- United States

- /

- Specialty Stores

- /

- NYSE:BBWI

Easy Come, Easy Go: How L Brands (NYSE:LB) Shareholders Got Unlucky And Saw 74% Of Their Cash Evaporate

L Brands, Inc. (NYSE:LB) shareholders should be happy to see the share price up 17% in the last month. But over the last three years we've seen a quite serious decline. In that time, the share price dropped 74%. Some might say the recent bounce is to be expected after such a bad drop. After all, could be that the fall was overdone.

See our latest analysis for L Brands

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

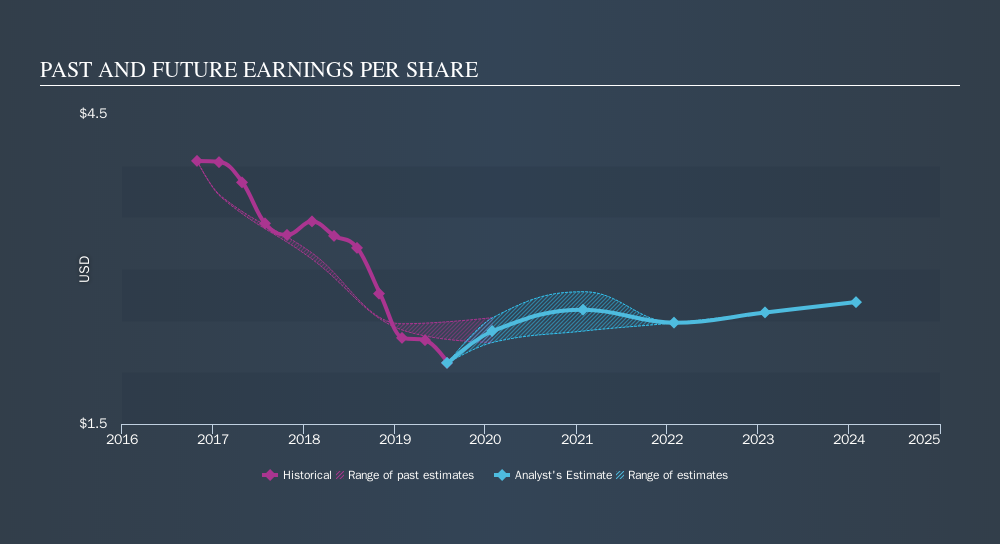

During the three years that the share price fell, L Brands's earnings per share (EPS) dropped by 21% each year. This reduction in EPS is slower than the 36% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. This increased caution is also evident in the rather low P/E ratio, which is sitting at 8.88.

The company's earnings per share (over time) are depicted in the image below.

It might be well worthwhile taking a look at our free report on L Brands's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of L Brands, it has a TSR of -69% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

L Brands shareholders are down 32% for the year (even including dividends) , but the market itself is up 1.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 19% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:BBWI

Bath & Body Works

Operates as a specialty retailer of home fragrance, personal and body care, soaps, and sanitizer products.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives