Kohl’s (KSS): Evaluating Valuation After Upbeat Earnings, Raised 2025 Outlook, and New CEO Appointment

Reviewed by Simply Wall St

Kohl's reported stronger-than-anticipated third-quarter results and raised its outlook for 2025, while officially naming Michael Bender as permanent CEO. These announcements sparked a wave of optimism among investors.

See our latest analysis for Kohl's.

Kohl’s stock has been on a tear lately, rocketing over 40% in a single day after the company’s upbeat earnings and CEO news, and now boasting a year-to-date share price return of nearly 72%. While total shareholder return over the past year stands at 69.6%, its strong recent momentum signals growing confidence in a sustained turnaround.

If this kind of momentum shift has you thinking bigger, now is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

The recent surge has turned heads. With shares now trading well above analyst targets, investors are left to wonder if there is real value left to capture, or if the market has already priced in all the good news.

Most Popular Narrative: 54.6% Overvalued

Kohl’s current fair value estimate from the most popular narrative stands well below its last close. This raises questions about whether recent price gains are sustainable at this level. This valuation is influenced by detailed financial projections and the evolving outlook for the company’s retail transformation.

The ongoing migration toward online and mobile shopping continues to reduce overall foot traffic to Kohl's brick-and-mortar stores. Although digital investment is underway, slower adoption relative to industry innovators and mixed omnichannel execution could suppress sales recovery and put further pressure on operating margins.

Curious what’s fueling this cautious view? One key assumption—future revenue declines and stagnant profit margins—drives the biggest gap between narrative fair value and the elevated stock price. Want the full blueprint for that projection? Unpack the complete narrative for the strategic levers, projections, and the math used to reach this target.

Result: Fair Value of $15.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong results from proprietary brands or success with the Sephora partnership could quickly change the current cautious outlook for Kohl’s shares.

Find out about the key risks to this Kohl's narrative.

Another View: Market Multiples Tell a Different Story

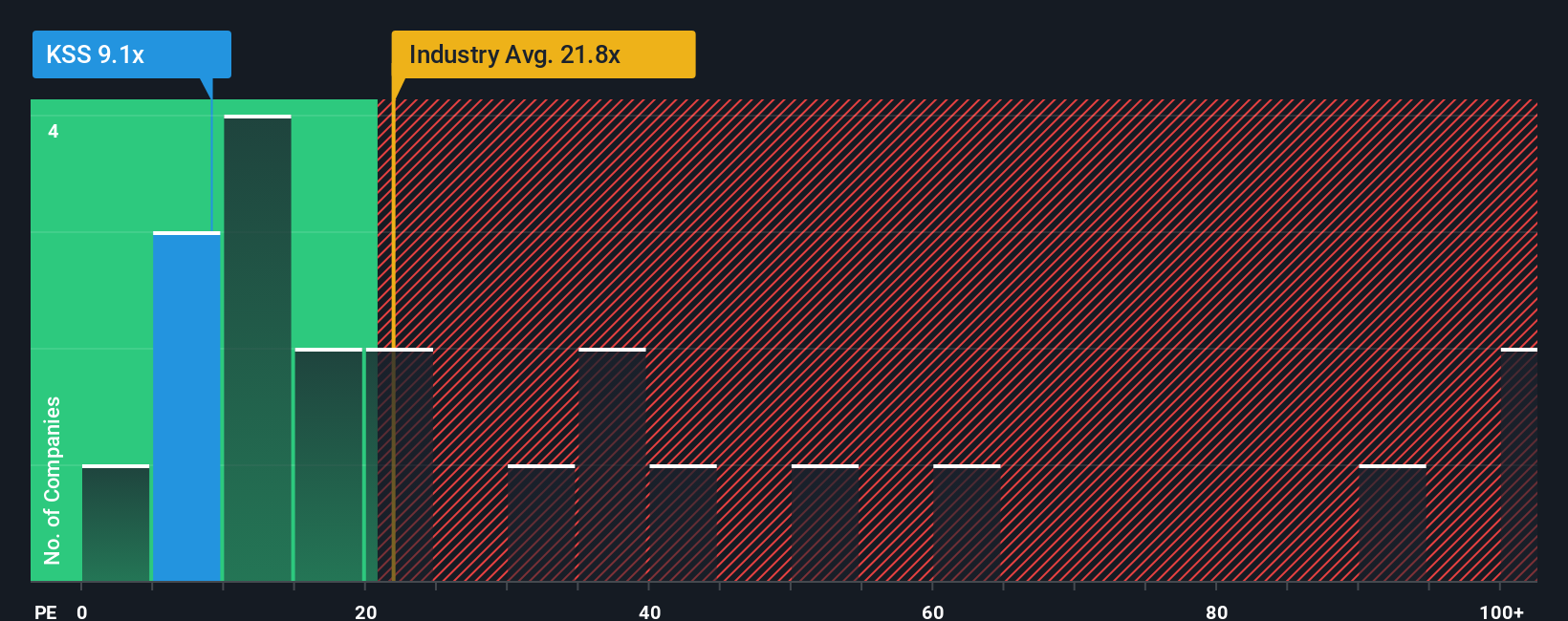

While the most popular fair value narrative pegs Kohl’s as overvalued, a look at typical valuation ratios adds some nuance. The company trades at a price-to-earnings of 13.9x, well below both the Global Multiline Retail industry average of 20.2x and peer average of 21.8x. The fair ratio our models suggest is 20.1x, meaning the market could re-rate Kohl's upwards if expectations improve. Are investors underestimating an upside here, or is the discount a warning sign for greater underlying risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kohl's Narrative

Not convinced by the story so far, or eager to dive deeper into the numbers? You can quickly build your own perspective and narrative by using Do it your way

A great starting point for your Kohl's research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Don’t sit out the next big move. Simply Wall Street’s Screeners handpick investment ideas making headlines and building real momentum, perfectly tailored to your strategy.

- Capitalize on market mispricings and enhance your portfolio by reviewing these 930 undervalued stocks based on cash flows based on strong cash flow fundamentals.

- Unlock passive income potential and secure valuable yields by exploring these 14 dividend stocks with yields > 3% offering payouts greater than 3%.

- Seize tomorrow’s growth and disruption by browsing these 25 AI penny stocks revolutionizing industries through artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kohl's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KSS

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026