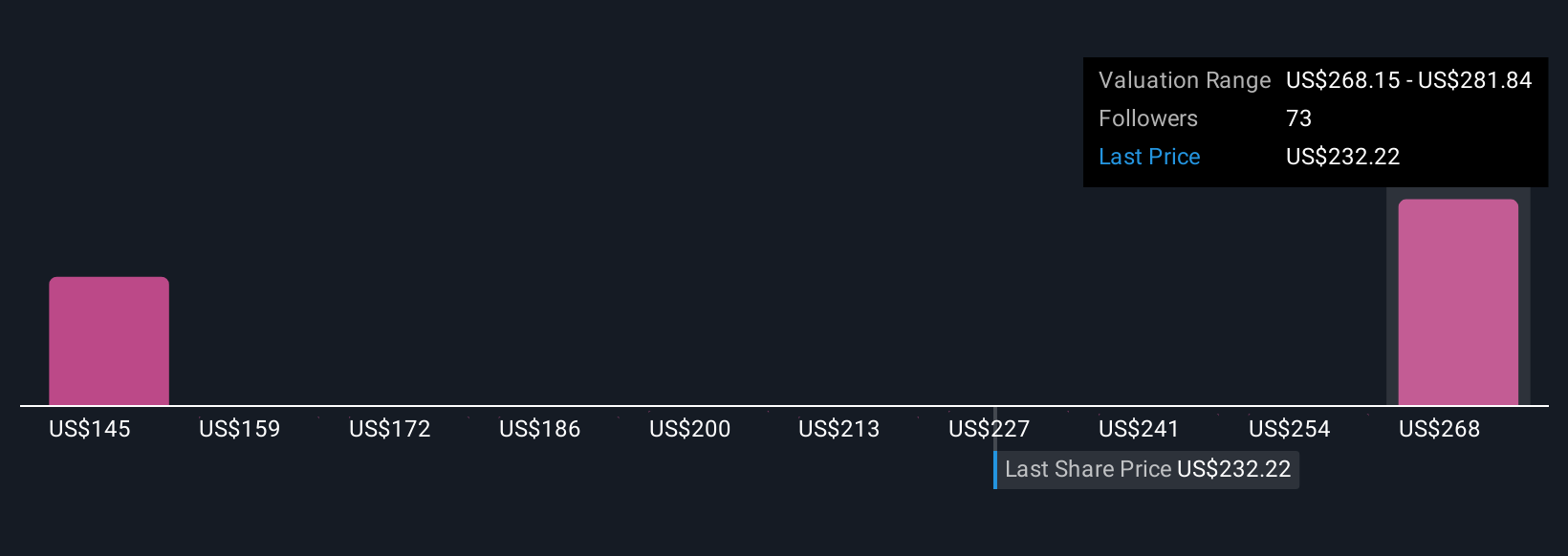

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, interactive way to connect your own view of Lowe’s Companies—the story you believe about where the business is headed—with your financial forecasts and a fair value estimate. Rather than relying on static metrics alone, Narratives bring your assumptions about future revenue, earnings, and profit margins together with the current price, so you can see instantly if your story suggests the stock is under or overvalued.

This approach is easily accessible on Simply Wall St’s platform in the Community page, where millions of investors share and fine-tune Narratives as new news and earnings come out. Narratives help you spot when to buy or sell by comparing your fair value to the current market price, and they update automatically when new information is available. For example, one investor might believe Lowe’s digital expansion and acquisition of Foundation Building Materials will drive earnings to $8.4 billion by 2028, justifying a price target of $325. In contrast, another, more cautious, Narrative may focus on rising debt and competitive pressures, supporting a much lower fair value of $221. Your own Narrative can reflect whichever perspective and assumptions you find most compelling, helping you make smarter, more informed decisions.

Do you think there's more to the story for Lowe's Companies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOW

Lowe's Companies

Operates as a home improvement retailer in the United States.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives