Investors in Jumia Technologies (NYSE:JMIA) from a year ago are still down 59%, even after 19% gain this past week

This week we saw the Jumia Technologies AG (NYSE:JMIA) share price climb by 19%. But that doesn't change the fact that the returns over the last year have been disappointing. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 59% in that time. Some might say the recent bounce is to be expected after such a bad drop. You could argue that the sell-off was too severe.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for Jumia Technologies

Given that Jumia Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Jumia Technologies saw its revenue grow by 30%. We think that is pretty nice growth. Unfortunately it seems investors wanted more, because the share price is down 59% in that time. It may well be that the business remains approximately on track, but its revenue growth has simply been delayed. For us it's important to consider when you think a company will become profitable, if you're basing your valuation on revenue.

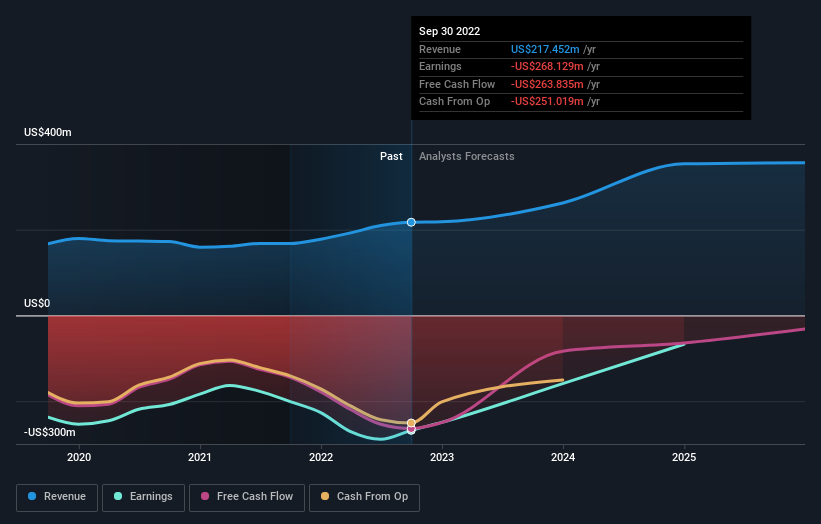

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Jumia Technologies' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for Jumia Technologies shares, which performed worse than the market, costing holders 59%. Meanwhile, the broader market slid about 15%, likely weighing on the stock. The three-year loss of 13% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Jumia Technologies that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:JMIA

Jumia Technologies

Operates an e-commerce platform in West Africa, North Africa, East Africa, Europe, the United Arab Emirates, and internationally.

Flawless balance sheet low.