Kohl's (KSS): Exploring Valuation After Recent Share Price Pullback and Analyst Debates

Reviewed by Simply Wall St

See our latest analysis for Kohl's.

While Kohl's share price has stumbled recently, with a 4.7% decline over the past month, a 90-day rally has seen the stock climb 37%. Still, momentum looks muted in the long run, as shown by a one-year total shareholder return of -7% and deeper three- and five-year declines.

If you’re curious about where else you might spot opportunities, this could be the perfect time to expand your search and discover fast growing stocks with high insider ownership

With a recent rally contrasted by longer-term declines, the key question is whether Kohl's shares are now trading below their fair value and offering potential upside, or if recent enthusiasm has already factored in future growth prospects.

Most Popular Narrative: 8% Overvalued

Kohl's shares ended the last session at $16.11, but the most widely followed analyst narrative puts fair value at just $14.92. This sets the stage for growing debate around whether the current price holds up to deeper scrutiny or signals that the optimism has outpaced fundamentals.

"Persistent decline in store transactions, especially among lower and middle-income, value-oriented consumers (Kohl's core base), despite focused investments and promotional efforts, signals ongoing headwinds from shifting shopping behaviors and demographic changes away from traditional department stores. This is likely to weigh on future revenues and limit comp growth prospects. The ongoing migration toward online and mobile shopping continues to reduce overall foot traffic to Kohl's brick-and-mortar stores. Although digital investment is underway, slower adoption relative to industry innovators and mixed omnichannel execution could suppress sales recovery and put further pressure on operating margins."

What’s driving the calculation behind this cautious fair value? Analysts are wrestling with critical revenue and margin forecasts that aren’t for the faint-hearted. If you want to see which bold assumptions could upend expectations or confirm your suspicions, dive into the full breakdown and discover the figures that shape this price target.

Result: Fair Value of $14.92 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stronger sales from partnerships such as Sephora or rapid digital improvements could help Kohl's outperform muted expectations and shift momentum.

Find out about the key risks to this Kohl's narrative.

Another View: Is the Market Missing Something?

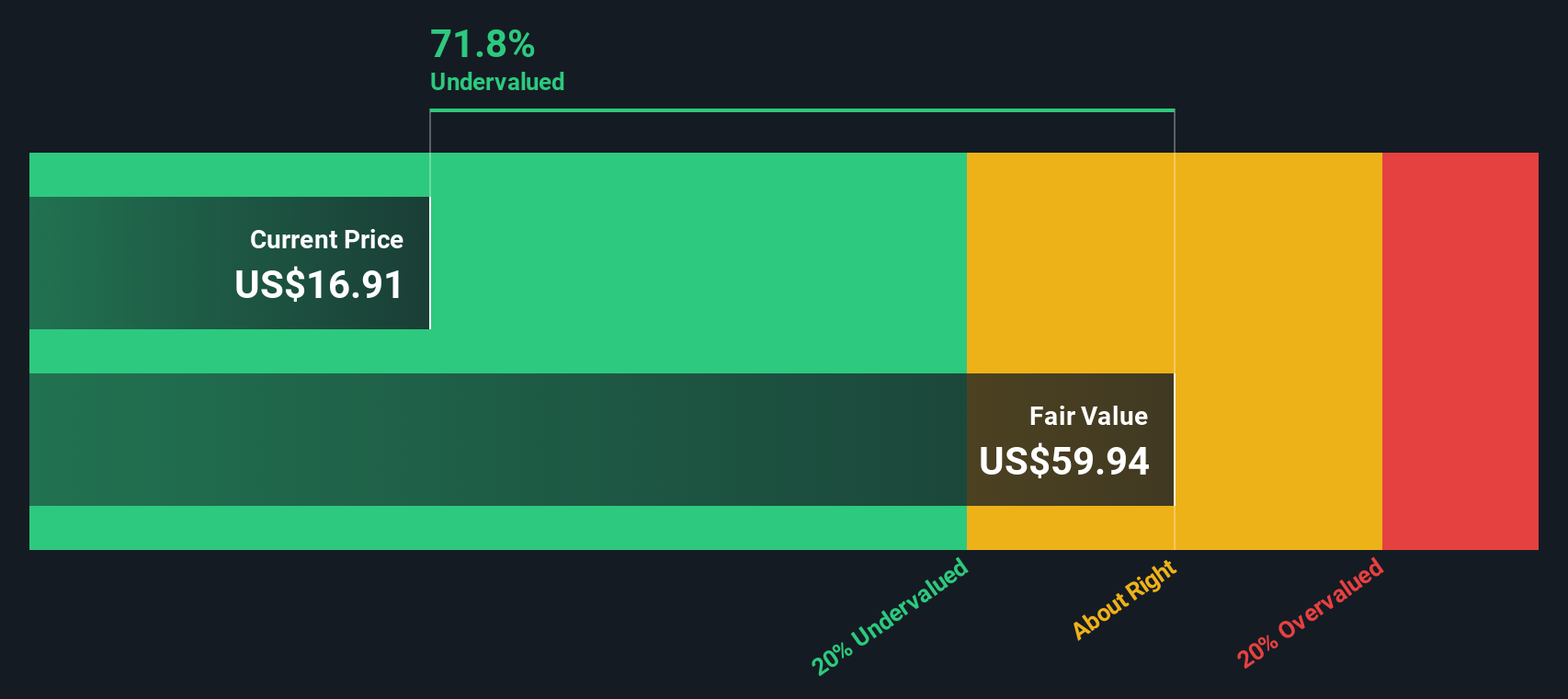

While analysts see Kohl's shares as overvalued using price targets based on earnings forecasts, the SWS DCF model presents a different perspective. According to our DCF, Kohl's is actually undervalued, with its recent share price sitting well below our estimate of fair value. Is the market overlooking long-term cash flow potential, or is there caution for good reason?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kohl's Narrative

If you have your own take or want to dig into the numbers personally, it’s easy to assemble a narrative unique to your perspective in just a few minutes. Do it your way

A great starting point for your Kohl's research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step beyond the obvious and unlock new opportunities with stocks that match your goals and spark your curiosity. Don’t limit yourself when the next big win could be just a click away.

- Target income for your portfolio and tap into reliable cash flow with these 20 dividend stocks with yields > 3%, which features yields above 3%.

- Seize early potential by jumping on these 3614 penny stocks with strong financials showing strong fundamentals before the crowd catches on.

- Accelerate your edge by finding these 27 AI penny stocks, powering innovations in artificial intelligence and redefining entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kohl's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KSS

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives